On the Dutch website Spaargids.be was an interesting article about how to teach your kids to save money. For most kids saving money is not an interesting topic and part of their world. Money is simply not part of their concerns. Saving money is a learning process. You can start teaching your kids from young age. You can also pay the kids “pocket money” to start the saving process or you can pay them for little household tasks to spice their savings. You decide how you want to teach your kids financial literacy. Guide them in the learning process. And certainly allow them to spend money on something they want badly….

On the Dutch website Spaargids.be was an interesting article about how to teach your kids to save money. For most kids saving money is not an interesting topic and part of their world. Money is simply not part of their concerns. Saving money is a learning process. You can start teaching your kids from young age. You can also pay the kids “pocket money” to start the saving process or you can pay them for little household tasks to spice their savings. You decide how you want to teach your kids financial literacy. Guide them in the learning process. And certainly allow them to spend money on something they want badly….Market Sentiment and Sector Watch

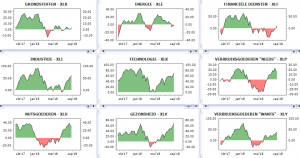

The sentiment change from past month’s blogpost had a short life. The market bounced and all negative sentiment disappeared. Nafta trade talks are going well with Mexico and Canada. The risks for a market drop disappear each time as snow for the sun. The markets are getting more immune for Trump’s tweets. As a result we see bullish sentiment. We are breaking new all Time Highs !

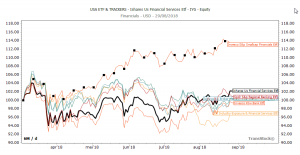

We did a quick analysis for the Financial sector. The tickers PSCF and IVG look the strongest ETFs for a breakout to more upside. Look at below graph. The black line is IVG and the line with black dots is PSCF.

We did a quick analysis for the Financial sector. The tickers PSCF and IVG look the strongest ETFs for a breakout to more upside. Look at below graph. The black line is IVG and the line with black dots is PSCF. Be aware we are not a financial advisor. Execute your own risk analysis and investment research. Read our disclaimer. We hope this sector review was useful for you to understand market opportunities and how we analyse potential opportunities.

Be aware we are not a financial advisor. Execute your own risk analysis and investment research. Read our disclaimer. We hope this sector review was useful for you to understand market opportunities and how we analyse potential opportunities.

Dividend & Options Income Update

During the month of July 2018, we received 84,32$ passive income. Only Dividend income as we enjoyed our summer vacation in Italy.

![]()

Portfolio analysis and Growth Strategy

We started with an amount of 10.000 EURO . The 2018 goal for my kids’ portfolio is to generate 1000$ in the total year. We achieved 73% of our yearly goal so far.

We have 725$ in our pockets so far ! We keep on grinding forward to our yearly objective.

![]()

Going forward

Four months left for the year to hit or miss the yearly objective. Let’s continue on building our options investing knowledge. I still consider myself a newbie in this field. Month after month we learn. Forward is forward. Options investing offer huge opportunities if you want to invest the time to learn. Nothing comes simple….persistence and hard work is the road to success.

Good luck with your personal finance strategy for your kids! Thanks for reading. Let us know your comments how you teach your kids to save money. We have 5 financial lessons planned for the kids this year. We only executed one so far ! School of Financial literacy will soon start again for our kids so we hit our yearly objective.

Putting money on a savings account for your kids is NOT a strategy to make it grow!

We hope you learned something from this blog post and keep on following us on Twitter and Facebook. As always we end with a quote.

Source : De Spaargids

No Comment

You can post first response comment.