you don’t know the following 5 key insights about investing money in the stock market

When you ask an investor what is the most important element of your portfolio, 95% will give you the WRONG answer. Most investors assume still that capital gains deliver the biggest return longterm. But in reality it is not capital gains, but dividend.

A SMART investor understands the importance of revenue and cash flow in a portfolio. The investor who has dividend shares, experiences how dividend adds cash flow month over month. That’s why many investors are surprised about the real power of (high) dividend stocks.

Dividends play a critical role in the total return of an investor. Who can follow the trend of a dividend, can maximize his advantage compared to other investors.

Here are 5 statistics about dividend investing that should convince you…

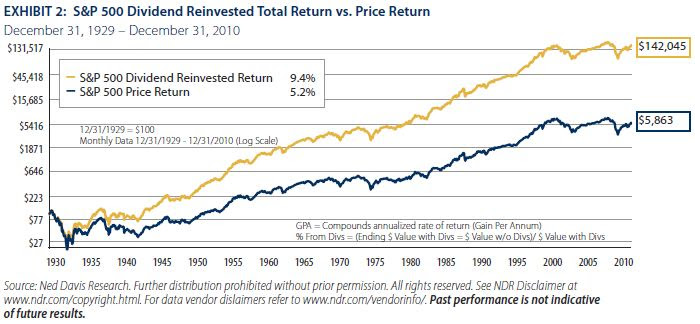

1. Dividend counts for the majority of your Return on Investment (ROI)

Most investors look at the performance of the index on a graph. But the real return is higher if you add the dividend to it. Don’t underestimate the extra cash of dividend. When you look at the last 80 years of the S&P 500, you will see that the index increased with 5,2%. An investment of 100$ became $5.863. But when you add the dividend payouts, the return increases to 9,4%. The investment of 100$ grows to more than $142.000 when you re-invest the dividends.

2. More and more companies pay a dividend

In Januari 2016 418 companies from the S&P 500 paid a dividend. That is almost 84% of the companies. The average dividend was 2,28%. This is low, but more than a 10year bond. If you do your homework, you will find many dividend payers between 8 -12%.

3. More companies and ETF’s increase their dividends

In 2015 there were 2159 companies that increased their dividend. Historically that is 1700 companies per year.

An example are the Dividend Aristocrats, who are a select group of 51 S&P 500 stocks with 25+ years of consecutive dividend increases.

They are the ‘best of the best’ dividend growth stocks. The Dividend Aristocrats have a long history of outperforming the market.

The requirements to be a Dividend Aristocrat are:

- Be in the S&P 500

- Have 25+ consecutive years of dividend increases

- Meet certain minimum size & liquidity requirements

There are currently 51 Dividend Aristocrats. You can download an Excel spreadsheet of all 51 (with metrics that matter) by clicking the link below:

The Dividend Aristocrats Spreadsheet list

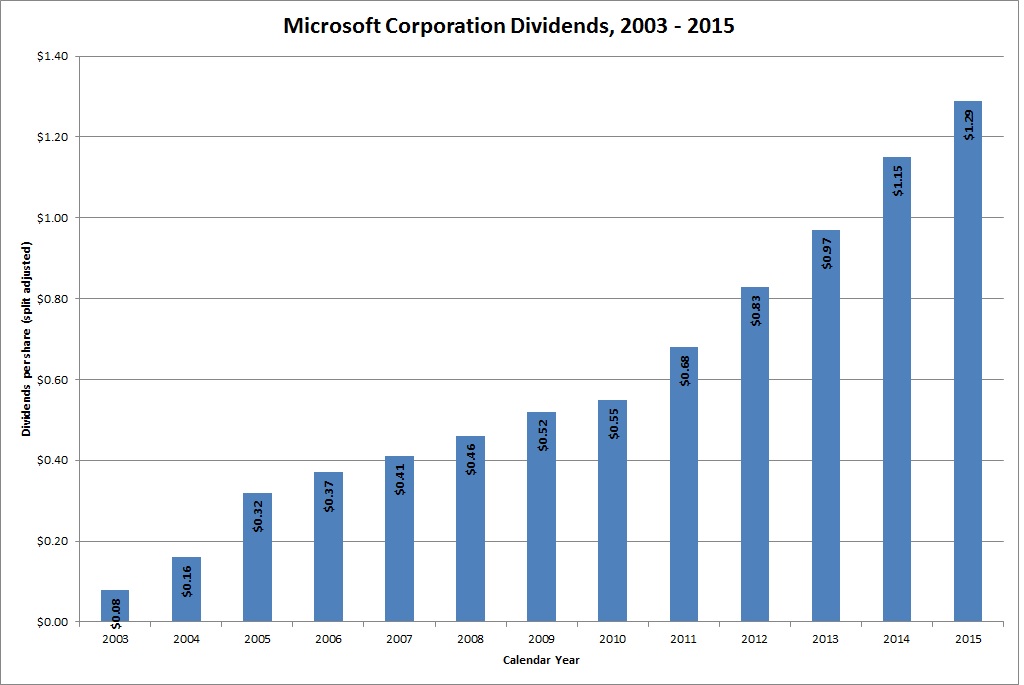

4. Technology companies become dividend payers

End of the years ’90, you couldn’t imagine that a technology company would pay a dividend. Every dollar was invested in organic growth. But now these companies have matured and created an amazing cash flow machine. This made some companies turn into royal dividend paying companies. Today the technology sector pays 15% of the total paid dividend within the S&P 500.

