May 2017 was another interesting month. We visited for one week Dalian in China where we saw this accident on the street. Nobody was hurt but the truck blocked three lanes. President Trump visited also Belgium and opened the new NATO headquarters with the other Western leaders. Bel 20 index rallied through to 4000 index points. Another interesting news note was that a study reveiled that all Europeans descent from Belgium….one Belgian minister commented that this can not be said for beers too. If you don’t believe me, read here the whole article “All Europeans are Belgians”

Anton van Zantbel, lawyer at Rivus wrote an interesting article about the budget control of the Belgian government. He quoted ” Our Belgian politicians are like trained and experienced ostriches that do not feel any sense of urgency !”

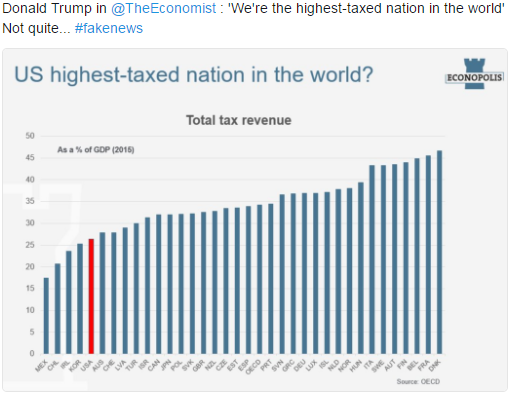

In july 2017 the Belgian government meets again to find 5 billion. Some parties are lobbying for a “fair tax system” or with other words “new taxes”. Trump said in The Economist magazine that US was the highest taxed nation in the world. Well following graph shows that Belgium is in the top 3 behind France and Denmark. USA is the red bar. I don’t think this is a graph where Belgian politicians should be proud of. This tax rate results in a government impact of 55%. But the sad part is that this Belgian state fails on many areas. While spending less on military and foreign development aid, the deficit of 450 billion is still not under control.

Belgian politicians keep on acting like the orchestra on the Titanic. The solution is although SIMPLE : LESS EXPENDITURE on what a government needs to do. With increasing costs of pensions for an older population and a taxation on less and less working people, there’s a sense of urgency needed to keep the budget under control if we want to guarantee the future of our Belgian kids.

In Belgium there has been no government that spend LESS than she taxed from her citizens…!

In the USA the situation is even worse. Americans have racked up more than 1,4 trillion $ in student loans. The Institute for College Access & Success found 68% of students graduate with debt. The average amount borrowed for a student loan is 30.000$. The average credit card debt per household in the US has increased from $2000 to $8000 within 10 years.

Recently the new government Trump announced some cuts which will put more pressure on the lower wage families and middle class. I list some out.

- Student loans : the loan program for low-income students is cut by $143 billion

- Food stamps : funding for this program drops by $193 billion.

- Farm subsidies : certain farm subsidies are cut by $38 billion.

- Medicaid : Medicaid and the Children’s Health Insurance Program will see a reduction in funding of $616 billion over 10 years.

- Obamacare : The replacement or repeal of Obamacare would save 250 billion over 10 years…

The financial pressure on the low-income and middle class families keeps on increasing. The credit card debt and student loans increase year over year…We will see how the Trump government will keep the budget under control going forward. They are cutting expenses and you can read above who will bleed due to those cuts.

So let’s go towards our Market Analysis.

Market Analysis

The stock market continues to rally higher. The Bull market is very strong.

On 19th of May I read an interesting article. “Waiting for the Market to Crash is a Terrible strategy” ! I quote some parts.

“Investors sitting on a lot of cash are usually worried about equity valuations or the economy, and tell themselves and others that they’re going to buy gobs of stock after a crash. The strategy sounds prudent and has commonsense appeal—everyone knows that one should be fearful when others are greedy, greedy when others are fearful. But historically waiting for the market to fall has been an abysmal strategy, far worse than buying and holding in both absolute and risk-adjusted terms.

The strategy fails for two reasons. First, the historical equity risk premium was high and decades could pass before a big-enough crash, making it very costly to sit in cash. Second, the market tended to exhibit momentum more than mean reversion over years-long horizons. As strange as it sounds, you would have been better off buying when the market was going up and selling when it was going down, using a trend-following rule.”

