On 19th July the news came out that the Belgian government considers a tax on investment accounts. When I read this news, I thought I was going to choke…and have a heart attack. “Do politicians have no common sense or brains about investing at all ?” was my first thought. Hereby I write a reflection on what’s really going on…

The real situation

The inventor of the speculation tax

The government Michel got stuck last year when vice prime minister Kris Peeters (CD&V) put a capital gain tax on the table as (bribery) exchange for lowering company taxes. He considered a move to “fair taxes” while at the same time asking a solution for 800.000 Arco investors from the government. Arco investors got in the past “cheated” by Beweging.net (former ACW) who sold “safe” stock market investment products as safe guaranteed savingsaccounts. Somehow this institution and the party CD&V has managed to make this a governmental problem and uses this case as bribery for other governmental decision making…how a criminal can write his own escape script..I would say. The only solution for paying the Arco victims is the organization Beweging.net and not the pay payer ! The Belgian citizen and tax payer has nothing to do with this !

As all big decisions are blocked by this party CD&V, the proposal to have a subscription tax on investment accounts has been launched….in order to please this party.

I still remember the invention of the speculation tax in 2016 and what a drama this caused. Some investment brokers almost got out of business…Read here our reflection on that debacle of Mr. Peeters’ invention.

The Speculation Tax is dead – What can we learn ?

The current tax pressure on investors

The current tax pressure on investors is already really high. During the past years some taxes doubled…here is a summary.

Witholding Tax

Investors pay today 30% on dividends, bonds and other investment products. This withholding tax resulted in 4,3 billion euro in 2016.

This withholding tax has doubled since 2011. Read here our January 2017 blog post Who’s stealing our money about this topic. The doubling of the withholding tax has resulted in lower income for the government as people have changed their behavior. You can only squeeze a limon until the last drop right?

Stockmarket transactiontaks

When investors buy or sell stocks, bonds or funds, they need to pay 0.27% transaction tax on the investment amount. This tax has also been increased in three steps from 0,17% to 0,27%. The tax on funds has more than doubled from 0,5% to 1,32%.

This transaction tax has resulted in 213 million in 2016.

Tax on insurances

Investors that buy an insurance product, pay 2% tax. This tax was increased from 1,1% to 2% under the previous Di Rupo Government.

The real questions

In addition to all above taxes, one party NVA launched the idea to increase the tax deductible amount of pension saving accounts from 910 to 1200 euro. This idea would be good for banks as they would get more money. It is amazing how the banking lobby impacts governmental decision making. When will I be able to invest my pension account money MYSELF ? Why does the bank decide how to invest my pension saving account money? I am not happy with the 1 to 3% they grow my money every year !! I can do a lot better than that ! When can Belgian investors invest his own pension funds money the way he wants to invest it ? GIVE US the freedom to invest it OUR WAY, not the way banks want it ….I love the way Americans or Canadians can invest their IRA or ROTH accounts and grow their OWN money.

Instead of inventing new taxes and adding tax pressure on the Belgian population, other questions should be asked….

The real issues are the following

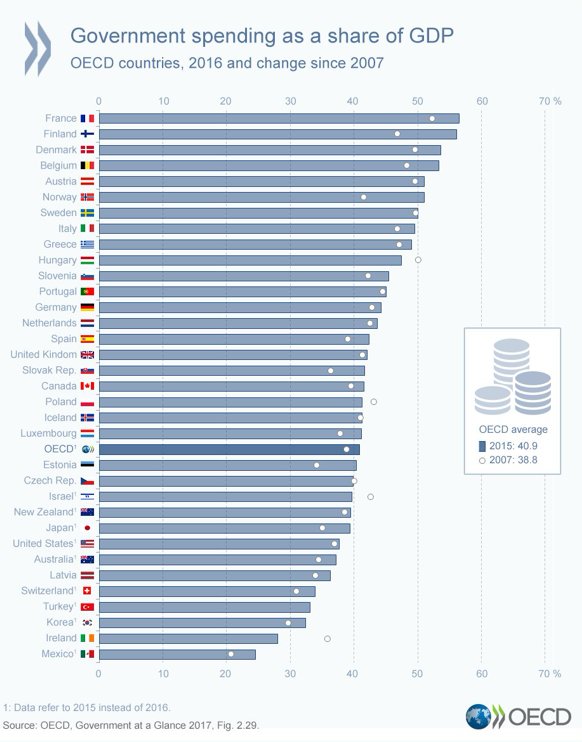

- Government spending needs to decrease : Belgian governments really need to think about what they should be spending money on. The fact that Belgium spends more money on government than Greece or Portugal really makes you wonder where all that money goes to…. Politicians must review all WASTE in governmental spending.

