Last Friday was again a special day with NFP news. The stock market got bad news because the june jobs growth in the USA was stronger than expected. Today a strong jobs report means the economy is doing better than expected. The Fed should be increasing rates but gave the impression that a rate cut could be in the books.

Despite this friday’s minor setback, the stock market is breaking out of a range that’s held it down for nearly a year now. Visions of a “melt-up” scenario driven by a rate cut AND a trade deal are now the talk of Wallstreet. That is stimulus when we don’t need it.

If a Federal Reserve that becomes hesitant to slash interest rates because of a strong economy is something you don’t like, fear not, because Trump’s Fed nominees are on the way. Trump’s pick Judy Shelton told CNBC on Friday, “When you consider that more than half of American households are invested through mutual funds and pension funds in the market, I don’t want the Fed to pull the carpet out from under them by taking a position that is not conducive to further providing the liquidity for this growing economy.” Economic data are quite mixed in the US and now in July the earnings season is about to start. The USD dollar moved back above the trend supportline

In more and more countries we see negative cash rate. But economic growth from excessive debt and immigration rather than productivity will lead to failure because growth is an illusion. Banks and governments have been buying gold silently as gold backs up the financial system of money. The trend on gold is firmly higher. Central banks can’t print money endlessly. One day they will run out of power.

Take a look at the weekly GDX chart. Do you see the increase in volume and do you see the break out of this channel ? We expect a return to a higher trend.

Slowing global growth remains a concern but…..today there is no alternative to equities.

Now let’s see what our May & June 2019 cashflow was for my mom’s portfolio.

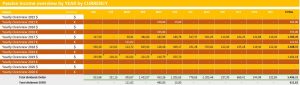

Passive Income in May & June 2019

During the month of May & June 2019, we received 696,49$ passive income. In May 140,79 Dividend Income. In June we earned in total 555,70$ with 384,96$ options premium.

Here you find the overview of all passive income payouts during the year 2016, 2017,2018 and January 2019.

We have now 40% of our yearly objective.

The Options Trade Review

We did one Options trade on the ticker UVXY with a strike price of 32$ with an expiration of 21 of June. The price didn’t drop below 32$. The options premium of 384,06$ stayed in my mom’s pockets.

ProShares Ultra VIX Short-Term Futures ETF provides leveraged exposure to the S&P 500 VIX Short-Term Futures Index, which measures the returns of a portfolio of monthly VIX futures contracts with a weighted average of one month to expiration.

- Designed for knowledgeable investors who seek to profit from increases in the expected volatility of the S&P 500, as measured by the prices of VIX futures contracts.

- Reduce U.S. equity portfolio risk, since changes in the VIX Short-Term Futures Index have historically been negatively correlated to S&P 500 returns.

- Intended for short-term use; investors should actively manage and monitor their investments, as frequently as daily.

Going forward

Vacation time has arrived and it’s time for my mom to visit the Belgian coast. (see blog post pic) We still have all our cash available in my mom’s portfolio. We closed our bank account at BINCK Netherlands. They charge even 32 Euro when you have a ZERO euro portfolio. That’s what banks do….charge for NOTHING !

What service are they providing ? What assistance are they giving for a ZERO Euro portfolio? Nothing, but they keep on charging. We don’t want to pay for bank services that cut our dividend income. We moved on to another bank so we can increase our cash flow. You don’t want to give a part to a bank.

So let’s find those juicy options premiums and continue to grind further towards our yearly goal.

In 2019 we will send out ONE newsletter per month to our blog followers. Life can be busy sometimes and people lose track of following a personal finance and travel blog. Subscribe and you will get one email per month highlighting what you missed…

Thanks for following us on Twitter and Facebook and reading this blog post. We end with a quote as always.

No Comment

You can post first response comment.