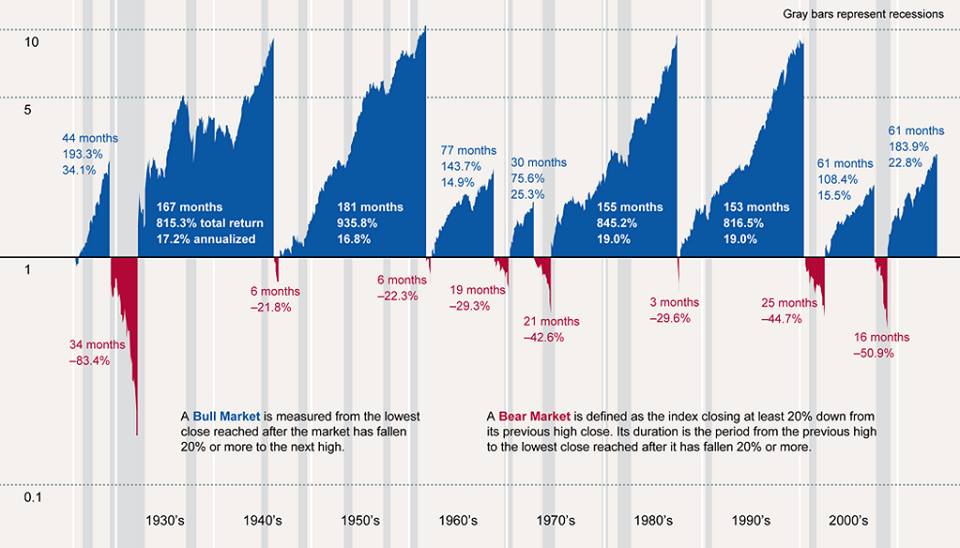

Now we are 61 month in a bull markets. More and more investor gurus are saying : “The market crash is coming”….when we look at below chart it can still take a while before the market turns to a bear market. in the 1990’s we had an 153 month bull market.

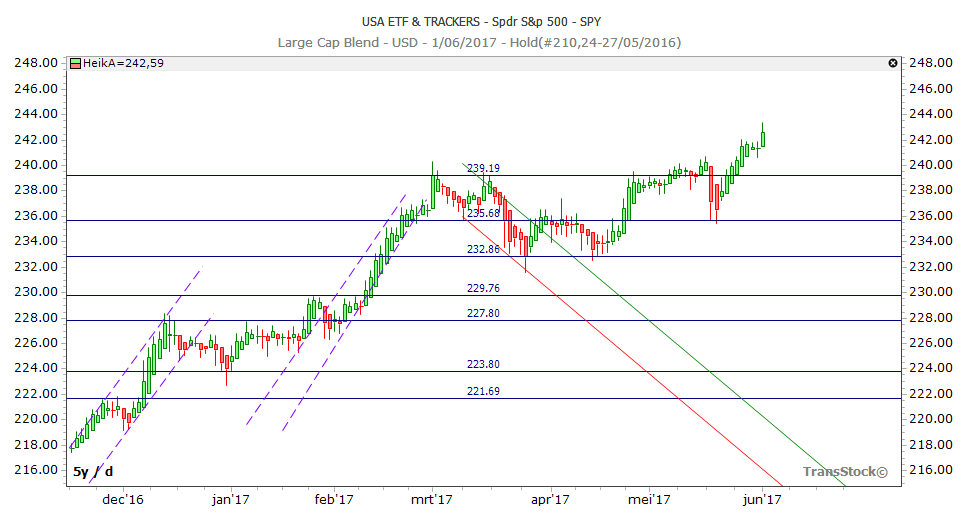

When we analyse the performance of the SPY (screenshot 1 June) we can conclude that our thinking was correct about a consolidation phase in April and also in May. The SPY ETF did break out of the 239 level at the end of May after touching and bouncing off the 235 level. We are now back in an uptrend channel and going to new highs. Where is the end of this bull market? Who knows…do you have a crystal ball? In a climate where central banks keep interest rates low, there is simply NO alternative compared to savings accounts or bonds.