An example is Microsoft. Look at the dividend increases year over year.

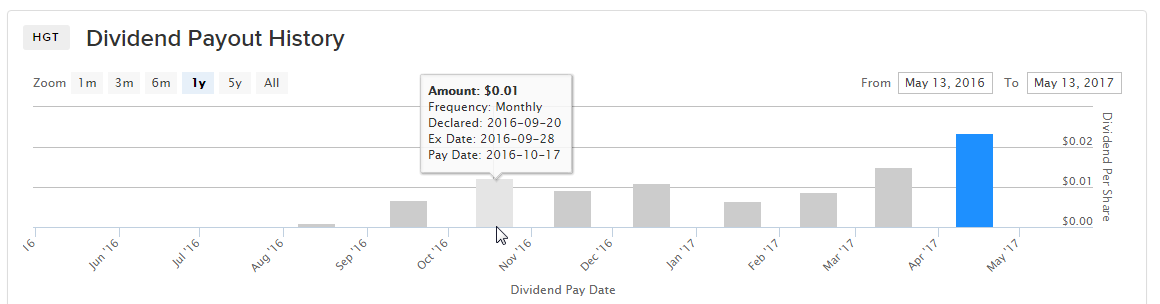

5. Dividend in the energy and utilities sector

The decrease of the oil price has forced some companies from the energy sector to lower or stop their dividend payouts. The oil sector was until 2015 the biggest dividend paying sector. Now oil has bounced back to 50$ and today more than 34 energy companies from the S&P 500 are paying a dividend. Some companies in the gas distribution pay more than 10% as they have stable longterm contracts with increasing revenue streams.

An example of a Trust active in the oil and energy sector is Hugoton Royalty Trust.

They started to increase their dividend payouts again and now pay 14% dividend on a monthly basis. The last 4 months they have increased their dividend payouts.

Final conclusion

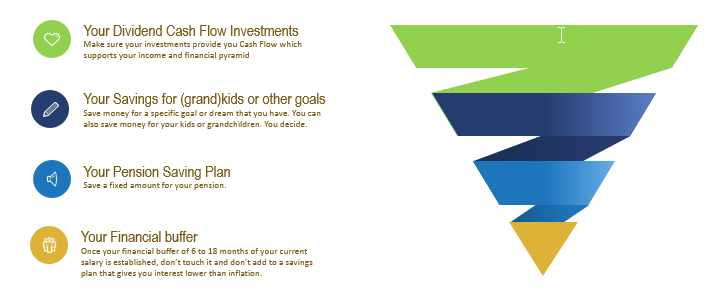

You MUST build a money machine, harnessing the power of compounding to create an income stream for the rest of your lifetime. In other words, you must automate your savings and utilize a portfolio investment strategy that will keep earning dividends in any season.

Grow your investments (layer 4 in our Financial pyramid) to a point at which the interest from your investments will generate enough dividend income to support your lifestyle without having to work. Eventually you reach a “tipping point” at which your investments will hit a critical mass. This simply means that you don’t have to work anymore – unless you choose to – because the interest and growth being generated by your account give you the income you need for your life. This is the Financial Pyramid we are building towards.

Do you agree with this strategy? What is your strategy for creating a money machine? Give us some feedback…

4 Response Comments

I definitely agree with the dividend growth investment strategy. Of course, I don’t discount investors who chooses a different strategy. You have to find the strategy or a combination of strategies that work for you. Because I started late in life, I’m not sure I’ll be able to get to that sweet spot where the dividends cover ALL of my expenses. However, that’s no reason not to pursue the strategy. Who wouldn’t want the benefit of supplemental income.

Right now, my dividend portfolio is around $4000. One of the beautiful things I like about the strategy is that it utilizes the power of compounding. Finally, like your post mention, I mainly invest in Dividend Aristocrats and other such companies with very strong fundamentals but with a history of paying rising dividends.

Great article Dividend Cake. I think this is my first time visiting your site.

Thanks for your feedback and visiting us. You can also follow us on twitter and facebook.

Dividends are totally the way to go from an investment standpoint and making sure they are in high quality stocks that are unlikely to cut them is very important. I like the thought of those high flying potential home runs, but safe and slow wins overall.

Dividends are the way to go for sure. Even in the down times they keep paying as well as increasing their dividends. And by reinvesting those dividends in the down times as well as in bull markets, it will put you in a better place financially long term. Thanks for sharing.