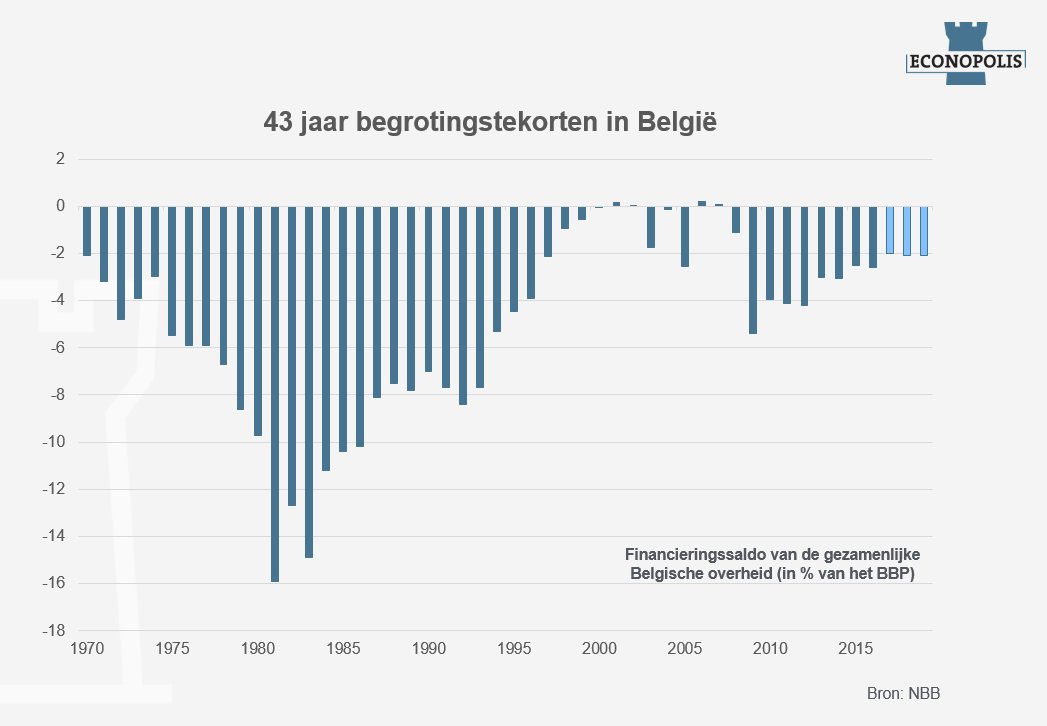

The number 1 problem is really the spending of the tax money ! In the last 50 years Belgian government spend MORE than they taxed from citizens…do you see WHAT is the real problem here? The below chart speaks for itself…

