On the 2nd of October the student organization Capitant Antwerp organized an event “Start to Invest” for the students of universities in Antwerp. The theme of the evening was “your first steps in investing”. The conference room of the university was too small for all students interested to attend the event…

Two speakers were invited : Sven Sterckx of VFB and Stijn Ceelen, country manager of Binck Bank.

The Presentations

Wim Van Halewyck, president of Capitant Antwerp opened the evening and explained the mission of Capitant. The mission is to introduce and guide students into the financial markets. Events, workshops, Finance trips (London & Amsterdam), company visits (for example visit Financial companies such as Bank Delen) are organized throughout the year.

As a student you can get a certificate when you attend these events. It shows a future employer your interest in the financial industry. Become part of Capitant and get YOUR certificate ! Wim explains the upcoming events such as a workshop Technical vs Fundamental analysis, Fintech day (Big data, Blockchain,…) , …and many more.

Sven Sterckx explains the macro-economic picture. He highlights to the students that putting money on savings accounts is the worst thing you can do.

If you want to read the transcript of the presentation, read our blogpost of the investment club Bull’s Eye Society.

Investment club Bull’s Eye Society Event : Saving and Investing your money

The second speaker Stijn Ceelen explains why you need a broker to invest in the stock market. He explains the function of a broker and the different order types when placing a stock order. Costs are important when doing stock transactions but price is not everything. Stijn explains the different costs. You need to look at the total package.

