Your financial future has never been more important than now. No one will take better care of your money and your future more than you. My ultimate goal is to become financially independent. What’s your financial objective? The fact that you are reading this, is a great step in the right direction. Do you have the skills or knowledge to become financially independent ? Do you want to learn how we do it ? Continue to read and understand every step in our strategy. Take your time and if something is not clear, reach out to us !

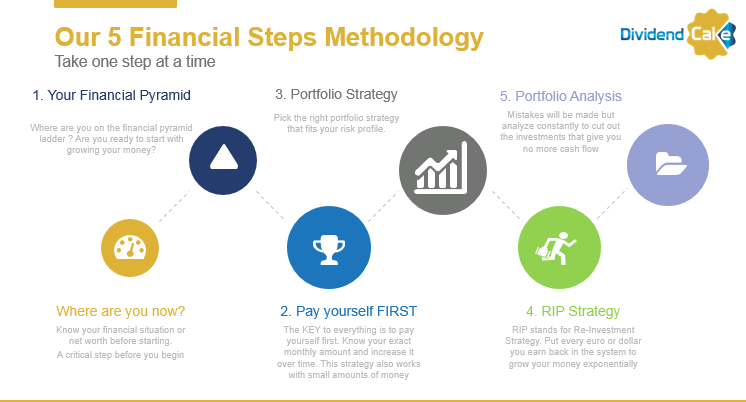

Over the past years we have developed a clearly defined strategy which we are now sharing with you. It is a 5 Financial steps methodology. It took several weeks to clearly outline this in simple terms to ensure everyone can understand.

You can download this in PDF format at the end of this article.

Our 5 Financial Steps Methodology is the key to be successful in obtaining financial freedom. Do you know what this means financial freedom? It means you are NO longer dependent on a salary or pension to cover all your expenses. Does this sound great? Remember that this strategy is not about becoming rich, it is about financial freedom and how to achieve it. It is a marathon and not a sprint.

The 5 Financial Steps methodology can not start before you know where you are now with your finances? This means you need to track all your income and all your expenses. The majority of people don’t bother…as long as they can pay all bills each month they are happy. They want to spend as much as they can. It is a choice in life. Well…if you want financial freedom, you will have to change your mentality and mindset if you want to be successful in following the described strategy. The first action you need to do, is to execute step 1 (as decribed in detail below) correctly and in detail. Step 1 is the most critical step in order to get understanding where you are now and where you need to go. Step 2 is the critical step to start walking on the path to financial freedom. Step 3 to step 5 are the steps to keep your pace to financial freedom going and stay focussed.

The 5 Financial steps Methodology consists of :

- Where are you now ? What is your net worth and where are your finances on the Financial Pyramid ? Make sure you have a clear detailled view on this before getting started.

- Pay YOURSELF first is the key to everything to start this strategy. Be disciplined in paying yourself and adjust to frugal living if you want to get started. This strategy does not restrict you from enjoying life.

- Portfolio strategy decisions need to be made dependent on where you are in the financial pyramid. You can follow 4 different portfolios on this blog and learn how we do this.

- R.I.P strategy or Re-investment portfolio strategy to increase your pace to financial freedom

- Portfolio Analysis is the process to manage your cash flow factory. You will make mistakes but it is important to stay focussed and discipled on your path to financial freedom.

