Twenty five thousand Euro. Have you ever seen such a bank note ? No? Neither did I but I did choose this blogpost picture because of an important milestone. Read on…you will quickly understand.

With the markets falling, press is writing many articles to scare the investors. Falling stock markets is always hot news in the media. In investor Facebook groups where I am part of, I already noticed people bailing out. That is sad when you know there’s always opportunity to make money in the stock market.

An interesting article within Time magazine website crossed my eyes.

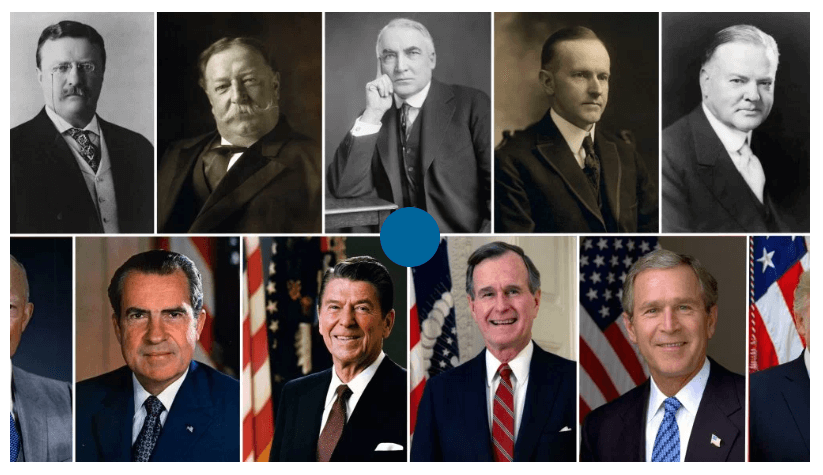

A 100-Year Curse on GOP Presidents Might Explain Why Stocks Are Tumbling

Theories abound as to why the stock market seems to be falling apart — with the Dow Jones industrial average plunging another 1,000 points on Thursday 20th of October and slipping into an official “correction.”

Some think this is a sign investors are scared of rising interest rates and inflation. Others believe the market simply got ahead of itself last year. And still others blame a slew of new-fangled leveraged investment funds that let investors bet on or against market volatility.

But history suggests there could be a simpler explanation. Call it the GOP president’s curse.

“Every Republican president since Teddy Roosevelt has experienced a recession in his first two years in office,” says Sam Stovall, chief investment strategist for the research firm CFRA.

In fact, nine of the past 10 recessions in history have begun with a Republican in the White House. And several Republican commanders in chief — Dwight Eisenhower, Richard Nixon, and George W. Bush — have presided over multiple economic contractions.

Since stocks are a forward-looking gauge of the health of the economy — the market has historically begun to slide 7 1/2 months before the onset of a recession — this crash could be Wall Street’s way of saying it expects a recession later this year, Donald Trump’s second year in office.

