Hi everyone !

In our 2017 Objectives Setting blogpost, we said that we wanted to do three finance lessons for the kids. My son and my girlfriend’s son are 12. My daughter is eight. You can’t start early enough with teaching kids how to deal with money.

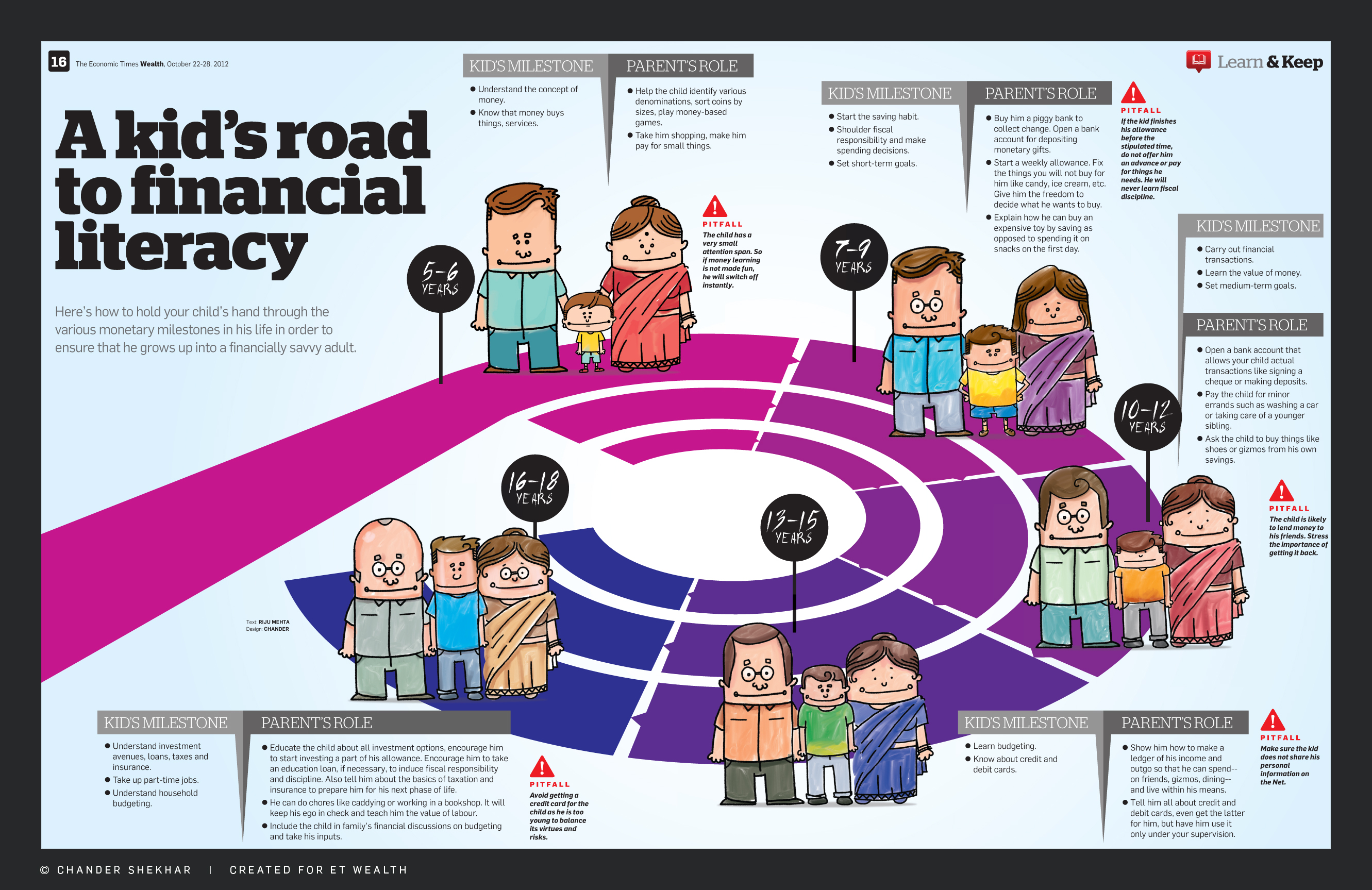

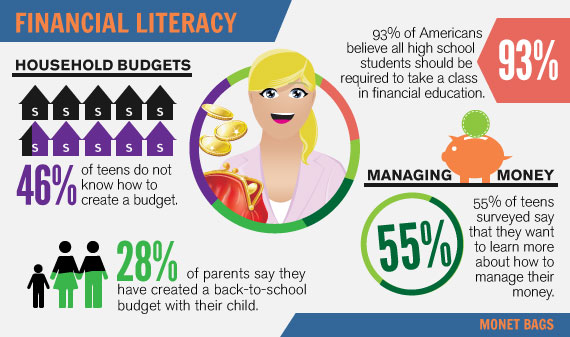

In below roadmap, you clearly see how you as parents can help children in their education to financial literacy. For 10-12 years old, as a parent you can open a bank account and allow your child to do transactions. The kid’s milestone is to learn the value of money and carry out financial transactions. For 13-15 year old kids, they need to learn budgetting and how to make a ledger of income and outgoing expenses.