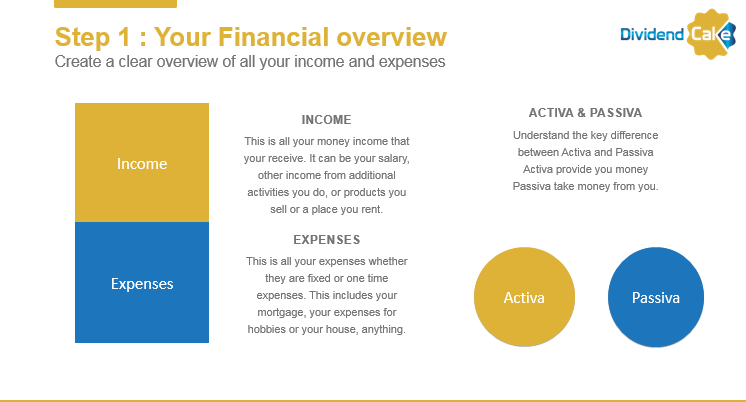

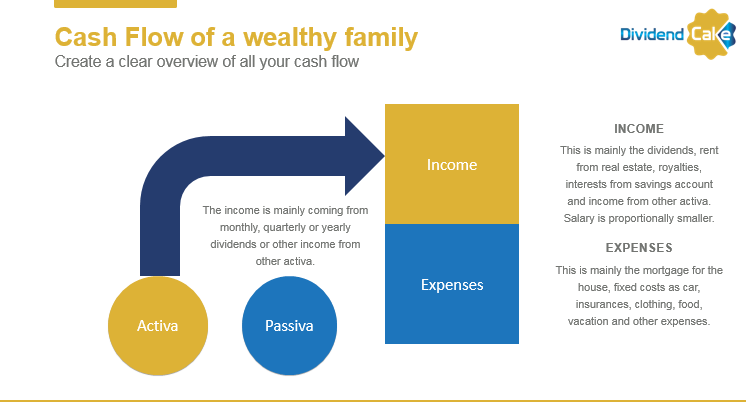

First of all, you need to understand some basic concepts and terminology. Income and expenses are clear, we think. But do you understand the difference between Activa and Passiva ? Activa provide or give you money. Passiva cost you money. Many people think that a purchased house is an activa. It is not an activa as it does not give you money unless you rent it to someone else and receive income. A house is an asset which is a passiva and paid by most people with a mortgage loan from the bank. A house is a passiva that takes money from you in the form of mortgage, maintenance costs and other costs you do within or outside the house.

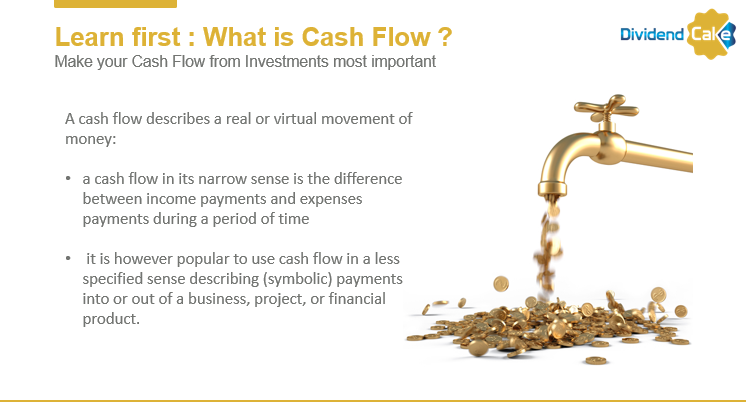

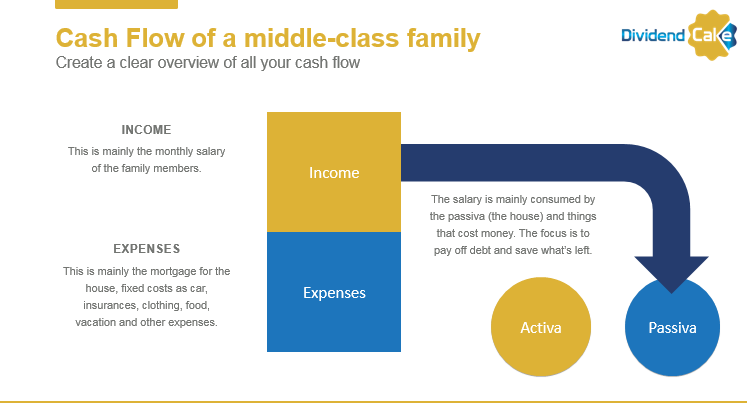

Cash flow is important for intelligent investing and making your money grow. If more cash goes out of the door than your income, you will soon end up in debt. Do you have a clear view on all your income and expenses that impact your cash flow? Cash flow is the movement of money, the movement of income payments and expenses. Now we will describe the key differences between the cash flows of a middle class family or a wealthy family. It is important you understand this cash flow difference.

In the above drawing you can see the cash flow of a middle class family. The income is mainly coming from the salary. You work for a company or are self employed in your company where you pay yourself a salary. Your expenses are the rent or mortgage of your house, flat, your expenses for your transportation (car, bus,..) insurances, food, clothing and all expenses for your hobbies (travel, sports, entertainment such as restaurants, cinema or other).