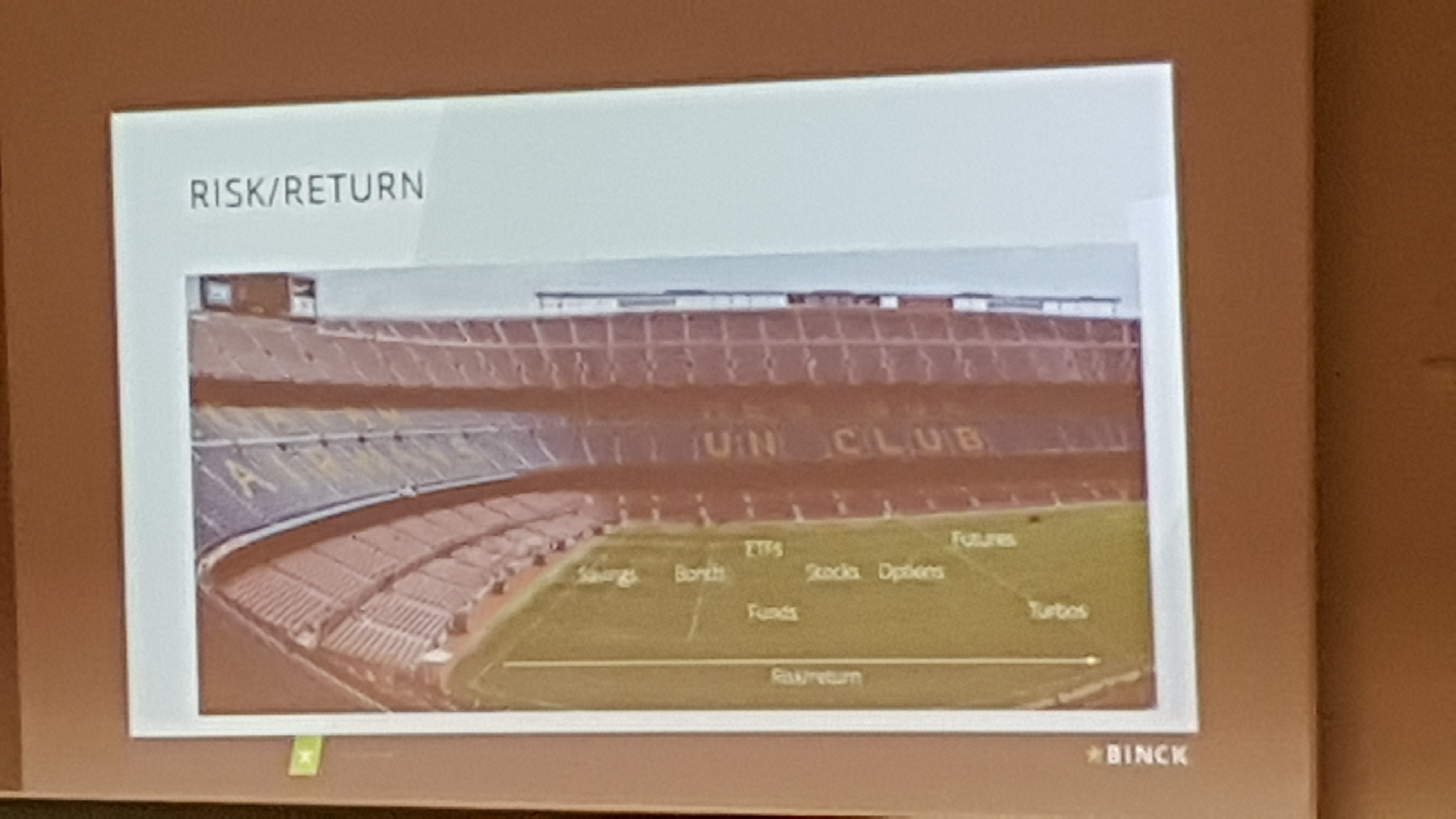

Investing in the stock market has a different risk/return dependent on the product you invest in. It’s like a soccer team. You have Savings – Bonds – ETFs / Funds / Stocks / Options / Futures / Turbos.

How do you select a stock to invest in? You can pick a name, a sector or an ETF. Today it is very hard to beat the market. The recommendation is to follow the markets actively and invest for example in emerging markets and execute active portfolio management. Stijn ends with 8 golden tips for the students.

8 Golden tips

- Keep an emergency fund available

- Invest with a longterm perspective

- Don’t put all eggs in the same basket – Diversification worldwide is needed

- You can achieve higher returns thanks to low costs – ex. Buy a low cost ETF tracker

- Don’t buy a cat in a bag – Know what you buy and how this works..

- Don’t be too overconfident

- Never underestimate the effect of exchange rates

- Cut your losses and let your winners run (Warren Buffett)

Final conclusion

During the evening we spoke with several students why they attended this infosession Start to Invest. The majority of the students realize that they lose money when they put money on a savings account. This awareness exists but they lack the financial education on how to invest in the stock market. Some students we spoke to, ask their bank what to do and get (as always) funds advised.. I wonder whether these students realize the costs of mutual funds. Other students were experimenting with turbos and buying stocks. The rest had no interest as they had other priorities in life…

We applaud the student organization Capitant for setting up this event and the massive attendance clearly shows the need for financial education of the youth. For more information about Capitant go to their website.

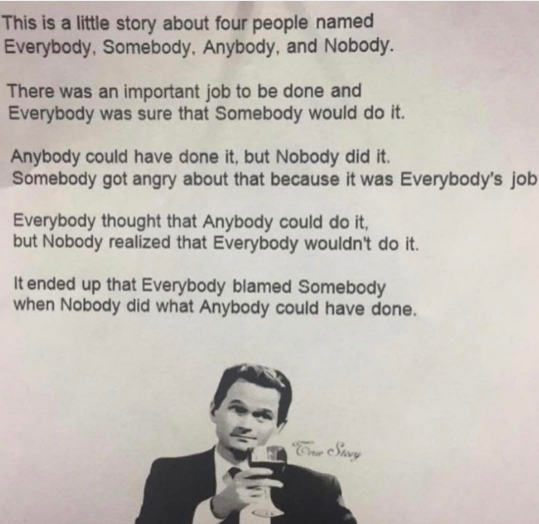

Thanks for following us on Twitter and Facebook and reading this blog post. Keep on investing in your financial education ! We end with a quote as always. A nice one to think about…

No Comment

You can post first response comment.