Autumn vacation for the kids finally…and Halloween is approaching. As a family we locked in two Halloween events and prepared our scary clothing and makeup. During the past weeks I have missed publishing some blog posts. The main reason is FOCUS. I am focussing on the achievement of my 2018 objectives.

If you follow this blog, you know I have only completed two financial classes with the kids. Before the year end, I want to focus and complete the last three financial education classes.

How many days are we away from the year end ? Sixty-three days only… Let’s make a quick review of the 2018 objectives :

- Save at least 10% of my yearly income. Result Year-to-Date (YTD) : 5.8%

- Achieve a total of 10.000$ passive income for the total year 2018. Result End of September : 5646$ or 56%

- Put my mom’s portfolio at work and generate at least a yearly 3.500$ passive income. Result End of September : 1831$ or 52%

- Grow our passive income in my kids portfolio to 1000$ for the whole year. See below !

- Give our sons at least 5 FINANCIAL educational lessons and teach him the basics of finance and how to manage money. Only 2 classes done so far…

So let’s move on to our Kids Portfolio. A portfolio I started with 10.000 Euro. We will grow this portfolio as an emergency fund for the kids and as big as possible.

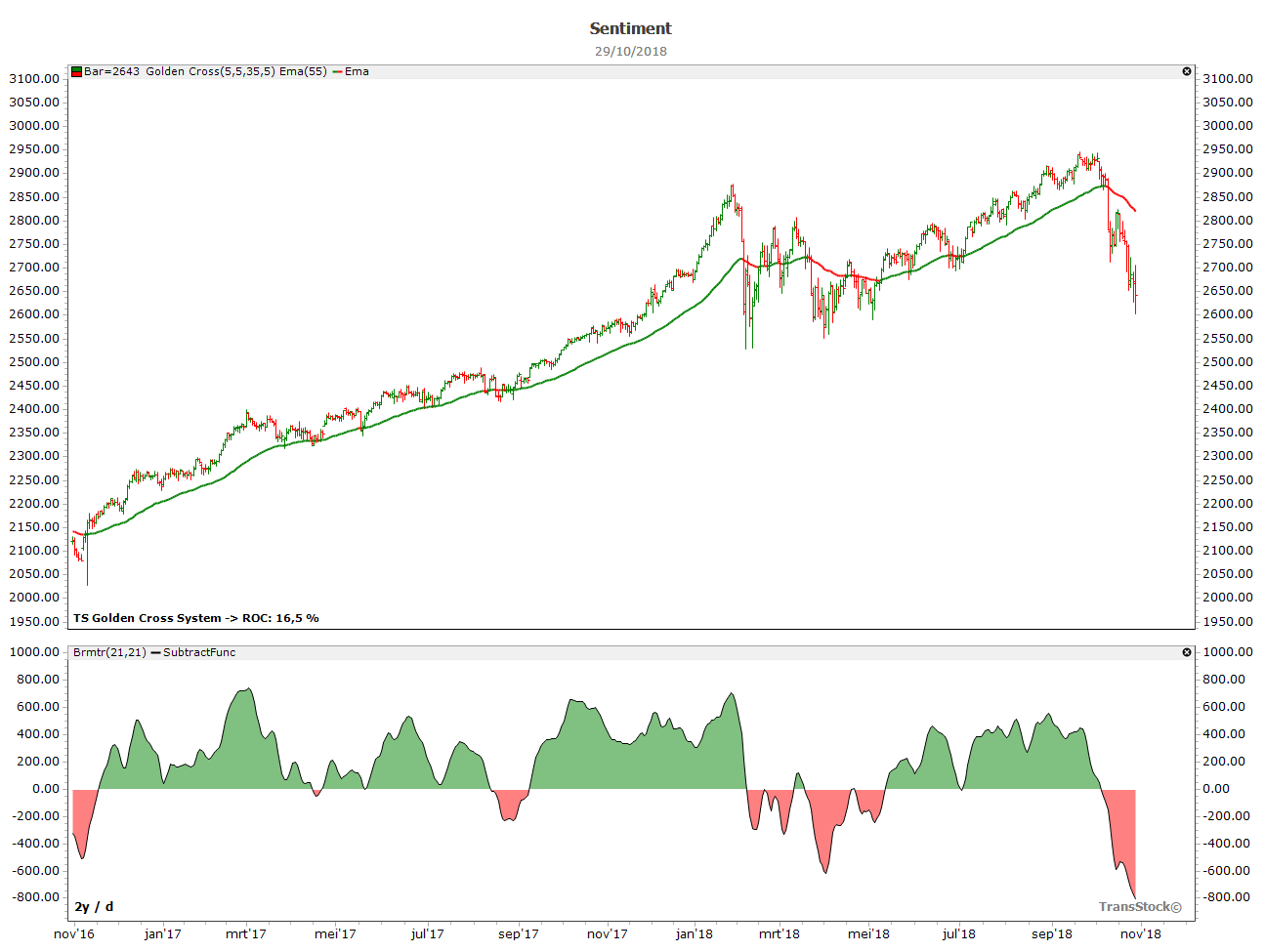

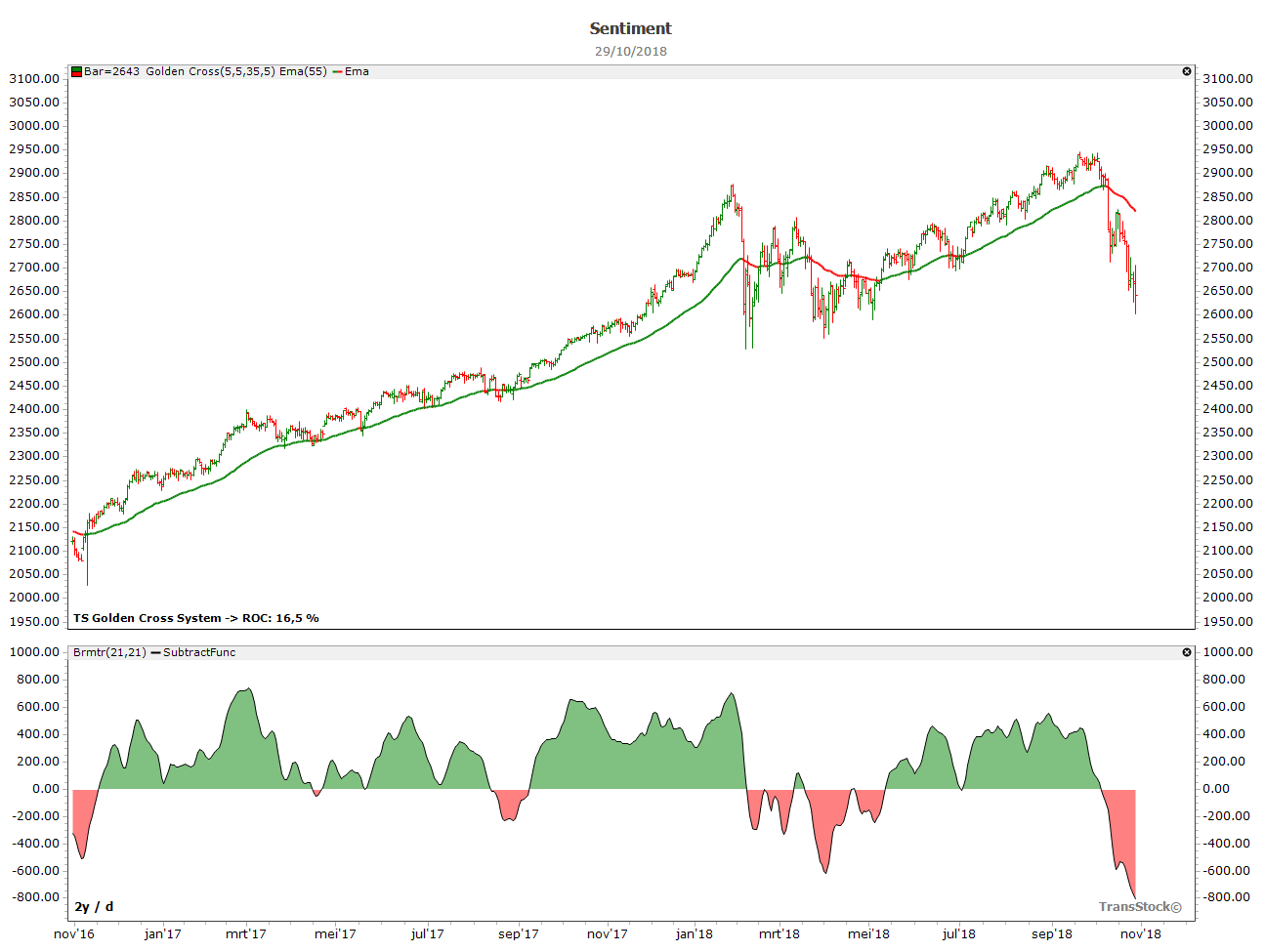

Market Sentiment and Sector Watch

Last month we wrote that we saw that the run to year end looks solid. But in the meantime the market sentiment has changed to the selling side. You see the market sentiment go fall off the cliff. Is this the end of the bull market ? Some say we are because we broke the 200 EMA, some say we are still not…and this is a buying opportunity. Many stocks are down by 20%+