As the two oldest kids are becoming 13, the first financial education topic I created is Budg€t Fun. Knowing where your money was spend instead of asking yourself where did it go? is important and can be achieved with a budget. A budget is the MOST IMPORTANT way to manage money in an excellent way.

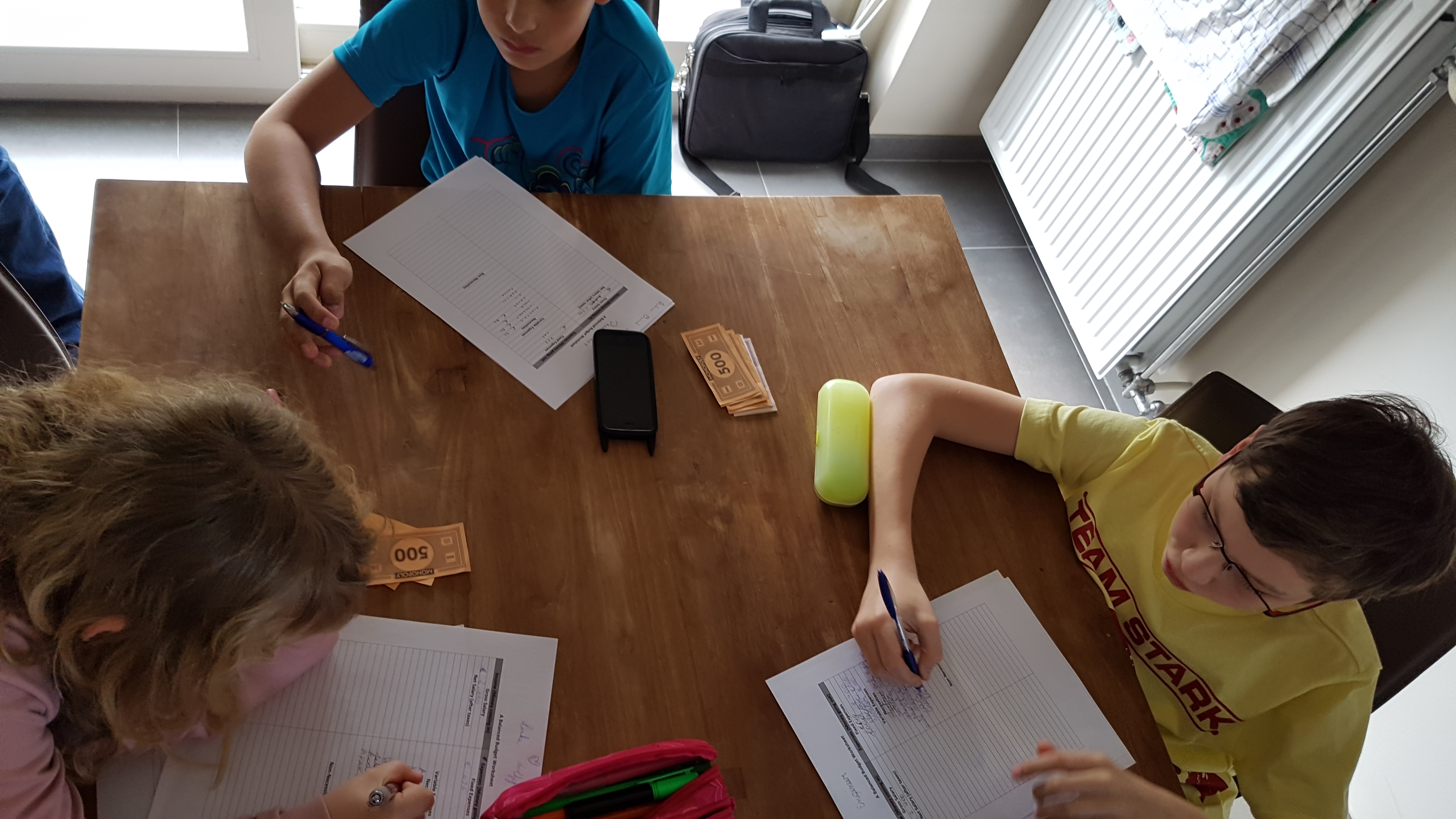

Here’s our interesting report out of our FIRST financial education class with the kids, done in the afternoon of the 13th of April 2017.

You can download the materials in English and in Dutch at the end of this article if you want to do this yourself with your kids. Have fun! We only ask you to make some publicity for our blog within your family and/or friends. And please send us also the pictures when you do this exercise and subscribe to our newsletter (below the search on our Blog page). It would make us very happy ! Thanks in advance. Here we go…

Start of the Educational game

Start of the Powerpoint presentation. Slide 2. I explained to the kids that the afternoon will be spend with an educational game about money. In order to know how to manage money, you need to learn how to budget and use your money. Many people don’t get any financial education and they have to figure it out themselves with bad consequences as a result. It is important in life to get financial education. I explained that they love to play monopoly. Monopoly is about buying rental properties but you can’t buy rental properties if you don’t have any money. The afternoon will be spend with the basics of managing money.