Let’s dive in the numbers of the May 2017 Dividend Income Report.

Dividends received in May 2017

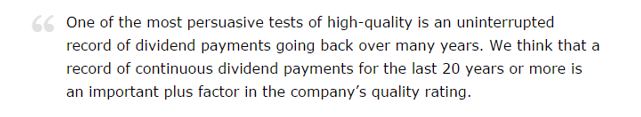

The legendary investor Ben Graham explained in The Intelligent investor :

Dividend stocks, more often than not, form the foundation of every great portfolio, especially retirement portfolios. And it makes perfect sense why: Dividend stocks offer three key advantages that attract long-term investors. To begin with, dividend stocks act as a beacon of profitability. Dividend-paying companies typically have time-tested and profitable business models, and the management at these companies probably wouldn’t continue to pay a stipend quarterly or annually if it didn’t foresee ongoing profits and growth. In other words, dividend-paying stocks are making investors’ weeding-out process of finding their next investment that much easier.

Second, dividend payments can help mitigate the pain felt during inevitable stock market corrections. According to data from Yardeni Research on the S&P 500, there have been 35 stock market corrections totaling 10% or more (when rounded to the nearest whole number) since 1950, or approximately one every two years. While dividend payments aren’t going to make up for the short-term paper losses you could incur during a stock market correction, the added income can certainly take the edge off and calm one’s nerves.

Last, but not least, you’ll have the opportunity to reinvest your dividends via a dividend reinvestment plan, just as the pros do. Reinvesting your dividends into more shares of common stock eventually boosts your payout and increases your share ownership in a repeating cycle. It’s one of the smartest ways you can compound your wealth, which is why money managers love it so much.

Reinvesting our dividend payouts is exactly what we keep on doing. In May 2017 we received a total of 575,50$. Another solid month above 300$, our new monthly objective.

![]()

Now let’s analyze the breakout.

We received 466,13 Euro from our monthly paying stocks and ETF’s. One quarterly payment of 109,39 from a preferred stock. We thought we only were going to receive 251,32 like last month but we made an error in our excel tracking file. Does that mean that we will receive now every month 466$. No as a lot has happened in my portfolio…continue to read on.

See our detail overview of all our dividend payouts.

![]()

Portfolio Analysis and Growth

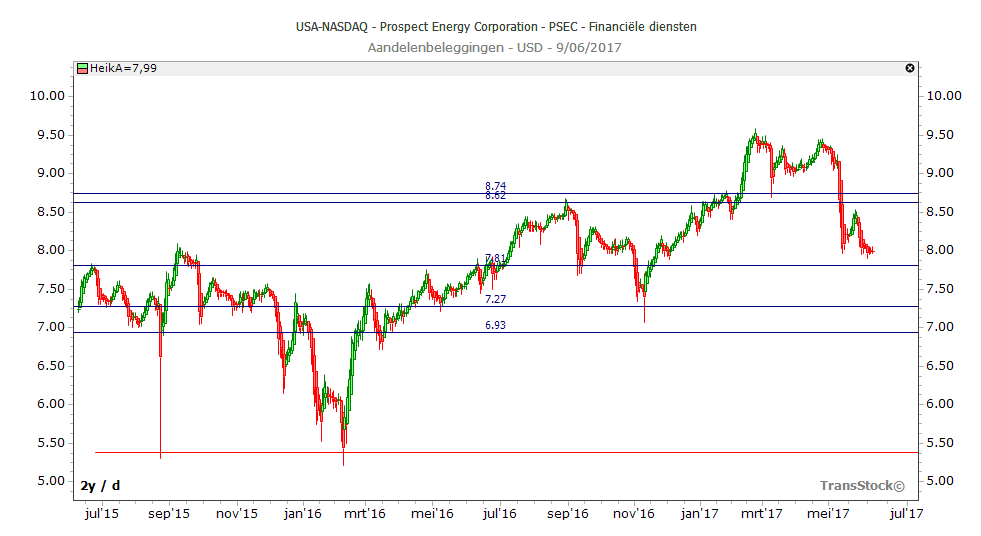

During the month of May I sold my position in the company PSEC. You can compare it with the car hitting the truck picture in China…a sudden event where I had to act and intervene…

I purchased PSEC long time ago at a purchase cost of $7,2. Per month I received a MONTHLY dividend payout of 141$. When PSEC was announcing their next 3 months dividend payouts, the management declared that the dividend payouts beyond September would decrease. The stock took a deep dive as dividend investors started to sell off. And I also sold all my shares and took my $2000 capital gain and last May dividend payout.

