Today is the last day of August 2017. Tomorrow kids go back to school…today they are playing their favorite game Roblox again !

While our August dividends have been transferred to our bank account, we spend one special week in Colombia. Keep an eye on our blog page in September and you will find out why…

In the meantime we follow the global markets, economy news and what impacts our portfolio and finances.

Market Sentiment and Sector Watch

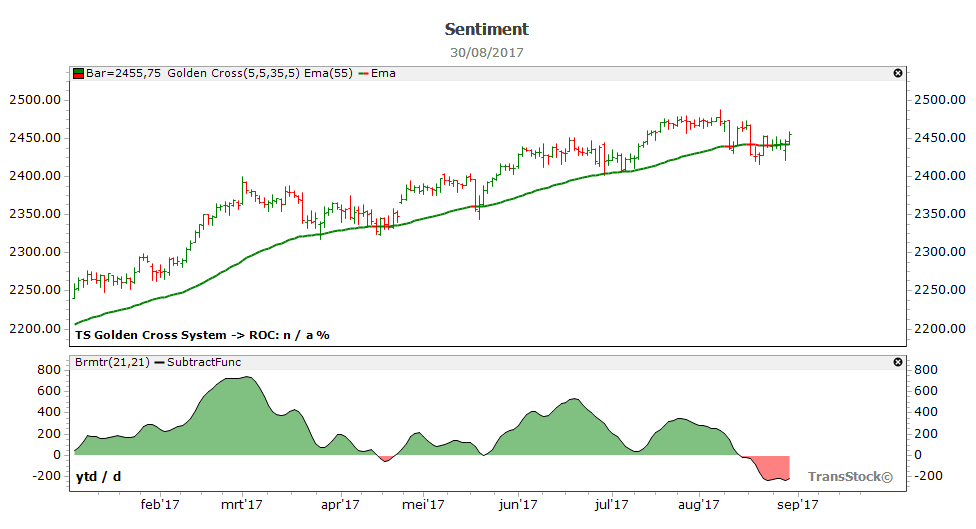

Let’s take a quick look at market sentiment. On the 17th of August we did see the market sentiment flip red. While tensions with North-Korea increase and Harvey hits the American mainland, stock markets get more and more sensitive.

More and more investors get nervous and market sentiment seem to be ready for a correction…

Let’s take a look at the Sector Watch. Here we look which sectors we should invest in and what is different compared to last month. We placed the July and August below each other…

