This week I am in the USA and the way Americans manage money always strikes me. They use credit cards to pay their bills, they have credit scores for debt, etc…

On the 13th of June, I read this article on the website of World Economic Forum

1. A quarter of Americans have no retirement savings

While financial preparedness increases with age, a new report from the US Federal Reserve finds inadequate savings are still common among those approaching retirement. Even among those over 60, 13% have made no provision for stopping work, while fewer than half (45%) think their savings are on track.

And despite tax penalties, a fair share of people have chosen to withdraw funds from their pension pots in the last year.

More than a quarter of American adults consider themselves retired, with nearly half of all retirees last year giving up work before they were 62. A further quarter retired between the ages of 62 and 64.

Filling up the bank

Financial literacy among the general population is fairly low – the vast majority of adults failed to answer questions designed to test their knowledge about savings. And many people, particularly women, expressed discomfort about making investment decisions.

Ethnicity also has a role to play in financial planning. Black and Hispanic people are more likely than white people to have no retirement savings, and are less likely to view their finances as on track.

2. The global picture

The picture in the United States is mirrored around the world. Investing In (And For) Our Future, a new report by the World Economic Forum, has highlighted the degree to which retirees are going to outlive their savings.

In six major economies, retirement pots will run dry well before they are no longer needed: the savings gap in some cases is up to 20 years. Japanese retirees and women are the most likely to outlive their savings.

The savings shortfall has been driven to a large degree by governments coming under increasing pressure to cut back on policies that benefit older generations, and the deterioration of employer-sponsored pension plans.

Individuals have found themselves increasingly responsible for their own savings plans, but have not responded quickly or adequately enough. The situation in Belgium is not different. People think they can rely on the government for a state pension. The government has two choices : to raise the pension age or to motivate people to save money for their pension on their own.

With people living to an older age, taking a long-term mindset earlier on in life is crucial to bridging the divide and ensuring they can enjoy old age in comfort.

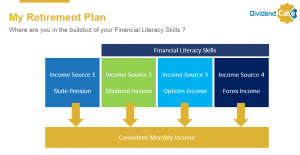

3. My Retirement Plan

So what is my Retirement game plan ? I personally don’t count on a state pension. If I obey the government, I will be required to work another 17 years at least and that is not my objective. Why ? Because by the time I will retire, they will raise the retirement age again…

My gameplan mainly consists of building the financial literacy skills to retire early or never have to worry about money anymore as I do have the skills to generate cash flow out of the stock or forex markets.

Below you can find a great infographic that visualizes this future mindset that I want to possess.

Final Words

So where are you in building out the financial literacy that you require for your retirement ? Or are you lazy or use the excuse of having no time ? Most people I know, always have an excuse for not executing or learning the skills that they need. Financial literacy on how to grow your money or generate cash flow is a BASIC skill you need to never worry about money anymore. Make sure you don’t wait until you retire to learn a skill that can set you free forever. Being wealthy is having freedom of time.

This is the end of this blog post.

In 2019 we will send out ONE newsletter per month to our blog followers. Life can be busy sometimes and people lose track of following a personal finance and travel blog. Subscribe and you will get one email per month highlighting what you missed…

Thanks for following us on Twitter and Facebook and reading this blog post. We end with a quote as always.

Source : World Economic Forum

No Comment

You can post first response comment.