Your cash flow is mainly consumed by paying off your financial obligations. In Belgium many families invest in the purchase of a house and their salaries are consumed by the passiva that cost money. The focus within the cash flow is to pay the bills or pay the debt and save what is left.

In the above drawing you see the cash flow of a wealthy family. The income is mainly coming from activa that generate money. Examples of activa that can give you money are dividends from your own company, dividends from stocks, ETF’s you invest in, rent from real estate you invested in, interest from your savings accounts, royalties, or income from other activa. Your salary is a smaller percentage compared to the other activa. The expenses are the same as for a middle class family.

Your first reaction may be : “well, I am not rich, so I can’t do this! I don’t have the skills to do this!” Here is the first problem you need to fix! You need to change your mindset and reprogam your brains. You need to be aware that anyone can become a wealthy family if you follow a disciplined strategy. You can start with small amounts on an annual basis. So did I ! The goal is not to become a millionaire, but the goal is that your activa generate more money than your current annual expenses. Then you have achieved your goal of financial freedom.

So track in a spreadsheet (Google Docs or Excel) or on paper all your income and expenses. Everything ! If you want to receive our document, send us an email at [email protected] . We possess several different examples or we can guide you to different examples which may best work for you.

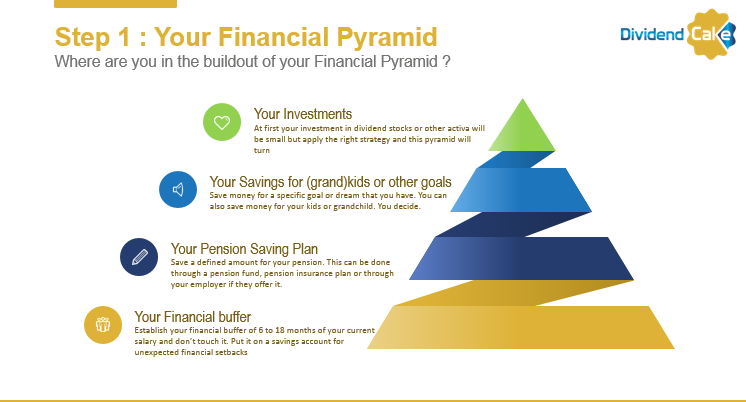

So now with all your income and expenses overview, you should be able to map your current financial situation in the following Financial Pyramid. The net worth of your house does not below in the financial pyramid as this is a passiva unless you rent it out. The Financial Pyramid maps your current money in different categories. The Financial Pyramid consists of 4 layers in which you list or map your net worth. The first category is your financial buffer. This is money on your savings account. You need at least 6 to 18 months of your current salary as financial buffer for financial setbacks. You can do the math yourself. If you have a monthly net income of 2.000 Euro, then you need to have a financial buffer between 12k to 36.000 Euro on your savings account. Anything above that threshold must be listed under your investments where you list your activa generating income. Make sure you have established your financial buffer before starting your investment strategy.

The second layer in the financial pyramid is your pension saving plan. If you are not retired, start as soon as possible with your personal pension saving plan as there is no guarantee that the government will provide you with a pension when you retire. You can do this through your employer, or you can start a pension fund plan or pension insurance plan. Start as early as possible, is our advice ! The third layer is putting money aside for your kids or a dream. If you want to give your kids a financial buffer when they are adults, you can start with a fund savingplan. Don’t save money for kids on a savings account as it doesn’t grow your money. Other people dream about buying a new car, travel somewhere in the world, whatever your dream may be. The third layer categories the money for this specific purpose within your net worth. You don’t need to do this 3rd layer within the financial pyramid if you feel it is not needed.

The last and 4th layer is the top layer and your investments or your activa. This is the most important category in your financial planning and strategy. List out all the money that you have here and get a clear picture on how much money or cash flow your investments generate on a quarterly or yearly basis. Is your money working for you and is it growing ? If you don’t know the answer to this question, do your homework first.