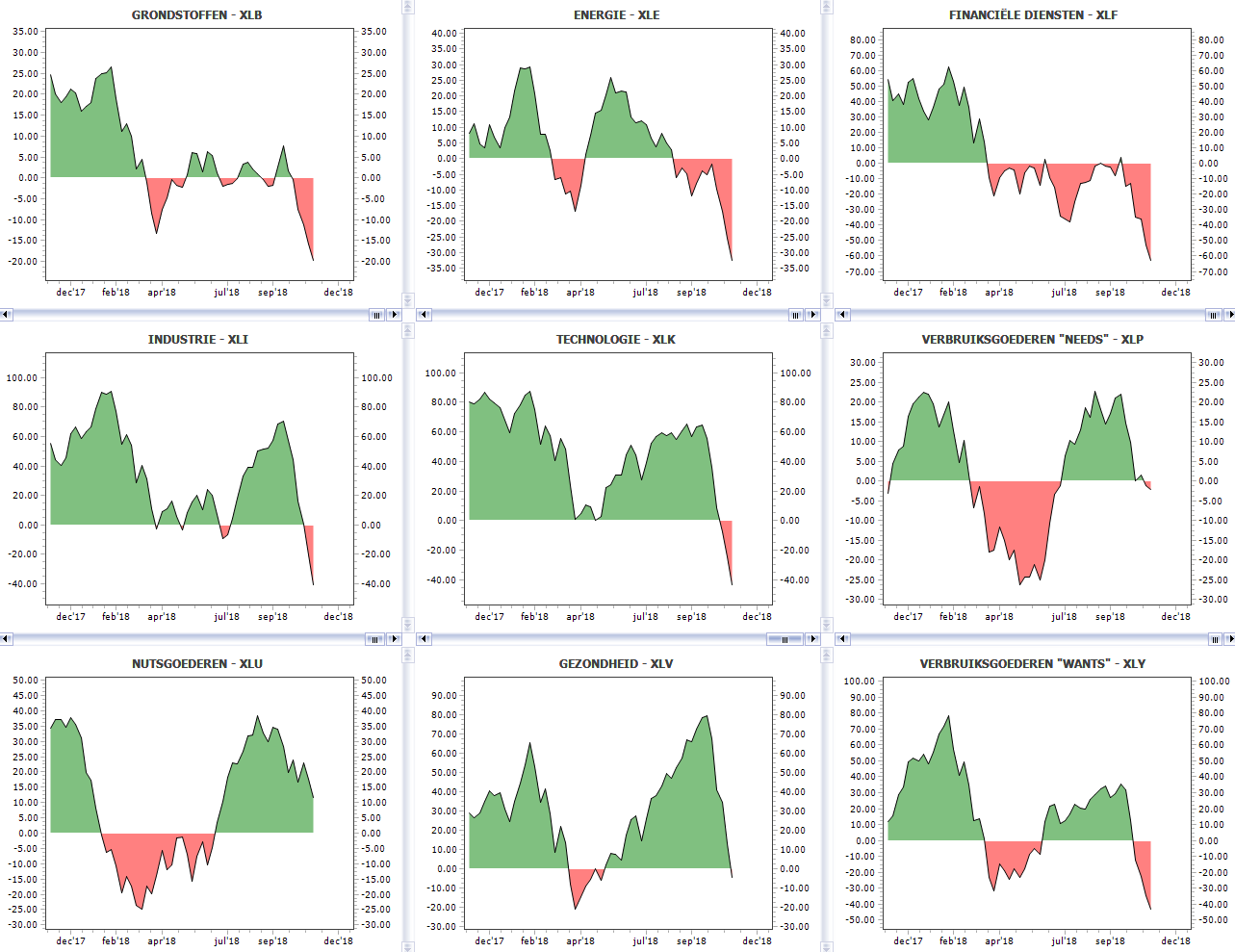

Let’s take a look at the Sector Watch. Here we look which sectors we should invest in and what is different compared to last month. We placed the latest Sector Watch graph below…This always allows you to make your own analysis.

As we did see a big selloff, all sectors except consumer goods and healthcare did sell off strongly. The strongest sectors Technology and Healthcare did sell off too. The FAANG stocks did selloff big. Did you see the selloff of Amazon during past weeks ?

