August has been a rollercoaster. It was a rollercoaster for my personal life and for my finances. The first week of August was relaxing with our vacation in France. The rollercoaster we visited is the ZEUS rollercoaster in Parc Astérix. At the end of August my friends, family, myself and kids took a flight to Colombia for our wedding. In summary August was quite an expensive month within our budget sheet. August was cashflow negative meaning that we spend more money than we received….

It was good we did put money aside as pictured in our layer 3 of our Financial pyramid.  Additionally we took a major hit in our portfolio. Read below more in our portfolio analysis. But money is not everything in life. We entered a new phase of happiness in our life. My wife Mrs. Dividendcake (from now on) and I are determined to build a financial stable future for our kids and ourselves. We will build that cushion for our retirement and try to be financially free as soon as possible while travelling the world and enjoying life.

Additionally we took a major hit in our portfolio. Read below more in our portfolio analysis. But money is not everything in life. We entered a new phase of happiness in our life. My wife Mrs. Dividendcake (from now on) and I are determined to build a financial stable future for our kids and ourselves. We will build that cushion for our retirement and try to be financially free as soon as possible while travelling the world and enjoying life.

Did you know that the Belgians keep on saving money on their bank savings accounts…78% keeps on doing so while they are losing money due to an inflation of 2%. If you had 100 euro and invested it in the stock market, you would have gained the highest return on your money. That should not be a surprise for you, right?

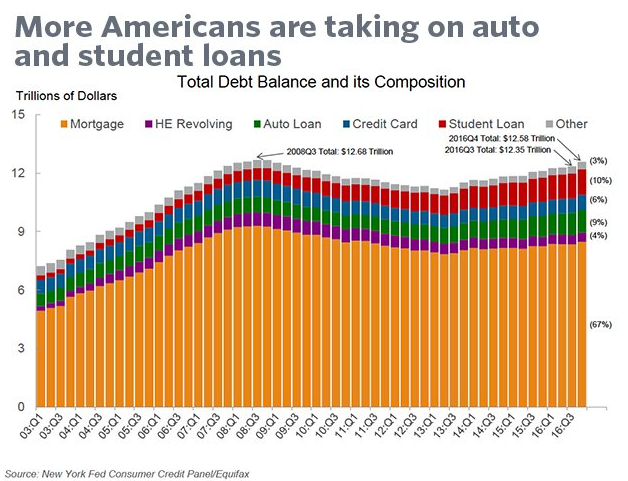

How are you growing your money? Another statistic that we did see on Twitter is that more Americans are taking on car and student loans. The middle class in the USA is taking more and more loans. Personally we are debt free and we don’t pay mortgage. We do not own a house today. We first focus on building a passive income that will pay for the mortgage or our total yearly expenses. Most Belgian people focus on buying a house (while putting themselves in debt) and then have no more money left to invest and build that passive income.

You don’t believe me that this is a good strategy…well..visit the blog of Millenial Revolution. This couple focussed on building their passive income using the stock market with a simple strategy. Maximize your investments in the stock market and minimize your expenses. They didn’t buy a house. They focussed on building their net worth to 1 million dollar. Today they are still debt free and they travel the world.

Interest rates will remain low according to us as government debts are too high. Central banks want to keep interest rates low to safeguard banks and governments in the hope to stimulate economic recovery. We are currently in a Financial Repression and if you don’t take action yourself to grow your money, you will become poorer as a result. Or you will simply pay off your whole life the debt of your house to the bank. I know many couples do this….as they consider a house a good investment strategy. They hope it will keep his value over time. Most people forget about the maintenance costs and extra taxes they pay. When we buy a house, we will either pay it in cash or have a passive income and cashflow stream greater than the mortgage. Take a look at the cashflow of a middle-class family and a wealthy family in our Financial strategy if you don’t understand. The future will tell…

So let’s go towards our Market Analysis.