As PSEC was representing 10% of my portfolio, I now had a large cash position for new investments. Replacing a 141$ MONTHLY dividend payout will not be easy as some valuations of high yield stocks are for me too high. We don’t buy high yield stocks that are valued with a premium against their NAV.

I have re-invested 50% of my new cash position in two Closed End Funds. One CEF is specialized in Emerging markets and pays a monthly dividend of 0,18$ with a dividend yield of 11%. Another Closed End Fund pays also $0,18 per month with a dividend yield of 12%. Together they should pay me around 75$ per month if my calculations are correct. We will see next month. I wanted to diversify my cash position in 4 new positions. Spreading the risk.

We have also been following the EURO/USD valuation. The EURO rallied to 1,12. We did not convert a piece of our EURO cash position in Dollars. Maybe we wait until 1,15. We will follow this closely.

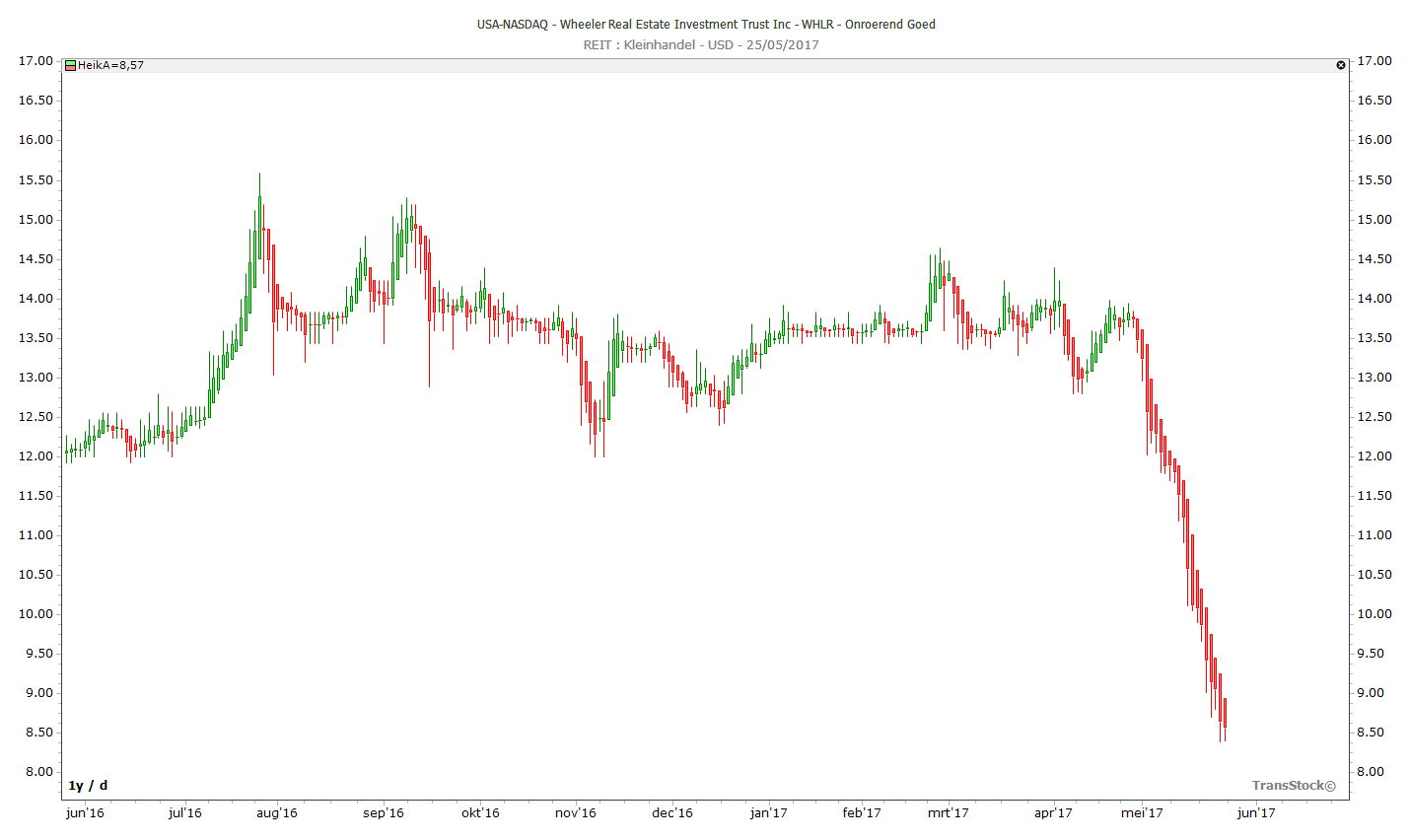

Do you remember that we sold in past months the REIT WHLR after they announced a stock split?

Well here’s what happened two months after we sold. They announced a dividend cut and their share price has lost 50% in valuation. If we stayed in that position, we would have lost 50% of our investment. That’s exactly the reason why we don’t like companies announcing reverse stock splits to boost their share price.

This shows again why you always need to be vigilant in your portfolio. This year we already sold FSC, WHLR, PSEC and EURN in our portfolio. Take also a look at the graph of Euronav….another stock in a downtrend channel. We are glad we said goodbye to that stock too. Step 5 Portfolio Analysis is critical in your investment strategy if you want to grow your passive income.

How are we doing on our journey towards our 2017 Objective?

We did a SMART objective of 6600$ for 2017 and we have now achieved 73% of this yearly objective. This is a total of 4798,4 dollar. Let’s see if we can break the 5000$ next month.

You can read our 2017 financial objectives here.

Going forward

We doubled our monthly dividend income of May 2017 compared to May 2016. However we lost 141$ monthly dividend income going forward. We replaced it partially but we definitely won’t beat May 2017 unless we re-invest all our cash position in new stocks or ETFs. However I still believe we are on track to beat our yearly objective.