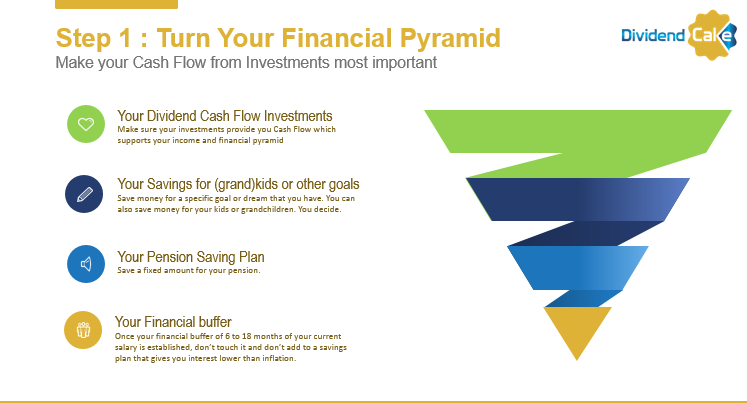

Now the last action in step 1 is to turn your financial pyramid upside down. This means that you have listed your financial buffer on the pyramid, you know how much per month you save for your pension and for your dreams and how this amount is year after year. Now you need to focus on your investments. This green category or the money listed there will be small in comparison with the other categories in the beginning but your goal is to make your investments grow year after year. Then the money listed under Your Investments will generate more cash flow than your financial buffer. After some years your financial pyramid will look like a pyramid standing upside down. Our financial pyramid does look like this and our yearly cash flow from our investments largely outweights the cash flow from our financial buffer.

Now how do we make our money grow year after year ? If you have completed the previous tasks as decribed about, then you are ready for step 2. Without the needed information we asked you to collect in step 1 for your financial pyramid, don’t bother going forward to read and learn about step 2 as you don’t have the mindset or you don’t want to put the effort to be honest with yourself.

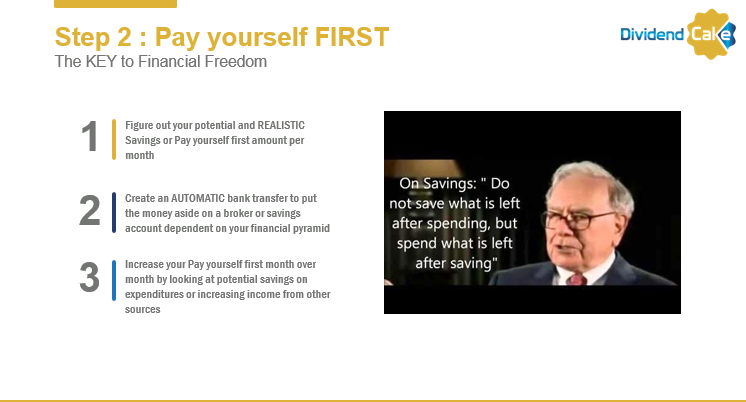

You have completed your homework in step 1 and are now ready for step 2. Step 2 is the most critical step to start the buildout of your investments. It is critical because you have to execute this step each month disciplined and diligently. Step 2 is Pay yourself first. It consists of 3 actions. Action 1 is to figure how much you can put aside in your investment plan each month. It must be a realistic amount that you pay yourself each month. Action 2 is to create an automatic bank transfer that transfers this amount to a broker investment account from the moment your salary is on your bank account. If you haven’t build your financial buffer, we suggest you do this first. Action 3 is to increase your monthly Pay Yourself First amount by reviewing your expenses for bank fees, electricity, insurances, everything you pay for and lowering them by selecting other suppliers. Over the past years we have been able to lower the expenses with 20%. Then you can increase your Pay yourself first amount month over month to speed up your investment strategy exponentially.

