Portfolio of my kids

There are several ways you save for your kids’ future. A dedicated child’s savings account is the most common one used by most families in Belgium however in today’s market, savings accounts carry very low interest rates, even lower than inflation so you lose money. You can use them to teach children about money and savings as they get older.

But to make money grow for your kids, you can use a more offensive strategy. For a time span of ten years or longer, Ameriprise financial advisor Dawn Jurkovich says, “Put it in a moderate aggressive investment … something with a higher dividend. Over a ten-year period, you can be more aggressive.” The money can then be used for college tuition, living expenses, a wedding, or anything else.

This is exactly what I have done. I opened a broker account with Binck Bank, who does not charge for your broker account compared to other Belgian banks…remember costs eat your return away. Another alternative is Keytrade bank. At Fortis bank you pay easily 30 Euro per year for storing your shares…for doing what? Compare and ensure you use the right company to maximize your return.

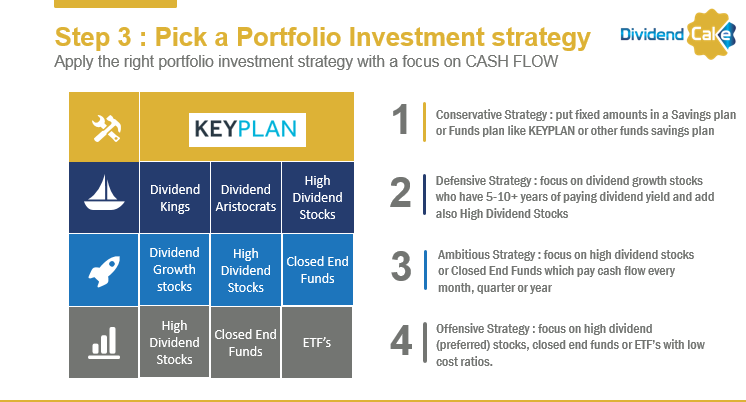

During the past 6 years I saved first on a consistent basis 5k euro for my kids. This 5k has grown to 10k with the conservative strategy of my Financial Strategy. See the Infogrpahic for my Financial Strategy below.

Now I am changing course going forward. I am switching an Offensive strategy.

I will invest in (preferred) stocks, closed end funds with low cost ratios, ETF’s or other that provide cashflow. The cash flow earned will be re-invested in new investments to make the compound interest scheme work.

The objective is simple : Save the financial buffer so they can immediately start with saving for their investment portfolios. I will report on the progress in the blog. There is no dividend report so far as this portfolio just got started. The journey starts now…