How are you all doing ? I hope you and your family are fine. I read that people are bored in quarantaine, struggle with their emotions, fight with their partner,… I can understand that this new situation puts people under stress financially and emotionally. But why don’t they use their time productive in learning a skill that can help them in the future ?

Forex trading skills is part of my EARLY Retirement plan. I see myself do this when I am in the Elderly Home …lol ! I hope you read my (EARLY) Retirement Plan blogpost.

Today I am informing you about the 2020 Smartphone Challenge progress.

The 2020 Smartphone Challenge Q1 Results

Besides the fact that I can do this from anywhere on the planet on my smartphone where I have data access, there are several reasons why investors should choose foreign exchange (forex) trading over trading stocks. I simply summarize the TOP 3 reasons AGAIN why the forex market is important for investors and traders. I do not understand why this is SO UNKNOWN !

1. The World’s Largest Market

Global market participants trade more than US$5 trillion worth of currencies per day, according to the Bank for International Settlements (BIS). Daily trading volume averaged US$5.1 trillion in April 2016, according to BIS’s triannual survey, which is considered to be the most thorough poll of its kind.

While this figure of US$5.1 trillion (or roughly US$213 million per hour) may seem high, it’s more than 5% below the record US$5.4 trillion reached during April 2013, according to the BIS. Today it’s above 6 trillion !!

In comparison, consider the following information:

- The New York Stock Exchange’s daily trading volume averaged US$38.5 billion during the first five sessions of May 2017

- The Nasdaq’s daily trading volume averaged close to US$85 billion during the first four sessions of that same month

While the forex market’s daily trading volume exceeds US$6 trillion, the U.S. dollar is responsible for nearly 88% of total trading volume, additional BIS figures reveal. This brings the greenback’s daily trading volume to more than US$4 trillion.

One major benefit of having a larger market is that it makes it more difficult for individual traders and institutions to engage in price manipulation, which can cause securities to experience sharp price fluctuations in short time periods.