Market Analysis

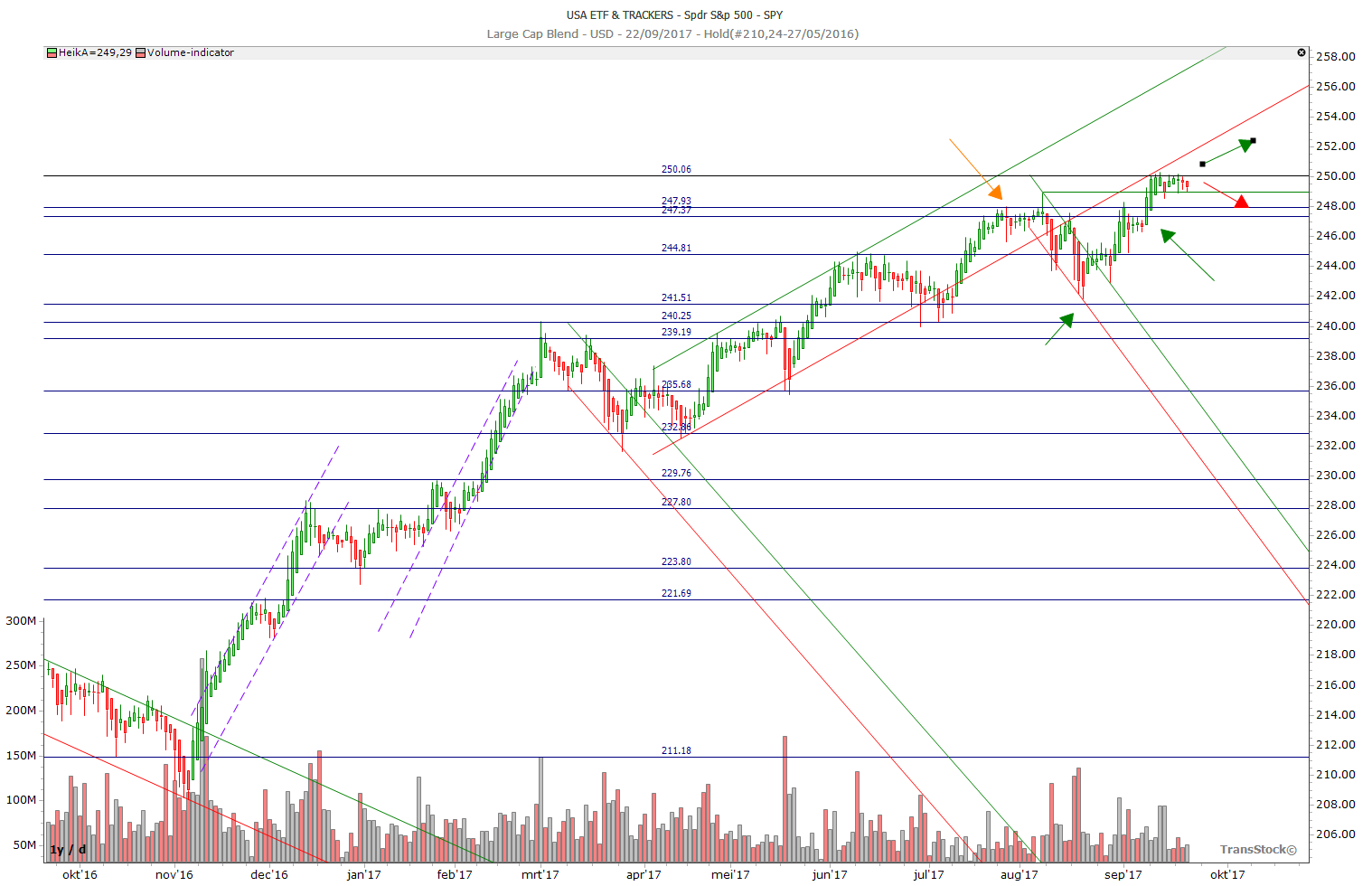

When we analyse the performance of the SPY (screenshot 24 September) we can conclude that the market remains strong. Investors are buying each weakness pushing the stock market higher every day…Did you know that Warren Buffett has build up 100 billion dollar in cash? That means more than a 40% cash component, an unprecedented mountain of cash in the history of Berkshire Hathaway. You should ask the question why?