Market Analysis

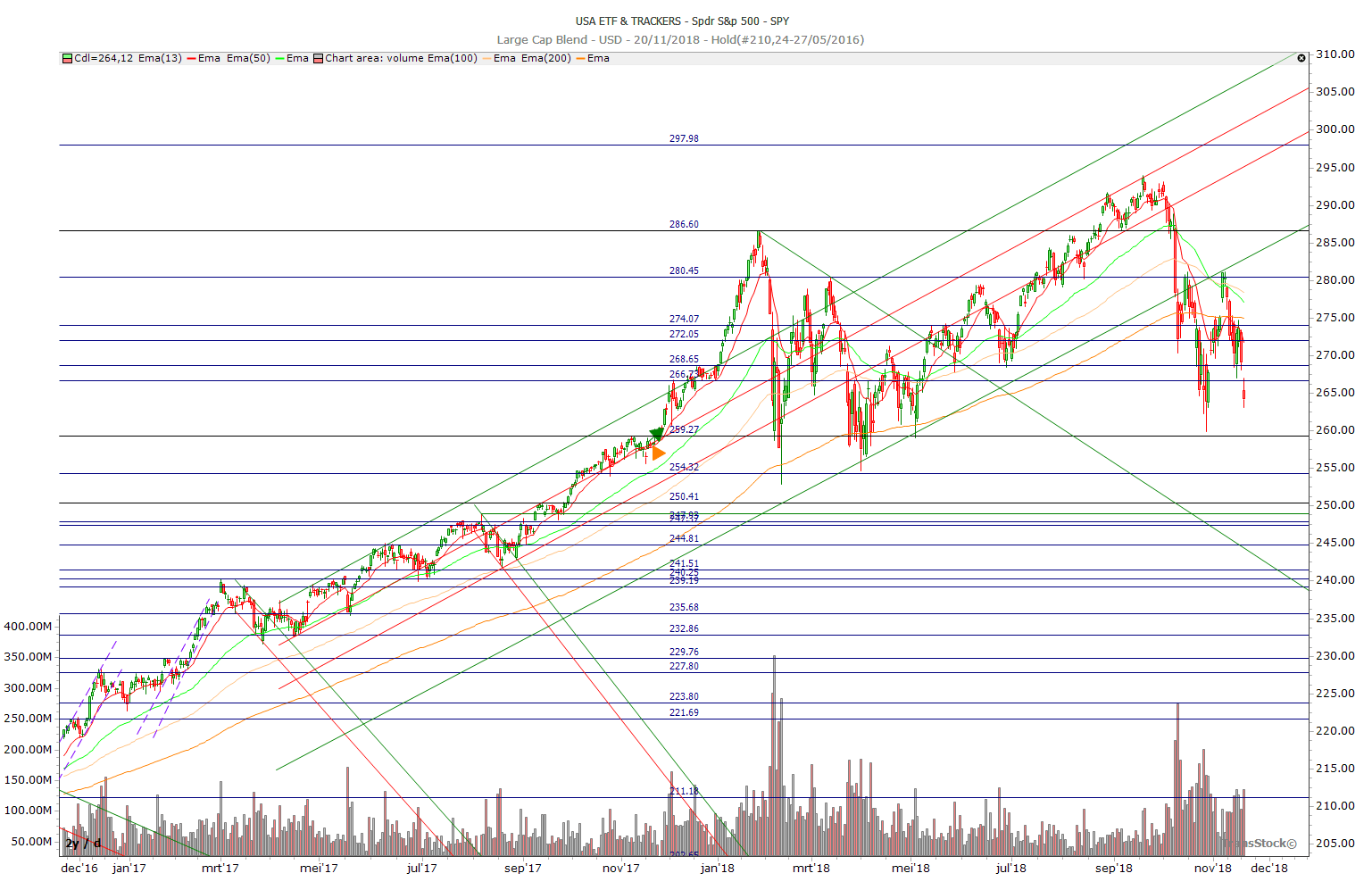

When we analyse the performance of the SPY (screenshot 21 October) we can clearly see that the SPY has broken the 266 support again after the bounce. Now there’s a lot of support above it. Oil prices have tumbling down as well. Last month I wrote : “If we break next week the 272 SPY level, we will see levels of 268 and 266 very soon !” Where are we today ? 266 levels…. I can not predict but I am surrounded with people who know and sense the stock markets better than me. This lifts my knowledge up on how they think.

Is the downtrend over ? Next week we have the G20 top for the world leaders. Will China and US reach a trade agreement or will the trade war proceed ? China is no longer importing oil from the US. This can get really ugly between those two. I noticed also this headline below and you know that higher interest rates mean lower stock markets and inflationary pressures.

Let’s dive in the numbers of my October Passive Income Income Report.

My Passive Income in October 2018

In October 2018 we received a total of 1550,75 $ passive income. We received dividend income from our ETFs and we made an options income of 935,48$. All the time spend learning different options strategies is starting to pay off. We did hit our monthly goal of 550$ per month.

Below you see the monthly summary overview of the cash flow coming into my bank account.