![]()

When we look at our dividend income of June 2016, we only received $144,49. This is the lowest dividend payout of 2016. Our goal for the month of June is to beat the 300$ goal and if possible the $352,78 of March 2017. One of the ETF’s won’t pay as much as in May…so we need to get to work and evaluate new investments.

What do you think about our monthly performance ? How was your passive income for May 2017 ? Don’t hesitate to leave your comments and feedback. Let us know what you think.

Good luck with your personal finance strategy! As usual we end with a quote. I meet frequently people who think everything comes easy and they deserve this or that with little to no effort. Mostly those people use politics or keep up appearances about their achievements. I hate it !

Success is something you work hard for…day in and day out. Follow your passion.

8 Response Comments

Fantastic results. Keep up the good work.

Excellent results, well done!

Based on my model, the next bear market is still 1-2 years away (at least). That being said, the stock market is bound to make a correction within the next 4 months.

Nice results so far. Looks you you will make your 2017 goal.

Dividends are not so interesting for me personally as I am in build up phaze and I do not need the cash flow. I dislike the 30pct tax we get from the government as well.

You’re well on track to reach resp. excel your dividend income goal for the year, keep up the good work!

Couldn’t agree more on the point you are making resp. referring to: sitting on cash waiting for a substantial market retreat is a very costly, risky and unsustainable strategy.

Cheers

Nice results, looks like you’ll hit your goal. We had a strong month in May, very happy with our results.

Very nice results for the month. waiting for the recession is tough game/gamble to make. Since I’m in it for the long haul, my strategy is to stick to my metrics, buy when something is undervalued based on our screener, and continue adding quality, long term dividend growth stocks to my portfolio.

Thanks for the read!

Bert

Great progress. Look forward to reading your June update.