With U.S. markets already at bubble levels and the rapidly decaying U.S. economy already showing signs of serious strain, the speculation is that Buffett is looking forward to an imminent collapse in U.S. markets. Buffett likes to buy at market corrections. But the central bankers continue to pump U.S. and European markets higher …but for how long? The recent decision of the FED to start cleaning up their balance sheet with a very slow pace was a clear indication of their fear that markets could correct sharply. Today we are in a manipulated stock market by the central banks. Be aware !

The U.S. economy seems “so strong” that the Federal Reserve seems to have no other choice than to raise interest rates. Higher interest rates are bad for the economy. Higher interest rates are bad for markets.

The disconnect between U.S. market valuations and the actual fundamentals of the U.S. economy is far, far greater than at any other time in history . Worse than in the Crash of ’08. Worse than in the Dot-Com Bubble. Worse than in the Crash of ’29.

This is why Warren Buffett is sitting on a $100 billion hoard of vampire dollars. And since Buffett clearly plans on spending those dollars himself, this means that the Mother of All Crashes is coming soon. We just don’t know when…what will be the spark? Will it be a war with North-Korea now that threats go back and forth between USA and North-Korea? Who knows? Will we go higher or lower?

Personally we see several dark clouds gathering above the stock markets. We will write a separate blog post about it. In case of a market correction, we will be prepared to earn money as well. We are working on two strategies to earn money when the stock market collapses. Keep on following this blog and you will find out how.

Let’s dive in the numbers of my August 2017 Dividend Income Report.

Dividends received in August 2017

In the month of August 2017 we received the TOTAL of 515,20$. Another solid month above 300$, our 2017 yearly objective.

![]()

Nothing to analyze. We simply received 515,20 dollar from our monthly paying stocks and ETF’s.

Portfolio Analysis and Growth

While July was an amazing dividend income month above 2000$, August was a rollercoaster month with a negative cash flow above 1500$. Let me explain.

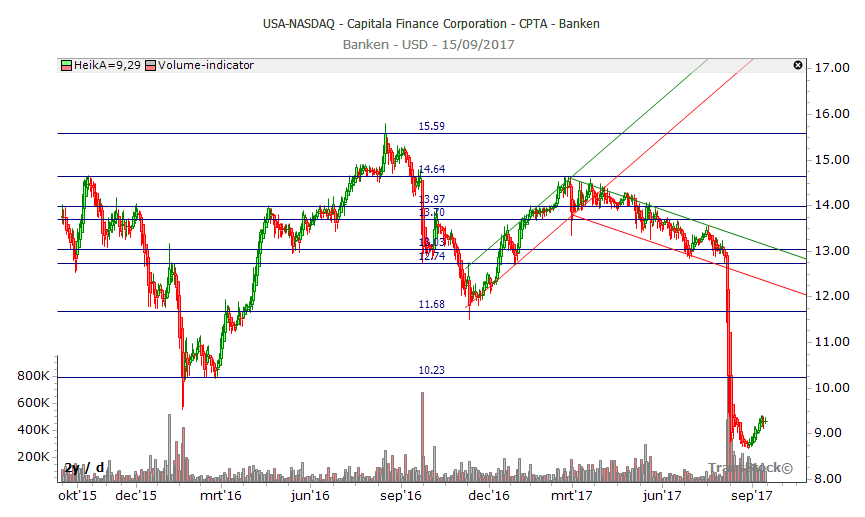

As explained in my Mom’s portfolio latest Dividend Income Report, we had another dividend income stock with a problem. The Business Development company CPTA dropped four points in a matter of days. The position in my mom’s portfolio was sold the first day with a stoploss but the position in my portfolio was sold the second day of the drop. Nevertheless we had to swallow a loss of 2135$…yeakes…very painful, indeed ! This equals almost our dividend income of July 2017. So let’s reflect on this loss. What could I have done differently? What can I and especially YOU learn from this investment loss?

- Cut your losers QUICKLY : I actually sold my CPTA position 1 day later than the position in my mom’s portfolio. This resulted in 1$ less sell price and a higher loss. I can only say STUPID MISTAKE ! Sell immediately is the best advice I can give you. My loss could have been smaller…anyways I want to be transparent with you so you can learn from it. I am not a perfect investor and each investor has a losing position one day in his investment career. We deal with the loss and move on !