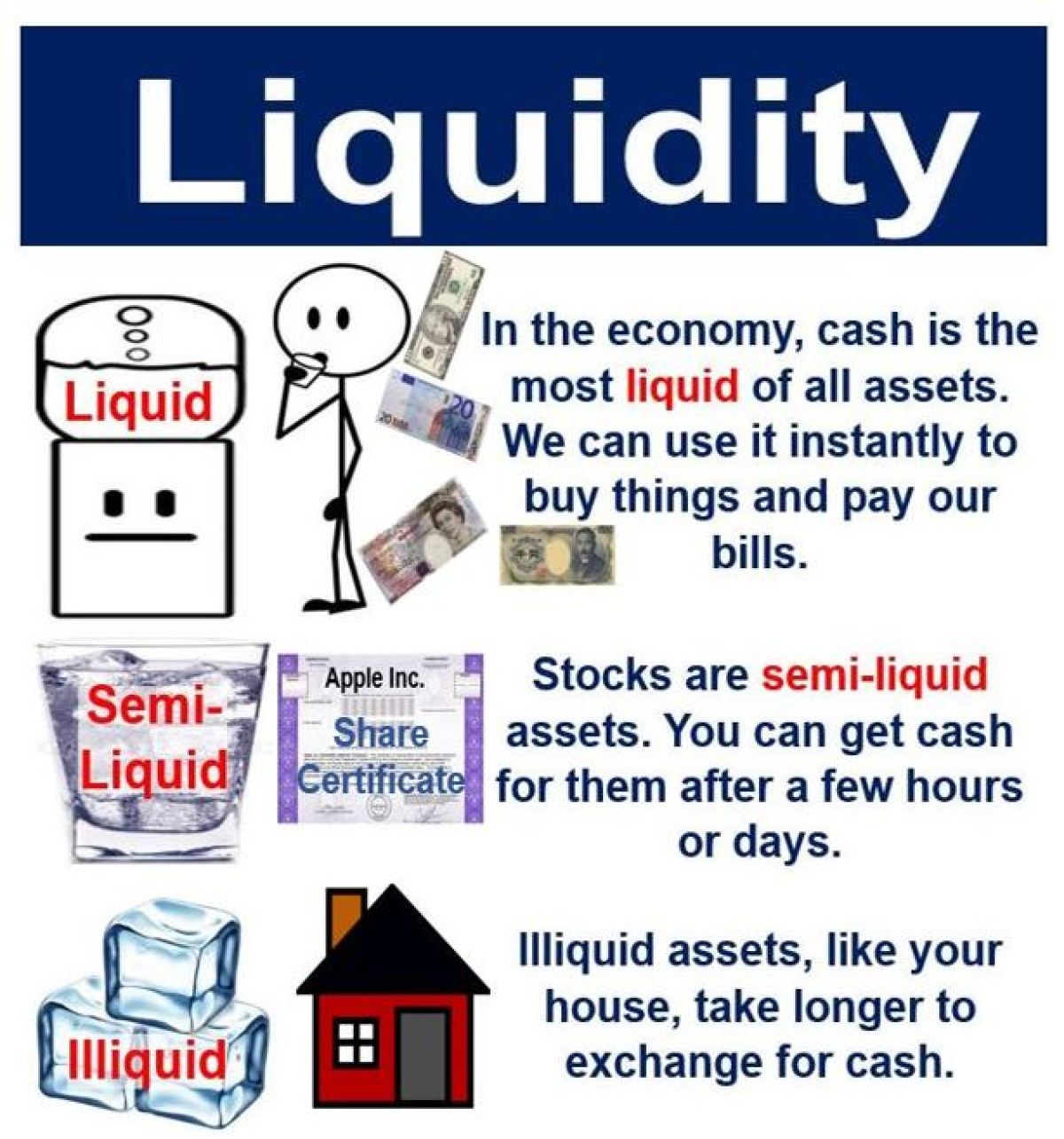

2. Robust Liquidity

Because the global forex market is so large, it offers traders significant liquidity, which is the ease with which traders can exchange one asset for another. In this case, the forex market’s significant size makes it so traders can enter and exit positions very easily.

In addition to giving traders greater maneuverability, high liquidity can help provide them with lower transaction costs, as financial institutions charge less to set up trades. Highly liquid markets can also help protect traders from price manipulation.

When a market enjoys substantial liquidity, it can more easily handle large increases in trading volume without experiencing significant changes in price, making the market less vulnerable to sharp changes in trading volume aimed at causing price volatility.

3. 24-Hour Availability

As I travel a lot for business, I lose always a lot of time on airports and in planes. One major advantage of trading forex is that the currency markets are open 24 hours a day. Investors around the world want to trade currencies. Companies require currency for international trade, and central banks have been making use of foreign exchanges since 1971, when the value of most currencies began to “float.” Read my previous blogposts how to earn money on a plane !!

Investors will find it far easier to combine this kind of trading with part- or full-time work. For example, if a person works a traditional, full-time job between 9 AM and 5 PM in their time zone, they can trade after they get out of work.

Summary

As outlined, there are several reasons why investors should opt for forex trading over stock trading. By trading forex, investors can access a market that is far larger in scope than that of the stock market. You are actually investing in a currency or economy of a country ! Because of its size, the forex market offers greater liquidity, which means that investors may be able to enjoy lower transaction costs and more easily enter and exit trades.

The forex market also offers traders greater flexibility than the stock market. Given that it’s open 24 hours a day, investors can more easily combine forex trading with other responsibilities. Finally, the forex market offers greater leverage than the stock market, a factor that can potentially amplify gains as well as losses.

