The heavy business travel of January is behind us and now we can focus on some of our portfolio’s and also the stock market. As always I start Sunday weekend morning with the update of Garry Davis from Specialist Share Education.

The title of his Weekly update is Being Negative is Easy! There is a lot going on with the trade war between US & China, a recession in Italy and the economy in Europe stalling. But you know what…the fundamentals and valuation are positive in the USA and we have seen that during the past earnings season. The US sets the tone for the global markets. Look out for companies that are raising guidance going forward in this climate. That means that those companies remain positive. Cut out the noise from the media and the people who like to scare you.

The sentiment in the stock market has shifted to buying the dips. That is how a student in Belgium won a stock market rally. He waited for a dip in the stock market, purchased different funds and then won the rally thanks to a 21,5% stock market bounce.

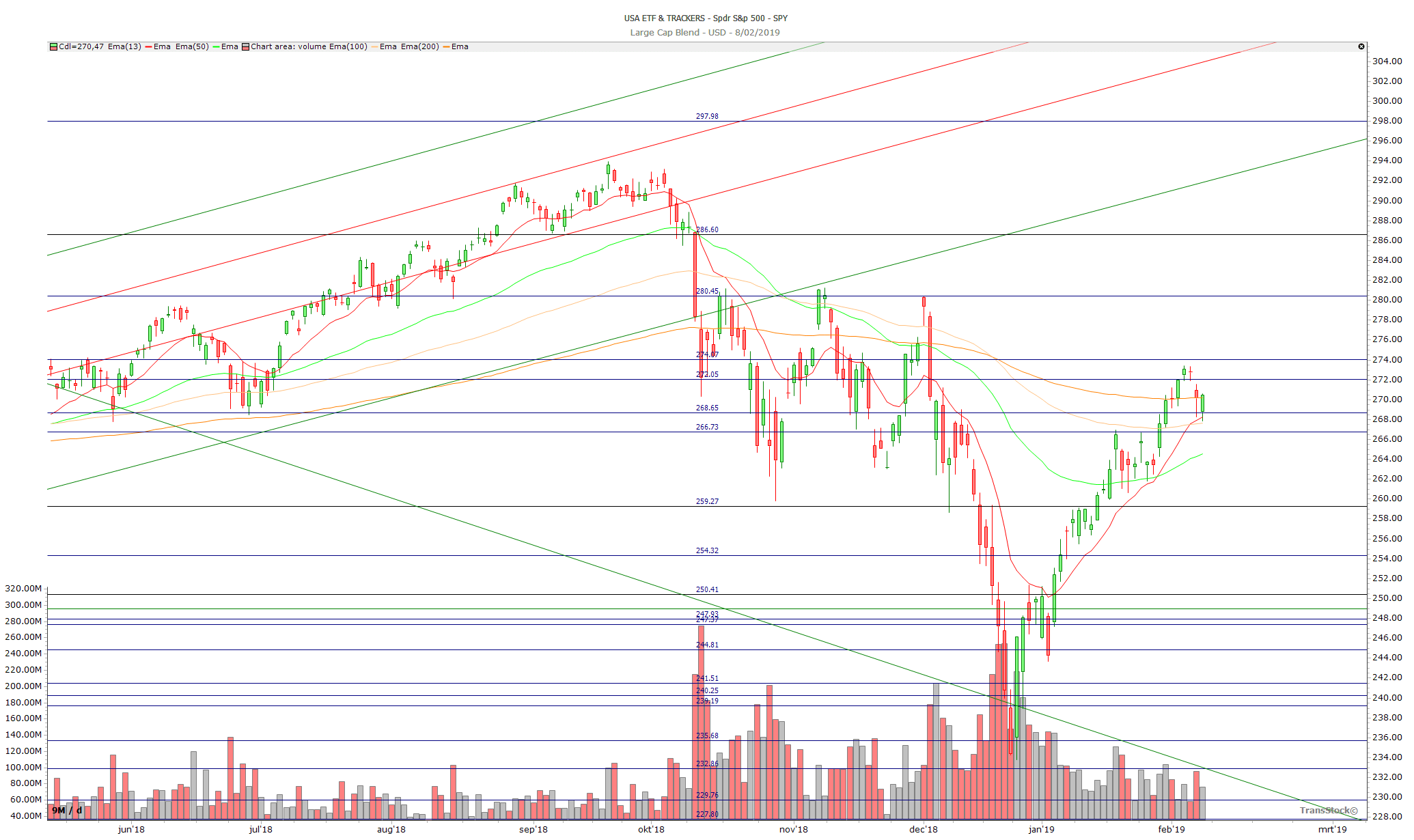

Currently the momentum is to the upside. Take a look at the SPY. We broke the 50 EMA and maybe in coming months we can reclaim the 280 level. That is a triple top level which is a huge resistance level in technical analysis.

What I also noticed during this weekly update, is the forecast for currency valuations. Garry gives his opinion on where he sees the Australian dollar go in the next two years. Since I start to learn a new skill set in FOREX trading, the currency valuation updates are becoming also valuable for me. Let’s make some money with this information.