- Minimize your Position size : Was my position size too high or did I pick the wrong entry ? With a bigger position, the loss will be bigger in case of a drop like this. Spreading the portfolio in smaller position sizes will limit the risk of a bigger loss. My maximum size was 10% of the total portfolio value. Going forward I will review whether I will resize each position to 5 to 8%.

- Picking a ‘SAFE’ Yield : Was I chasing yield ? Maybe I was…When I did chose CPTA as a dividend income yielder, it was bouncing between 10 and 15. As an investor, you never know the internal business of a company. Picking a SAFE yield stock is an investment practice which will not always guarantee 100% success.

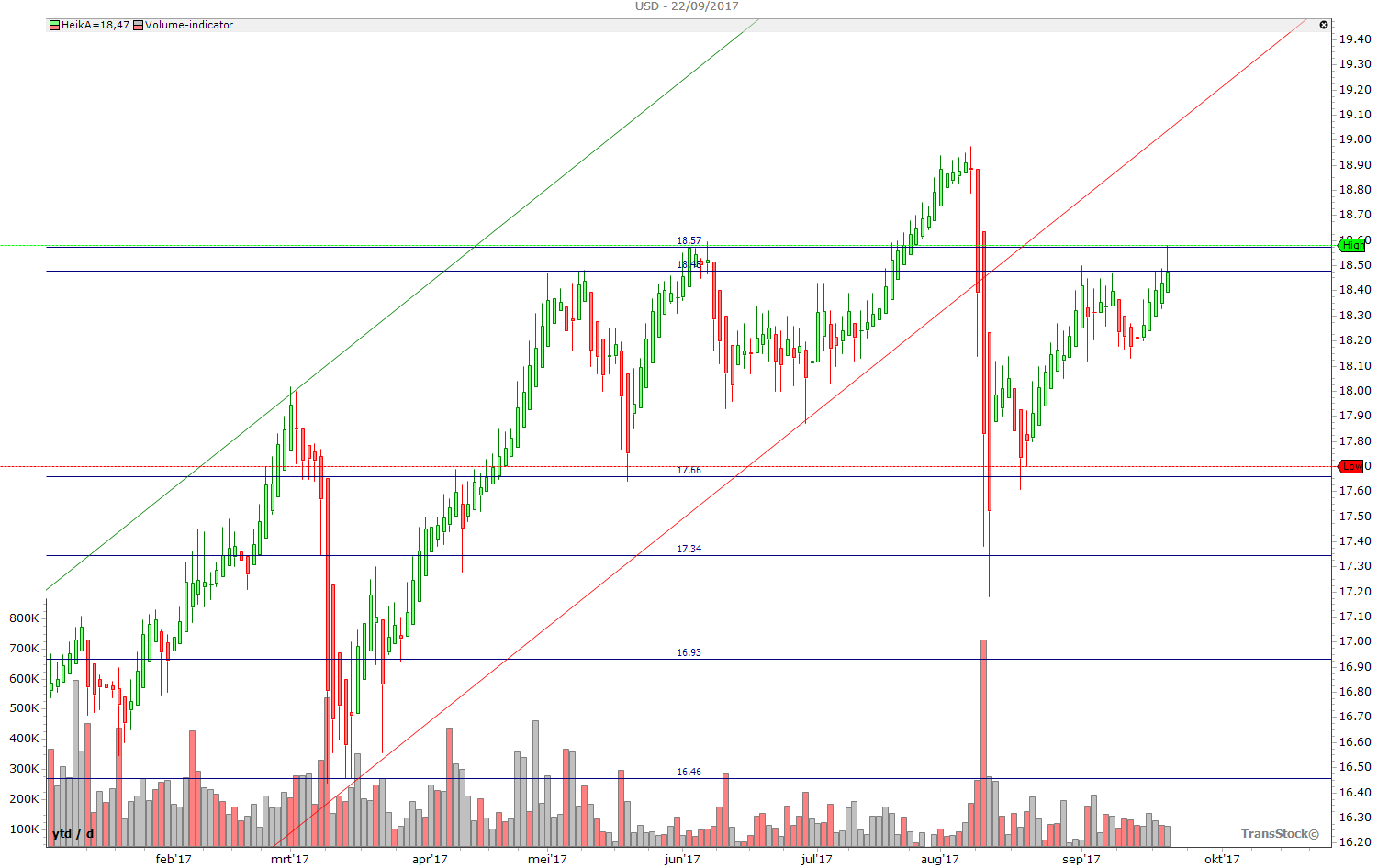

After our loss, we did put a stop loss under another position that we had. The markets were acting very volatile and nervous. Do you see that three day drop on HIGH volume mid August? More than 600.000 shares sold…

Our position was sold with a small profit. We didn’t want this one to end up in a loss. Better be safe ! This ETF went higher afterwards but we are glad we increased our cash position. This will impact our dividend paying result going forward but that’s okay.

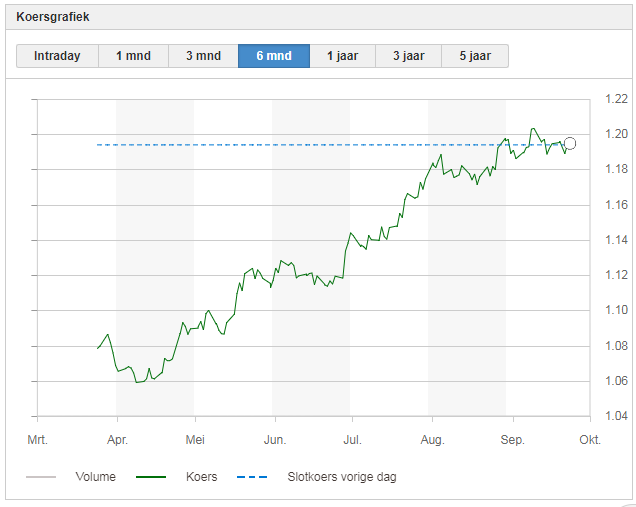

The Euro/Dollar trend

We keep on following the EURO/USD valuation. The EURO rallied above 1,20. We did not convert a piece of our EURO cash position in Dollars. We think it can rally to 1,25 and keep on following this chart closely.

If the EUR/USD valuation hits 1,25 or 1,30 we intend to convert Euros in Dollars. As long as the ECB keeps on pumping the stock market with buying bonds, we see an upward trend for the EURO. Once they start their Quantitative Easing (QE), the euro may lose his strength.

As described in previous month Dividend Income report, some analysts predict that the Euro will lose his value by the end of the year 2017. We will see.