My Real Account Results

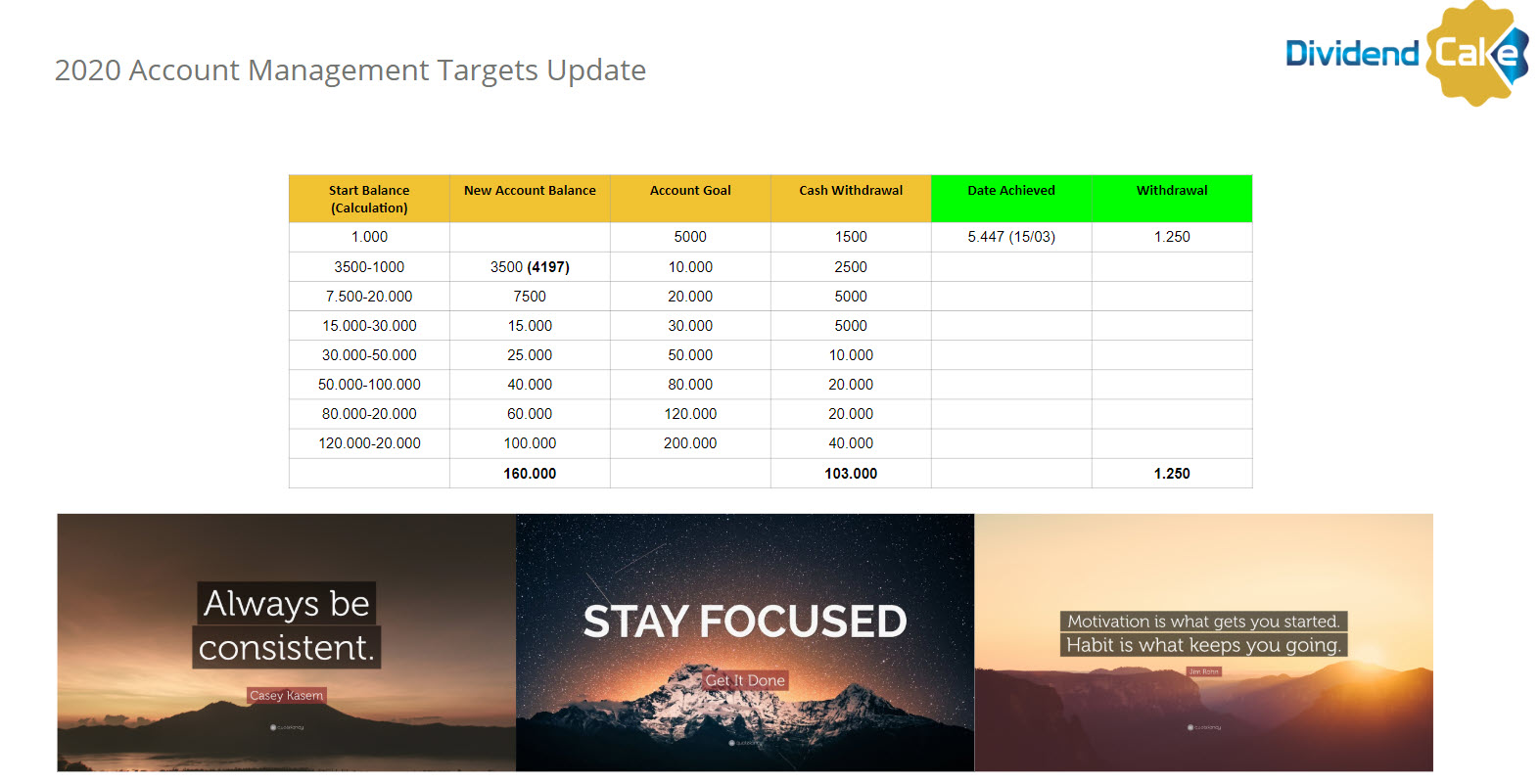

For the year 2020, we will focus on our live (real money) accounts. The plan was to start with a 1.000 Euro account and to trade this to 5.000 Euro and follow the below money management plan, that was outlined in our last Smartphone Challenge Objectives.