![]()

Options Trade Review in October 2018

If you follow this blog, you know I have a US based mentor who helps me to focus and apply the correct options strategies. The first thing every investor needs to learn and what he pounded hard on the table for, is RISK MANAGEMENT. Every investor (small or large) MUST know the risk he is taking for every investment.

So the FIRST decision we took is define the RISK REWARD for every options investment. For every investment we want to have a 1:3 risk reward ratio. Today we have 400$ dividend income each month. So we decided to start with an 100 – 300$ investment to make 300$ to 1000$.

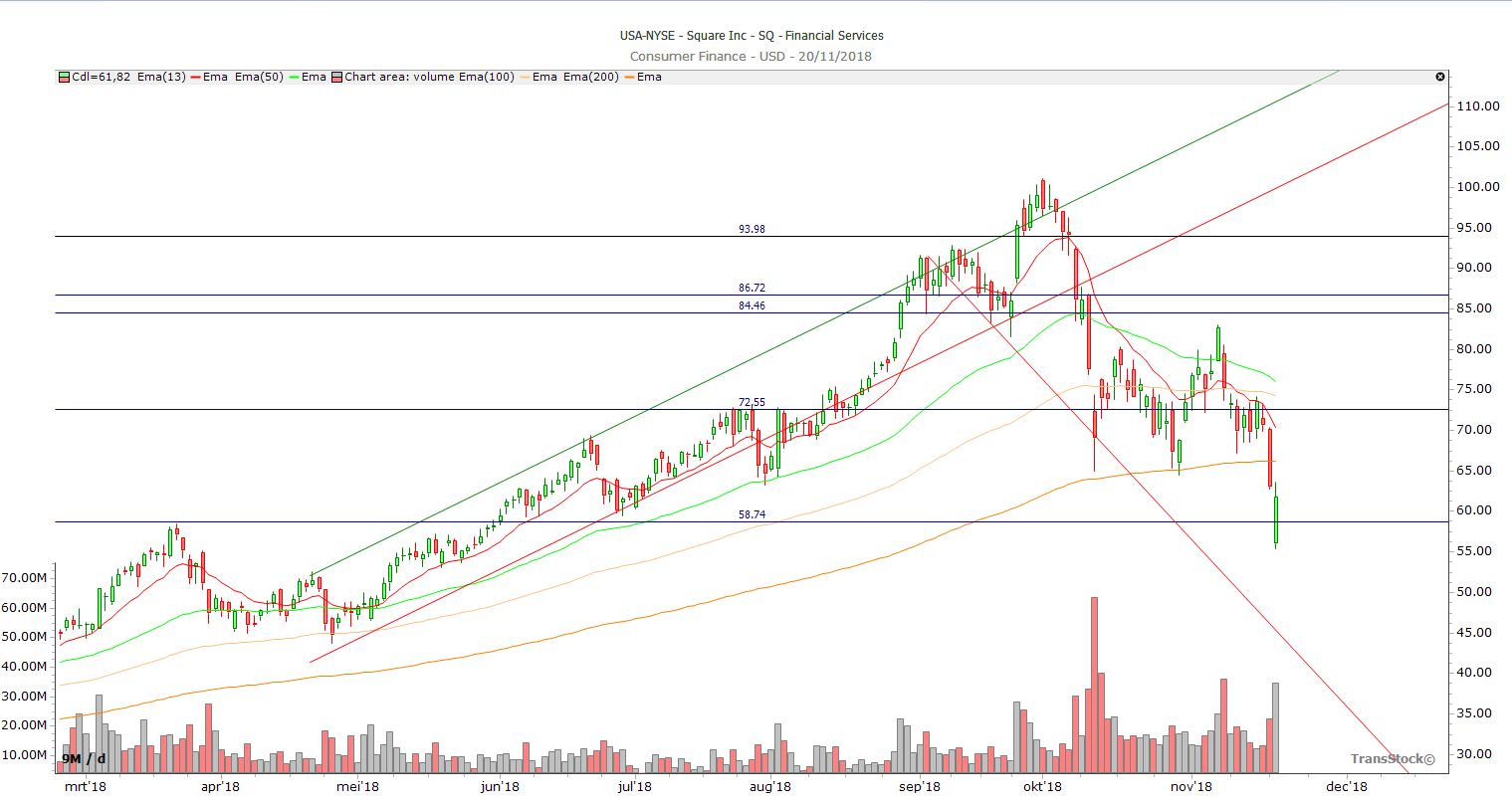

The best options investment trade in October was made on the company SQ. Take a look at the graph of SQ Square. When SQ hit the 13 EMA, I purchased 1 put 94$ for 227$. When it did hit 86$, I took profit. Actually I took this trade off way too soon as when the CFO news leaving the company hit the wire, the stock price took a beating until 76$. No idea how much money I left on the table. Nevertheless I hit the profit target so I took the profit from the table. 625$.