Going forward

How are we doing on our journey towards our 2017 Objective?

We did a SMART objective of 6600$ for 2017 but if we are honest we need to incorporate our monthly loss within our yearly results. So we adjusted our yearly result Excel table with an additional row called “Losses”.

The August loss brings our yearly result back to 5812,21 $. It is what it is…August 2017 will show a -1619,80 $ loss in the books. I hate losing money but we can only try to limit the losses in the future. The yearly result is stilll 5.812,21$. Now let’s still make that 6.600$ within the next 4 remaining months of the year 2017.

![]()

We now have a big cash position and research how we can use this. Maybe we will use it to hedge our portfolio.

What do you think about our monthly performance ? Did you ever had a bad month? Don’t hesitate to leave your comments and feedback. Let us know what you think.

Good luck with your personal finance strategy! As usual we end with a quote.

3 Response Comments

Interesting post. First off congrats on the marriage. I think mortgage debt is good debt and all the houses we have ownes have substantially increased in value before we sold. I agree the market is overvalued but will stay invested. Personally i think if the market pulls back it will get propped back up by governments printing more money! Theres still good buys out there just got to look harder. Just hope these companies keep paying dividends.

Thanks for your wishes. Canadian real estate market has boomed over the years. Definitely a good investment choice !

I doubt whether the governments have the financial capability to prop the markets. Definitely not the Belgian one as they have a growing huge government debt. Thanks for the feedback !

Sounds like a massive step in the right direction. Well done to you and looks like that forward dividend is continually growing.