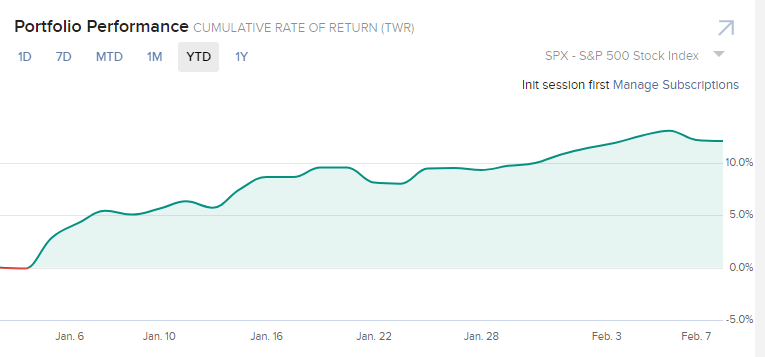

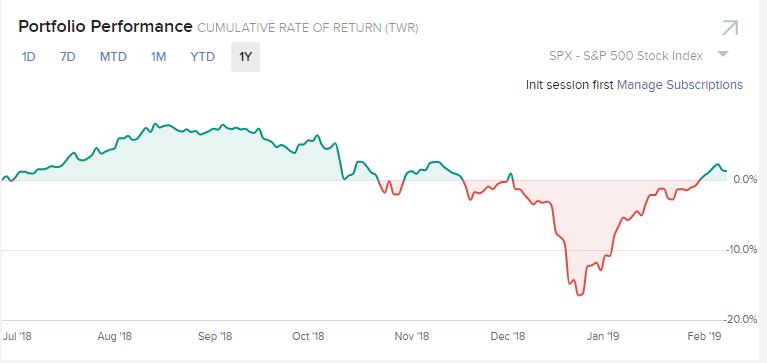

Let’s focus now on my mom’s portfolio. My mom’s portfolio has been dormant for the past months. Below you can see that the portfolio had a 12% cumulative rate of return. Since we transferred the portfolio from Binck to Tradersonly, we have a 2,4% cumulative rate of return. What’s more important is the fact that we generated more than 4% cash passive income out of this portfolio.

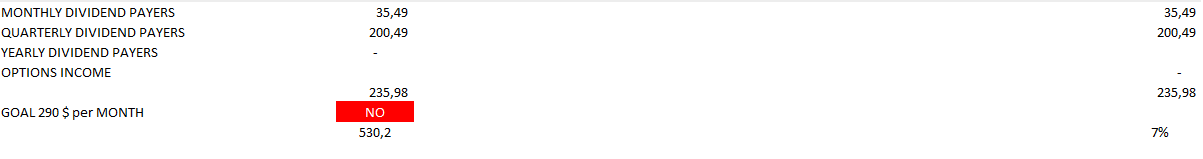

Now let’s see what our January 2019 cashflow was for my mom’s portfolio.

Passive Income in January 2019

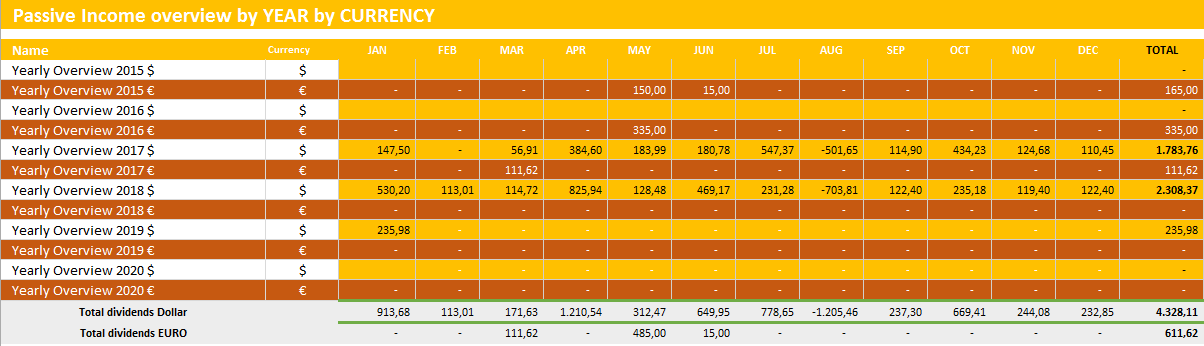

During the month of January 2019, we received 235,18$ passive income. Only dividend income.

Here you find the overview of all passive income payouts during the year 2016, 2017,2018 and January 2019.

The Options Trade Review

No options trades this past month.

Passive Income Growth

As you can see in the passive income overview, we did receive less passive income from our dividend stocks and ETFs. We didn’t achieve our monthly goal of 290$. We started the year with a 7% start.

2018 ended with a 2300$ cash passive income. As you can see in our table above, the passive income for my mom has been grown year over year. Have you paid attention to the blog post pic? That’s the same way my mom looks to my computer when she sees the results in her portfolio. Let’s do it again in 2019. 3500$ is the goal.

Going forward

Going forward we will first FOCUS on achieving the 290$ per month. As we have still cash in our portfolio, we will first put this to work. We will expand our investment portfolio with preferred stocks and investment trusts in the UK. Our first focus is to add another 150 $ per month to this portfolio using PASSIVE investments.

Stay tuned and we will tell you all how we progress ! Thanks for reading. In 2019 we will send out ONE newsletter per month to our blog followers. Life can be busy sometimes and people lose track of following a personal finance and travel blog. Subscribe and you will get one email per month highlighting what you missed…

Thanks for following us on Twitter and Facebook and reading this blog post. We end with a quote as always.

Source

No Comment

You can post first response comment.