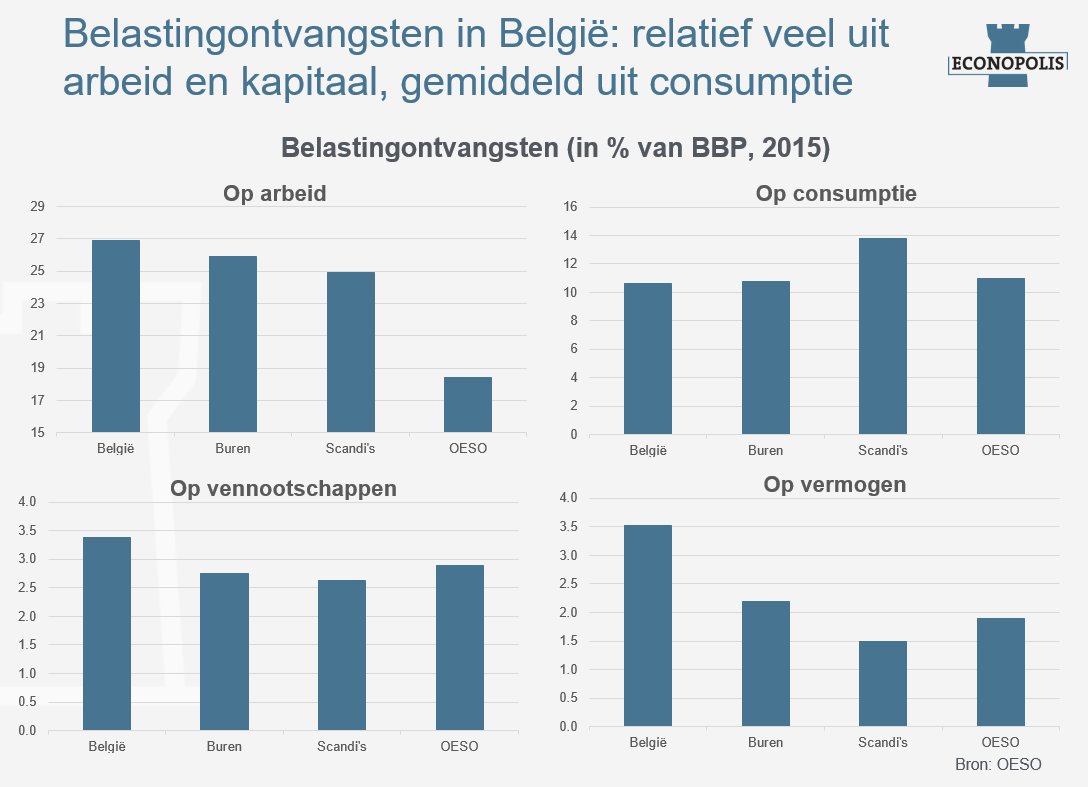

- Tax pressure needs to decrease : Today people in Belgium are working until end of July for the government before they earn money for themselves. It is around this time frame…Imagine that for the year 2017 you have only been working for Belgian government until now. From 1 August onwards the money you earn is for yourself…crazy isn’t it? The tax pressure on capital and work is already amongst the highest in the world. Taxes really need to decrease for companies and citizens. Foreign companies already invest in other companies abroad.

My Conclusion

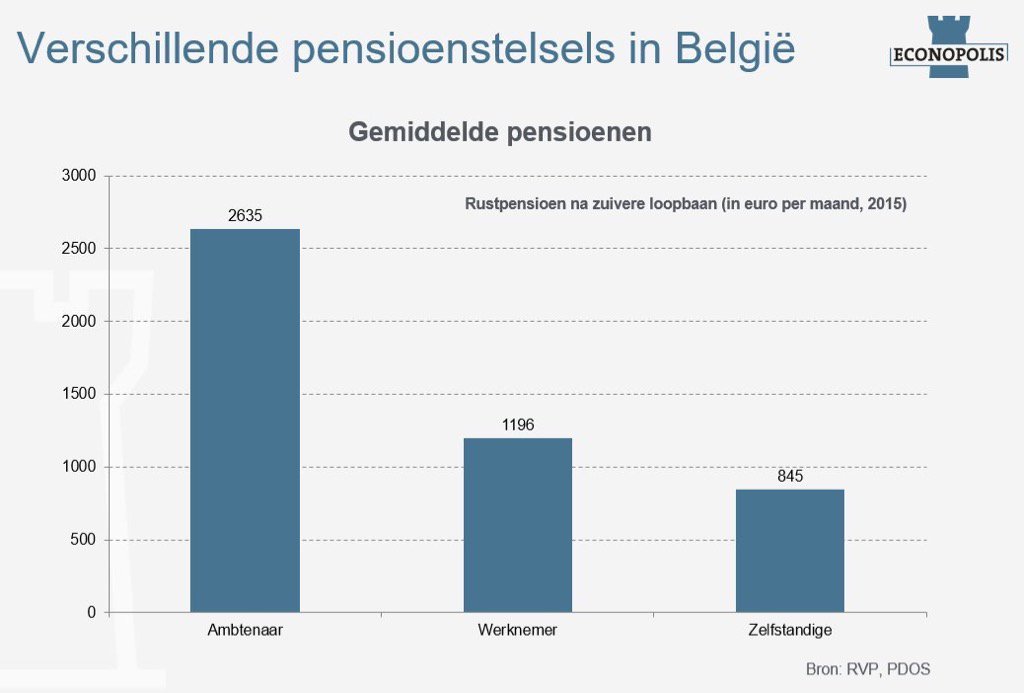

The average pension as an employee won’t pay for a pension home. See below pension systems in Belgium. And at the end of your career, when you need a pension home and help, the governmental institutions will be ready to consume all your net worth. You don’t believe me….read the following blog post I wrote earlier on..

How you can LOSE all your net worth and make also your kids poorer….ACT NOW !

Thanks for reading. Grow your money with any investment strategy ! Good luck !

No Comment

You can post first response comment.