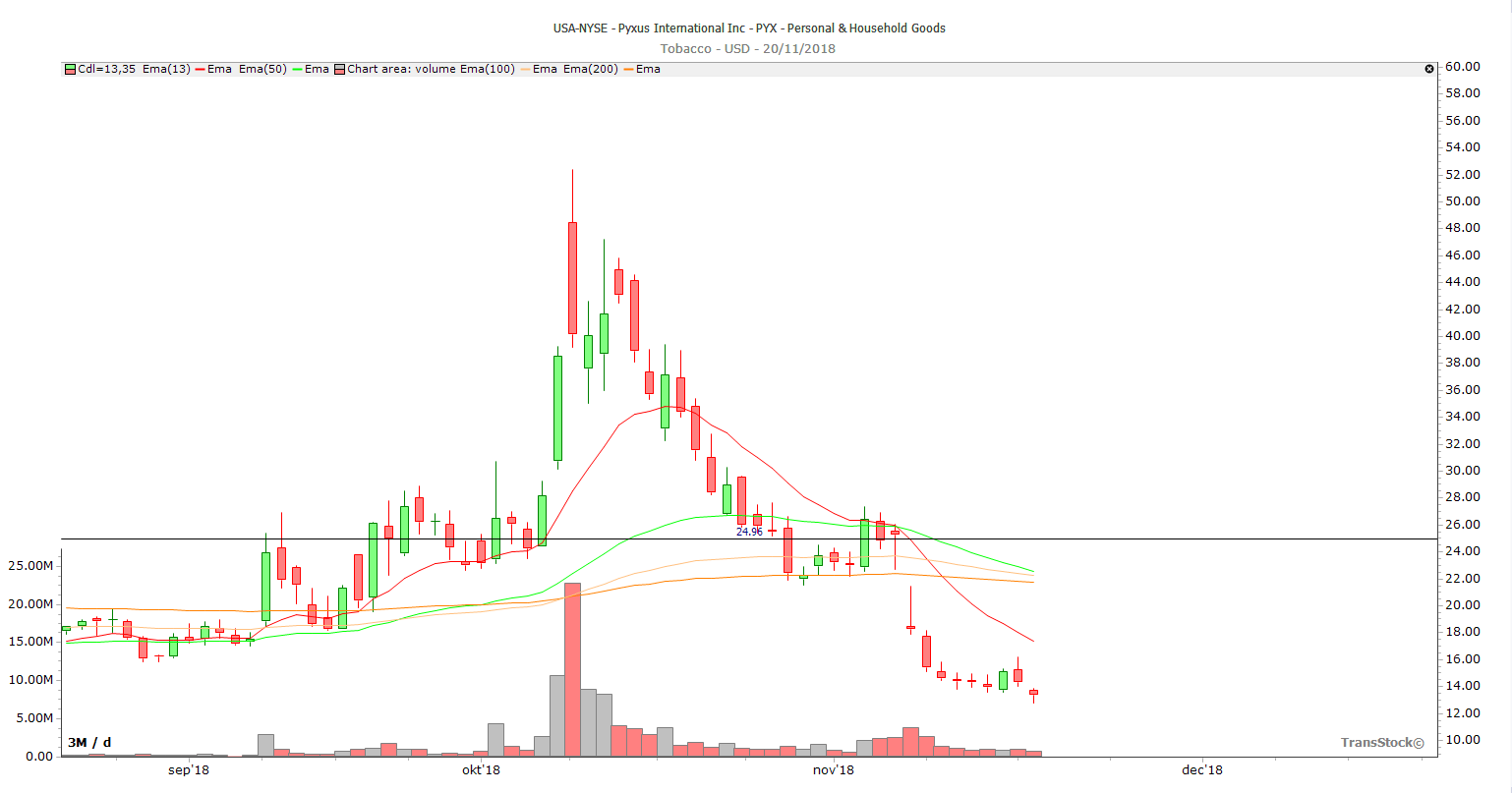

The worst options investment trade was the purchase PYX. A company starting with cannabis. I took the 25$ puts. Here I had the right idea but wrong execution. I took the weekly put which decayed quickly against me. Too bad that I did not re-enter this investment trade. Take a look where PYX is now. Loss 140$. Bad execution from my part.

Other swing options investment trades were SPY puts where I made money. Total investment profit : 935$. Great start.

Portfolio Analysis and Growth

So far we have 7197,52$ passive income for the year 2018. This is 72% of our yearly objective. The second time this year we cross the 1.000$ mark per month. Nice !

![]()

But what is more important to know ? I crossed the 25.000$ cash flow in 3,5 years. When we review our dividend forecasted cash flow we are at the end of December 1685$ short if we do NOTHING going forward. Let’s say 1700$ in the coming two months is what we need to hit our 10K objective for the year 2018.

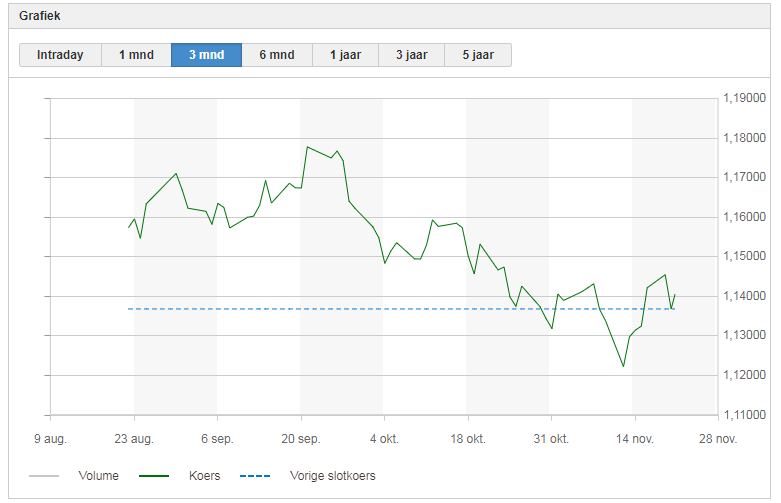

The Euro/Dollar trend

We keep on following the EURO/USD valuation. The currencies have been stable and EUR/USD has dropped to 1,12 . Then the dollar got weaker again again.

Basically it is chopping within a range. I don’t see much difference going forward.

Going forward

We focus in November and December on generating more cash flow. Let’s try to meet our yearly objective. We are aware we can still lose this profit.

For the followers who are interested in learning about my current and future strategies, you can attend “The Millionaire mindset” presentation on the 1st of December in Ghent. It will probably the one and only time that I share this in person. We will see. If you come, please click the register button below to get a ticket.

Are you working out investment strategies ? Don’t hesitate to leave your comments and feedback. Let us know what you think.

Good luck with your personal finance strategy! Thanks for following us on Twitter and Facebook and reading this blog post. As always we end with a quote.

Source : Time Money

No Comment

You can post first response comment.