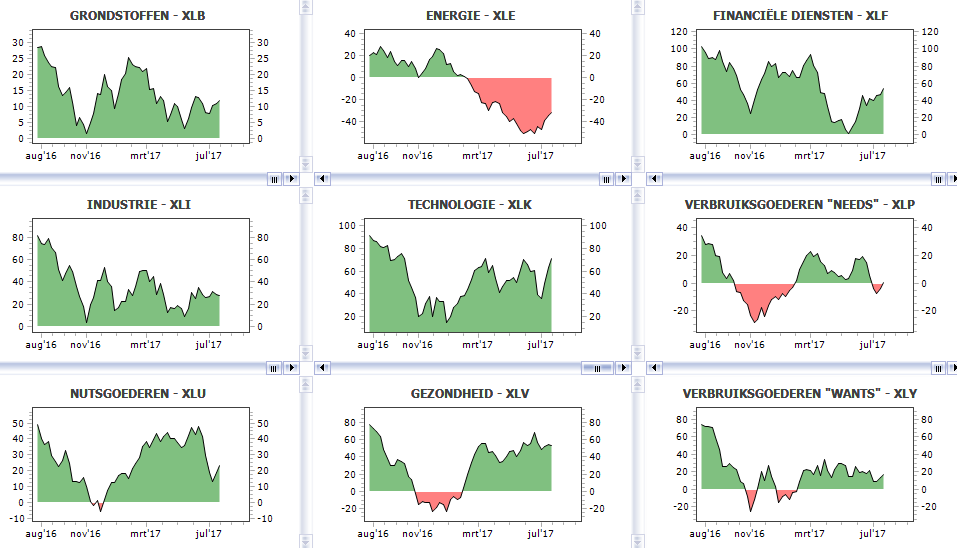

July Sector Watch

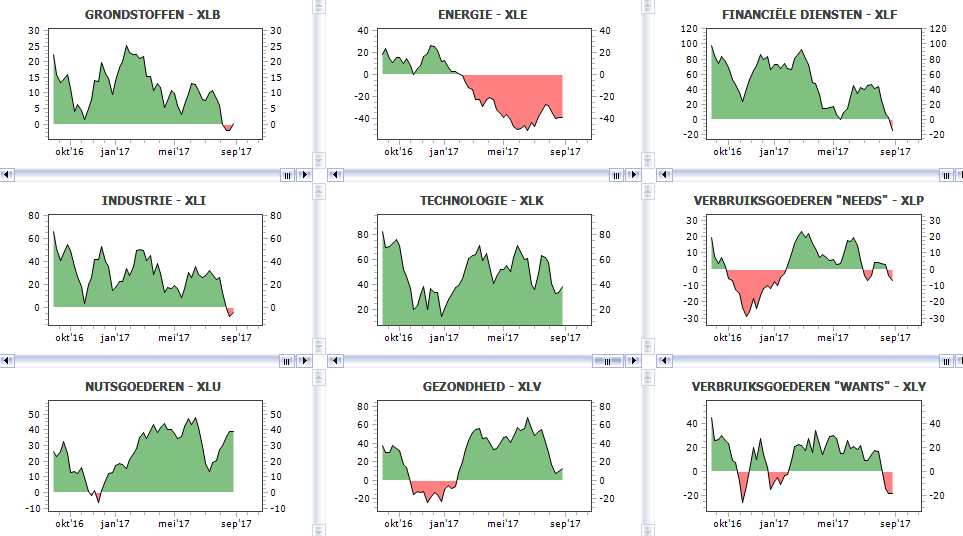

August Sector Watch

For the sectors XLB, XLF, XLI, XLV and XLY we see the trend go downwards. Only the sectors Technology and Utilities remain strong.

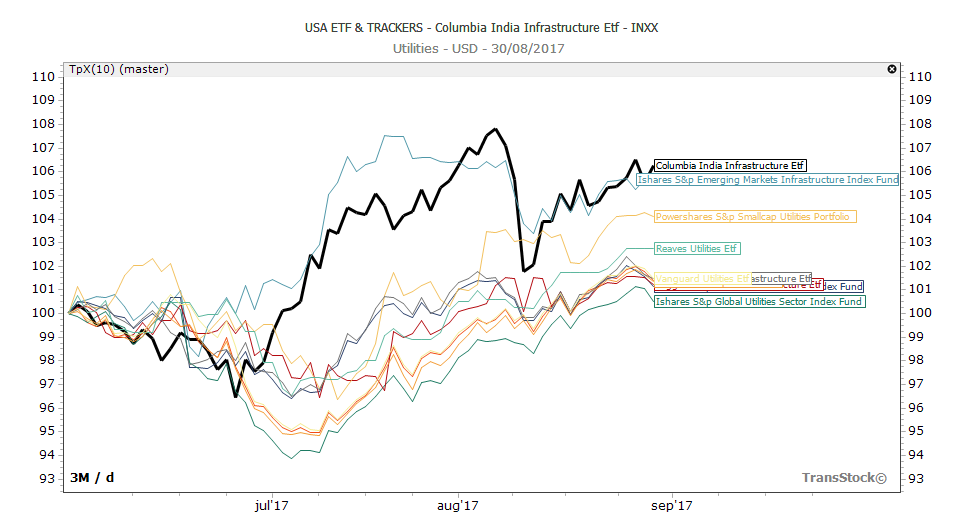

Let’s take a look at XLU Financials. Here the leading ETFs are INXX, EMIF, PSCU. Those tickers are the strong performing ETFs you should invest in.

Take a look at the trend chart of the above three tickers and you understand what I mean.

Let’s do the same for the Technology Sector.

Here the leading ETFs are CQQQ, ARKK, ARKW. Those tickers are the strong performing ETFs you should invest in.

Take a look at the trend chart of the above three tickers and you understand what I mean. They are in a nice upward trend channel.

I have been thinking how to use this market sector watch for my own investing strategy. Going forward I will develop an options investing strategy using sector ETFs or investing directly in strong performing ETFs.

We hope this market review was useful for you.

Dividend Income Update

Now let’s take a look at the dividend income report of July 2017 for my kids’ portfolio!

Dividends received in July 2017

During the month of July 2017, we received 134,74$ dividend income.

![]()

Portfolio analysis and Growth

We now have 470,58$ dividends received on a starting amount of 10.000 EURO AFTER 7 MONTHS. Here we converted the previous month dividend income in Euro amount to $ amount. The 2017 goal for my kids’ portfolio is to generate 600$ in the total year which equals to an investment return of 6%. We have now 78% ACHIEVED of our 2017 objective. We are slowing grinding to our yearly 2017 goal.

Going forward

We have a cash position of 3000 Euro which we don’t intend to use for the moment. We just accumulate our incoming dividends to a nice cash position.

Good luck with your personal finance strategy for your kids! Thanks for reading.

Putting money on a savings account for your kids is NOT a strategy to make it grow!

Thanks for reading the blog post.We end with a quote..

2 Response Comments

The sentiment is an interesting approach. I note that I am a little contrarian on the sentiment. I am short an XLE put., thus expecting the price to stay stable or go up. And I decided not to sell a put on XLK.

Interesting feedback ! Thanks for the feedback !