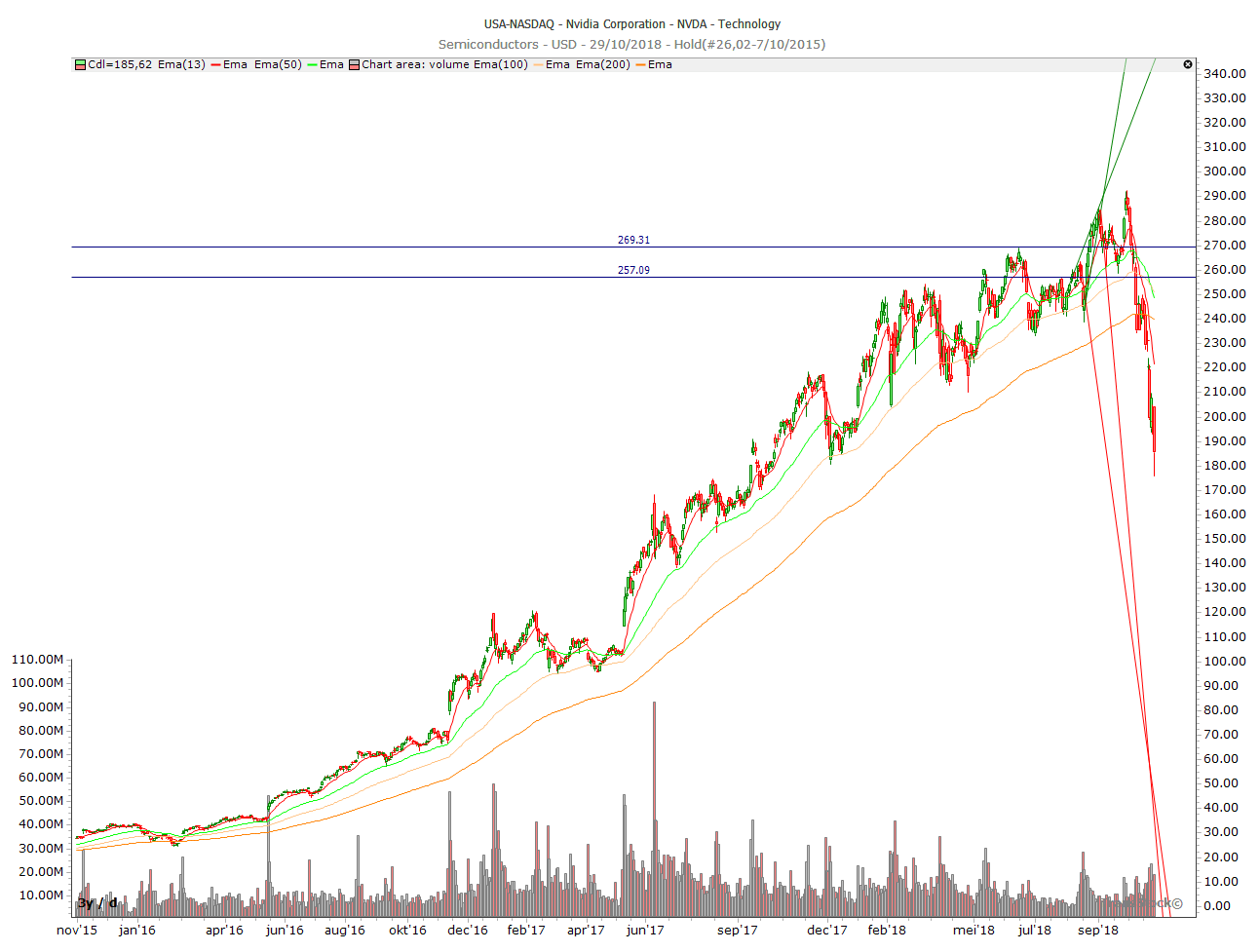

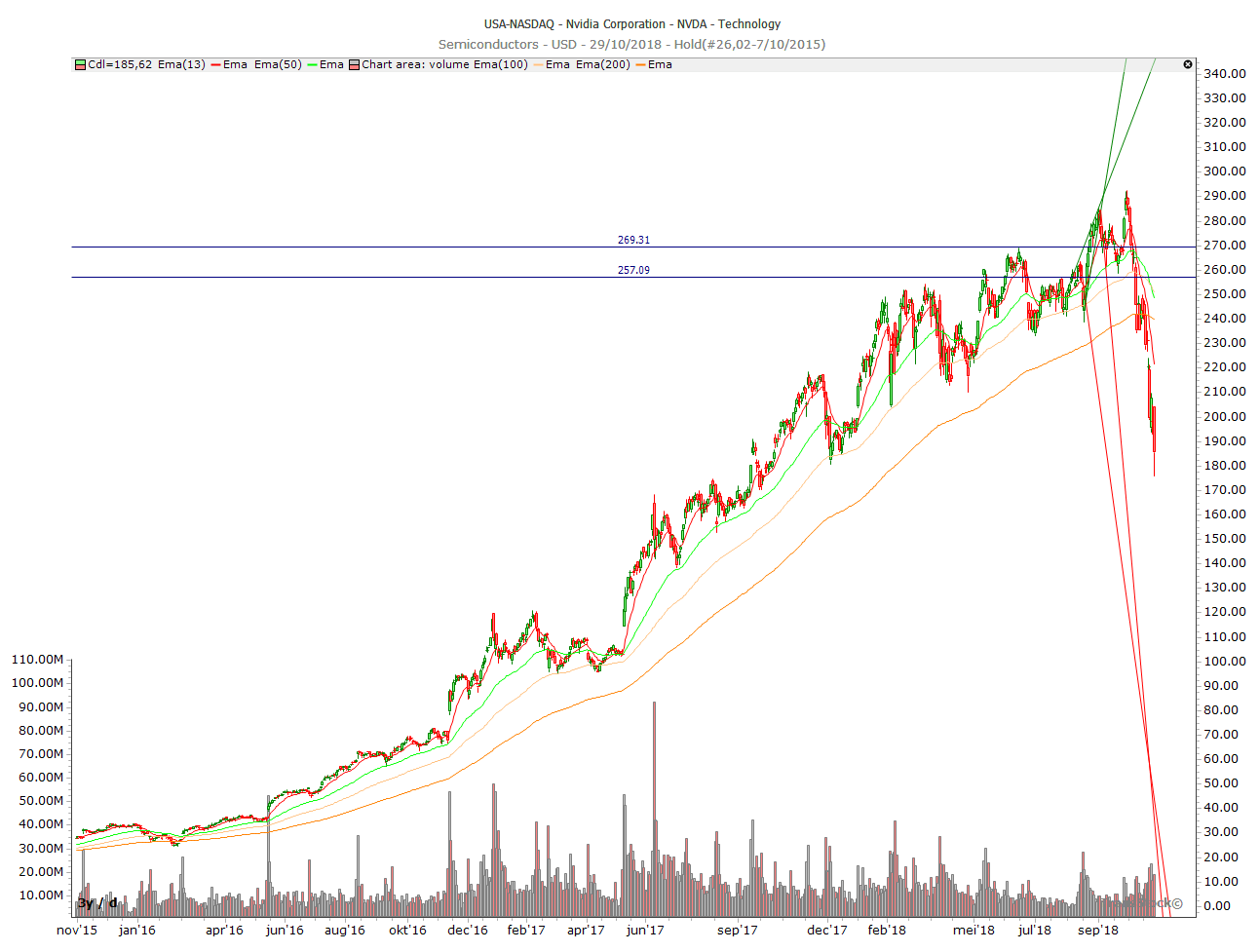

Also the energy sector did sell off. The sector that did have a lot of attention during the past years and investments from buy and hold investors, was the semiconductors sector. Names such Nvidia, Micron Technology were some companies in this sector. Did you see the sell off past week of NVIDIA ? When two weeks ago I said in a Buy and Hold Investors Facebook group that this was the top for NVIDIA, I got beaten up with the contrarian opinion of buy and hold