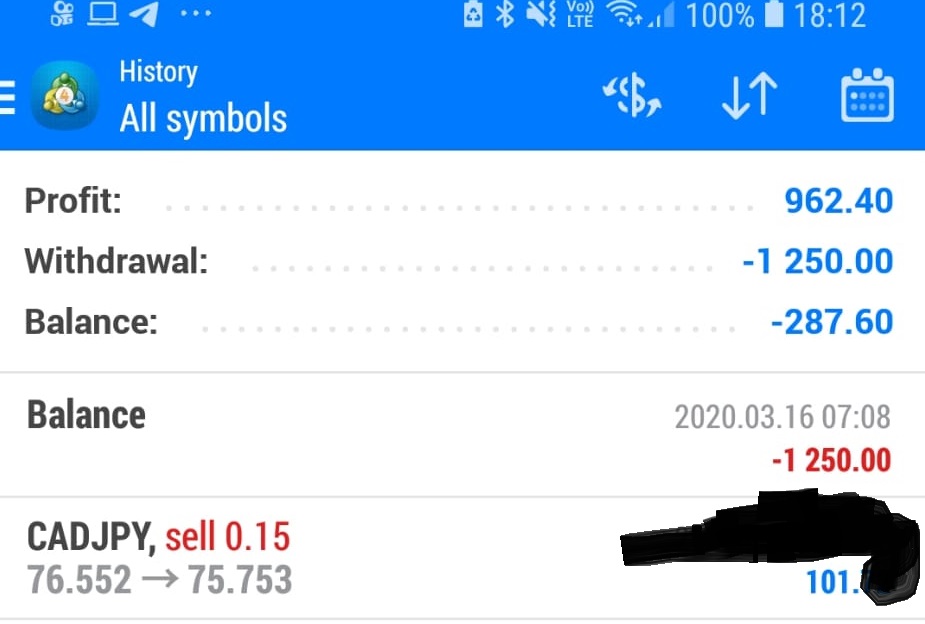

We did hit the 5.000 Euro and we paid ourselves 1250 Euro that we put aside so we can ALWAYS start again with a new account if we would blow it up and lose it. In the plan above I wrote 1.500. Below you can see our proof of the withdrawal.

Our next target is 10.000 Euro. Once we hit 10.000 euro, we will withdraw 2.500 Euro. We will continue this process until we reach 100.000 euro in our trading account. I also have a second real money account and this is also up 18%. We stay on course on our execution plan. Be aware that trading forex market always involves risk and past performance never guarantees future results. We have been trained and learned how to use proper risk management.

My 2020 Demo Account

The best decision last year was our time we traded in demo for 1 FULL YEAR. The demo account allowed me to learn about the mechanics of forex trading and test my trading skills and processes with ZERO risk. Yes, that’s right, ZERO!

MY Advice to YOU : “YOU SHOULD DEMO TRADE UNTIL YOU DEVELOP A SOLID, PROFITABLE SYSTEM BEFORE YOU EVEN THINK ABOUT PUTTING REAL MONEY ON THE LINE.”

WE REPEAT…

YOU SHOULD DEMO TRADE UNTIL YOU DEVELOP A SOLID, PROFITABLE SYSTEM BEFORE YOU EVEN THINK ABOUT PUTTING REAL MONEY ON THE LINE.

Put together a “Don’t Lose Your Money” Declaration

Now, place your hand on your heart and say…

“I will demo trade until I develop a solid, profitable system before I trade with real money.”

Now touch your head with your index finger and say…

“I am a smart and patient forex trader!”

Do NOT open a live trading account until you are CONSISTENTLY trading PROFITABLY on a demo account.

If you can’t wait until you’re profitable on a demo account, then there’s no chance you’ll be profitable live when real money and emotions are factored in.

On average you will need at least to demo trade for THREE to TWELVE months. You can hold off losing all your money for a year riiight? If you can’t, just donate that money to your favorite charity or give it to your mama…show her you still care. Another critical element is the trading psychology. One personal characteristic that almost all winning traders share is that of self-confidence. Winning traders possess a firm, basic belief in their ability to BE winning traders – a belief that is not seriously shaken by a few, or even several, losing trades. That is a belief I am still building upon as I execute more winning trades. I also have losing days, sometimes a week.

I execute my doubt trades still in my demo account. As a result, I can evaluate the winning ratio of those trades and regret afterwards why I didn’t take it in my real money account. The demo account was 90 million in my last blog post. Today it’s 232 MILLION !! Crazy numbers I know but the execution is the same and the RISK is NOT HIGHER. Still 1 – 3% of the account.

Final Words

We are today in phase 3 of the forex trading skills and we keep on building our skills towards a more experienced professional trader. Our goal is NOW to achieve the 10K. I know from trading the demo account the most difficult part is to grow your account from 1K to 10K as it takes most time. You can grow an account by compounding more easily from 10K to 100K.

Keep on compounding this account with 60, 100 or more euros. Little by little…Let’s compound our account and never take too much risk. It’s not about SPEED but the END RESULT. I only use PROFITS to grow the ACCOUNT. The 2020 objective remains to improve continuously our skills, our trading psychology and our risk management. I am always ONE STEP closer to my goal.

Stay tuned how we progress in 2020…it is definitely an exciting journey.

This is the end of this blog post.

Life can be busy sometimes and people lose track of following a personal finance and travel blog. Subscribe to our newsletter and you will get an email per month highlighting what you missed…

Thanks for following us on Twitter and Facebook and reading this blog post. We end with a quote as always.

Source :

No Comment

You can post first response comment.