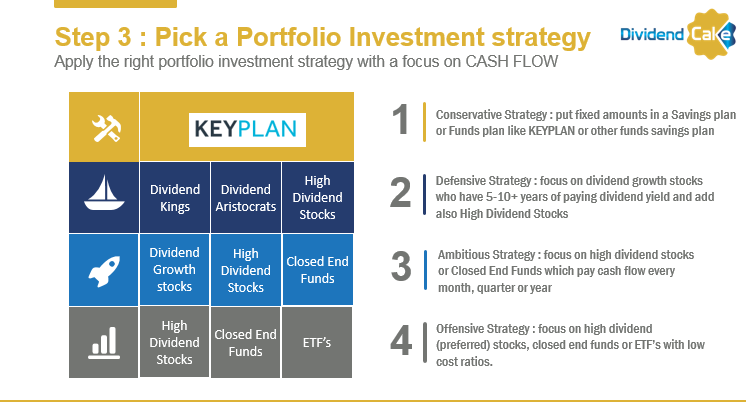

Now that you have reached the point, where you are putting money into your investments strategy, it is time to learn about step 3. Step 3 is how will you invest your money to grow your money and generate cash flow? You need to select a portfolio investment strategy. We have used Strategy 1, the conservative strategy for about 6 years and turned 5K euro in 10K euro. We still use today strategy 1 for my foster child in Nepal and as alternative savingplan for my kids. Strategy 2 is a strategy used by many dividend bloggers and focussed on companies that have a 5+ years historical strategy for paying more dividends per year. This strategy 2 is more defensive as you focus on companies and stocks that pay a lower dividend (on average between 3 to 8%). Strategy 3 is an ambitious strategy that we apply for our own portfolio. It combines dividend growth stocks with high dividend stocks and closed end funds. On average these stocks and funds pay between 6 to 12% dividend on annual basis. Strategy 4 is an offensive strategy where you also invest in ETF’s that pay dividends. There are also ETF’s that capitalize on your money and do not generate cash flow but we don’t invest in those ETF’s. Our investment strategy focusses on cash flow generated from our activa.

If you want to learn the process on how we find those stocks, you can book a training session with us or read more blogposts about this topic. We will create also and publish Youtube videos in the future to share our knowledge with you. The best start is to purchase our Dividend Cash Flow tracker sheet which lists out the stocks that we are tracking for future investments for the different strategies. The goal of each portfolio investment strategy is to generate bigger cash flows year over year. Evaluate which strategy you want to follow.

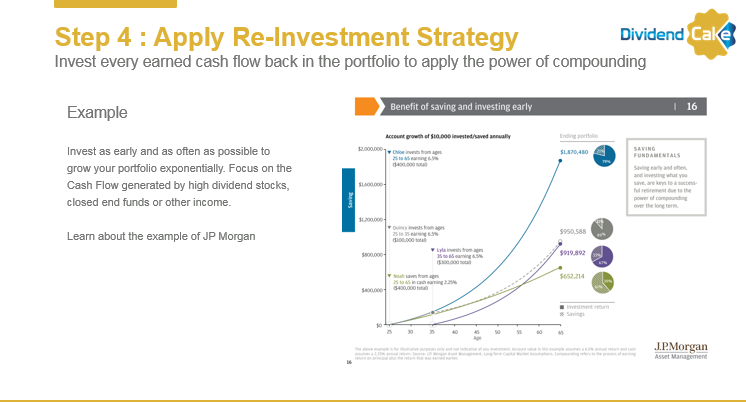

Once you have started purchasing your first portfolio of stocks or ETF’s and you see your dividends coming in on your bank account per month, per quarter or per year, you can start to re-invest this cash flow into your portfolio which will generate more cash flow. Invest as early and as often as possible. You can see in the example of JP Morgan how important regular investments are for the growth of your portfolio and cash flow. Once you compound your cash flow, your portfolio will grow exponentially.

Read about this Saving for retirement blog post here and the benefits of saving and investing early.

Step 5 is a process you need to master to evaluate each investment within your portfolio. This is a monitoring and evaluation process where you decide whether the cash flow is still guaranteed by the company or ETF you invested in. Don’t think you will always select the best ones. We learned the hard way when the oil & gas companies almost went bankrupt and stopped their dividend and investment strategies as a result of the low oil price. Therefor we recommend you to limit your investment to a specific amount that you feel comfortable with according to your risk tolerance.

Don’t think you won’t make mistakes. Know and understand when to sell your investment and pick another one that continues to contribute to your cash flow portfolio factory.

Remember it is a marathon and not a sprint. It’s always a pleasure to see my dividends come in each month or quarter on my bank account. It’s unfortunate and sad that the Belgian government continuously steals more and more from this income which makes our path to financial freedom just a few years longer…but we will get there one day. Stay focussed ! Good luck with the execution of the strategy and let us know when you need help or additional explanation or training.

Download our Strategic documents here in English or Dutch version

Dividend Cake – Our Financial Strategy – English Version

DividendCake_Our Financial Strategy – Dutch Version

Good luck with your Financial independence strategy !