investors. NVIDIA was a growth company and I was the “stupid” guy who wasn’t reading yearly earnings reports… Well, the graph of NVIDIA looks like falling from a cliff. Never fall in love with a company name ! Read the graph and learn how to make money in a downtrend market.

Be aware we are not a financial advisor. Execute your own risk analysis and investment research. Read our disclaimer. We hope this sector review was useful for you to understand market opportunities and how we analyse potential opportunities.

Be aware we are not a financial advisor. Execute your own risk analysis and investment research. Read our disclaimer. We hope this sector review was useful for you to understand market opportunities and how we analyse potential opportunities.

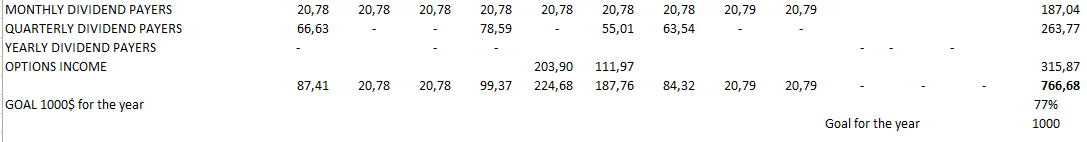

Let’s dive in the passive income update for my kids portfolio.

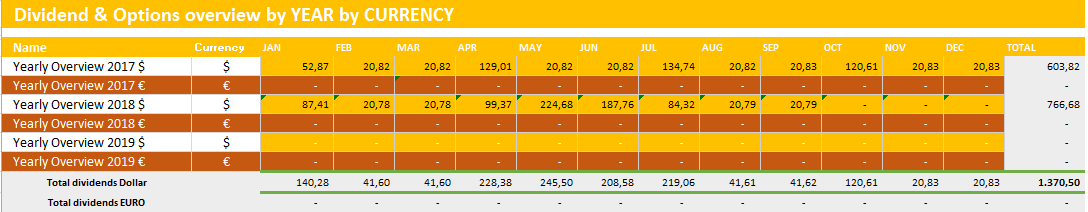

Dividend & Options Income Update

During the month of September 2018, we received 20,79$ passive income. Only Dividend income as we have been very busy with the strategy in our own portfolio.

