On Saturday 5th of May, VFB organized his second event of Financial planning. Last year we did attend this event as well and wrote this blog post about our key learnings.

VFB event – Financial Planning : what did we learn ?

Last year around 100 people attended this event and this year even more people attended this event. This time I was joined with my sister as I convinced her to learn about Financial planning and inheritance planning.

Four presentations were planned about the new inheritance tax laws and wealth planning. You can download the presentations at the bottom of this blog post.

What did we learn ?

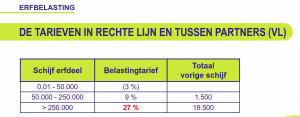

The first presentation of Thomas Weyts of the company Lemonconsult explained the new inheritance taxes. The inheritance taxes in Belgium were due to a revision as other family structures are more dominant in current modern society. Citizens want more freedom to decide upon their inheritance and wealth planning. The reform of the new inheritance (tax) laws is impacting three components :

- The reserved amount for the kids

- Changes on rules for donations and legacies

- Possibility to draw up an inheritance contract

On the 1st of September 2018 the new inheritance tax laws become effective.

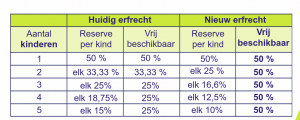

Parents passing on their wealth have more decision freedom as now they always will have 50% available. Below you can find the new distribution percentages between the number of kids and their parents. With this 50% you can donate a part of your heritage to kids of a second marriage, friends, your new partner or charity…

Also the rules of inheritance contribution will change. In the new inheritance laws the valuation of the donations will be based on the index. This will allow fair and correct equal donations comparisons.

Also the rules of inheritance contribution will change. In the new inheritance laws the valuation of the donations will be based on the index. This will allow fair and correct equal donations comparisons.

Now you can also enter in inheritance agreements between parents and children. You can arrange a global inheritance contract or an agreement about specific matters. A global agreement can be made for example to divide an inheritance equally between kids from different relationships. Everyone can agree and sign the contract. At the end of the presentation a case of a family was explained. Take a look at the presentation.

The second presentation of Thijs Keenen from the company Pareto explained how you can pass on wealth using a life insurance construction. There are some fiscal advantages using this way of inheritance planning.

The third presentation of Kristof Reynders from the company Krefinco focussed on generating income from wealth. There are 3 ways to generate cash flow from wealth :

- Dividend investing

- Writing options

- Sell real estate on annuity

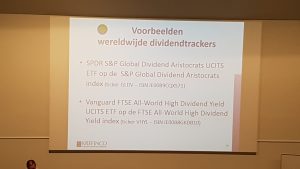

Kristof explained the dividend strategy using Dividend aristocrats and ETFs with high dividend yield. Take a look at the slide 9 of European dividend aristocrats. The second strategy is writing options with an expiration period of 3 to 6 months. The time value within the option will slowly decay out of the option value. This options selling strategy works best with companies with low volatility.

The last strategy that you can execute is to sell real estate on annuity. This provides you with a monthly cash flow.

The last presentation was given by Jo Stremersch of the company Stremersch, Van Broekhoven Partners. His presentation provided 7 essential advices. Nr 1. The objective does not justify the means…here you need to focus on an understandable and controllable planning adjusted to your needs and desires. Nr 2. Evaluate the price of fiscal savings. Sometimes people focus too much on fiscal savings…make sure you don’t lose comfort as a result. Nr 3. Watch out for (assumed) fiscal abuse…Jo explains some rules from the Flemish government. Nr 4. Give the right YES… decide upon the right marriage or living together form as this provides the rights that will be applied. Nr 5. Donating : Given is considered given forever…when you donate to your kids, make sure you don’t jeopardize your future capital needs. Nr 6. Make a tailored testimony according to your needs and desires. The last advice Nr 7. is to think about your wealth and inheritance planning early enough as you can never plan for bad times.

You can never predict if something bad (accident or health issue) will occur to you…plan for the worst !

Final words

While driving home, I reflected with my sister on this interesting VFB event full of inheritance and wealth planning advice. It was great to view the presentation of Krefinco explaining two cash flow strategies that I am executing each month. We discussed also our own personal inheritance and wealth planning for our families and our mom.

We definitely encourage you to ask yourself the same important life questions about wealth planning and inheritance. Plan for the worst and don’t let your family figure it out when also the tax man (and government) takes a large portion out of your wealth… The government doesn’t deserve it to take money out of your wealth.

Thanks for following us on Twitter and Facebook and reading this blog post. As always we end with a quote.

The Presentations

No Comment

You can post first response comment.