Portfolio analysis and Growth Strategy

We started with an amount of 10.000 EURO . The 2018 goal for my kids’ portfolio is to generate 1000$ in the total year. We achieved 77% of our yearly goal so far.

We have 766$ in our pockets so far ! We keep on grinding forward to our yearly objective.

Going forward

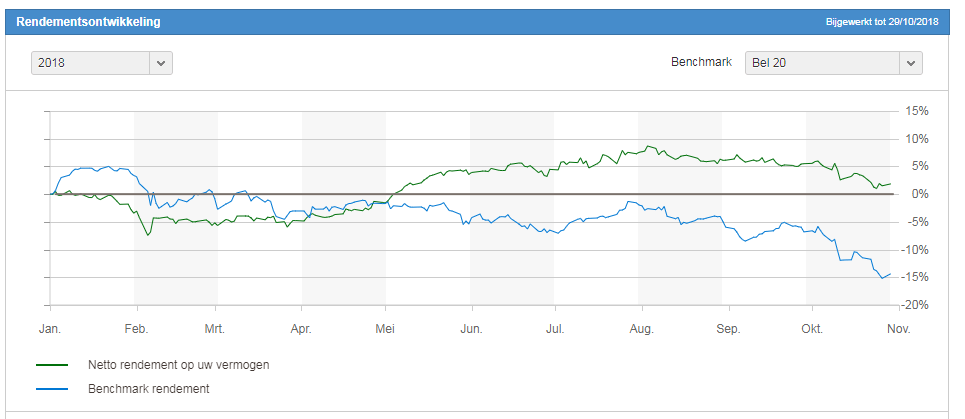

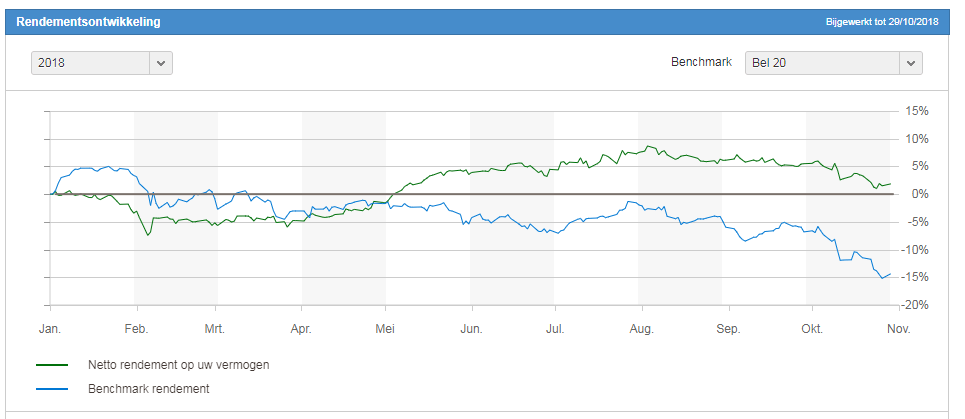

We are two months away from the year end and we will review if we can execute some options selling strategies to get some more cash flow in this portfolio. In our broker platform we found the following comparison graph of our kids portfolio performance compared against the BEL20 stock index. Our portfolio shows still a total value above 10k. If you were invested in BEL 20 stocks, you lost 15% year to date. This graph does not represent our cash flow performance of the portfolio.

Good luck with your personal finance strategy for your kids! Thanks for reading. Putting money on a savings account for your kids is NOT a strategy to make it grow!We hope you learned something from this blog post and keep on following us on Twitter and Facebook. As always we end with a quote.

![]()

![]()

No Comment

You can post first response comment.