Slide 3. Rules of the game explanation

In life you should always pursue your dreams. First be happy with what you have but aim for more…This afternoon there are no winners or losers within the game. Money is simply a tool that can work for you. You only need to learn how to use it wisely and put it at work for you! This afternoon kids can voice their opinion, discuss with each other. The afternoon will be spend on “learning how to use money” and have fun while learning !

Start of the game

Task 1 : What is your future dream profession ?

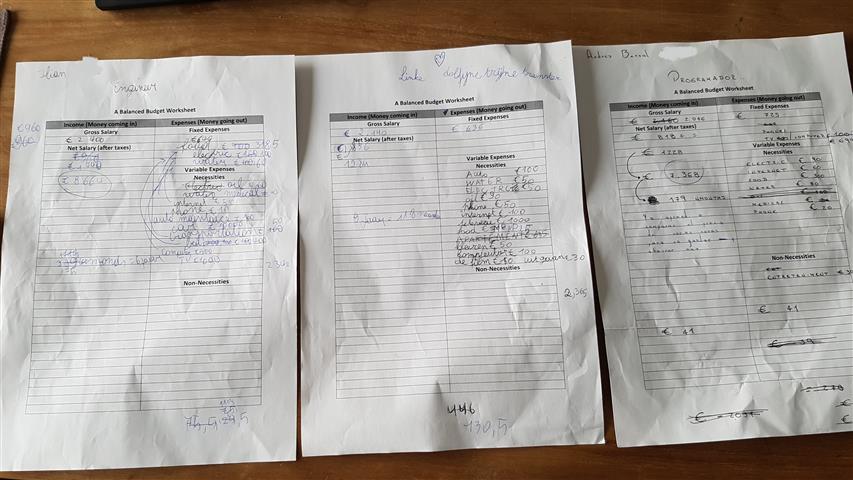

Life starts with your first job. Finishing your education successful is important for your first job. I asked to write down on their budget sheets what would be their dream profession. Here are the three dream professions kids wrote down :

- Engineer (2140 Euro)

- IT Programmer (2046 Euro)

- Dolphin trainer (2400 Euro)

Then I went to the website Salariswijzer where I searched for the first salary of this profession without any years of work experience. I asked the kids to write this amount in the cell Gross Salary. See the amounts above. I handed them their first GROSS salary with monopoly money. I congratulated them with their first income !

Task 2 : Where do you want to live ?

I explained to the kids that they had taken the decision to live alone or with their girlfriend. They wanted to be free and live in their own house, apartment, boathouse, caravan,…they needed to make a decision where to live and how much money to spend on this ….

I went to the website Immoweb where we looked up apartment and house rental prices. Kids decided which rental property they liked and we wrote down the rental fee cost in the cell Fixed Expenses. Kids and I compared different properties (houses and apartments) and the pro and cons of each property. Here are the prices of the rental properties that kids decided upon.

- Apartment 1 : 635 Euro

- Apartment 2 : 640 Euro

- Apartment 3 : 725 Euro

My daughter had the cheapest apartment for a price of 635 Euro. So now they had a place to live…and they had spend their first money.

Task 3 : List out all your monthly expenses

Now it’s time to write down everything you think you need to spend money on. So I asked the kids to list all their possible expenses. I explained them the difference between fixed and variable expenses. They also needed to make a decision about their transport means (car or public transport to work), their hobbies expenditure,…They wrote down all possible expenses they could imagine and I helped them writing down the amount of each expenditure. Kids also reviewed the purchase price of a TV or laptop.

A lot of good questions and thinking here …

Clothing, food, internet, phone, electricty and water bills, entertainment (cinema, going out with friends,..) were all listed as basic costs.

Kids were surprised about the cost price of some services. But I explained them it is important to compare and use the lowest cost provider.

Task 4 : Compose your weekly dream menu

Moving on to task 4. Of course food is a big piece of a monthly budget.

Now each kid had to decide what to eat during 2 days and together the 3 of them had to decide what to eat on Sunday. Write down all the ingredients required to prepare the meal. The goal was to create a SHOPPING LIST for all the food required for ONE week.

Once the weekly food and drinks list was ready, I explained to the kids that we would go to the shop and buy everything needed to eat and drink during one week. So once the list was complete, we went shopping food and drinks.

Kids did search for all the food and drinks needed from their shopping list. We reviewed how kids were doing their shopping. Once the shopping completed, we explained one important item :

Did they compare prices of the food they purchased ?

The answer was no. So we send them back with the bag of Iglo chicken nuggets and the bag of French fries they selected. They came back with another bag and said the price was 2 EURO cheaper. Aaahhhh….important lesson here. They told us that they were surprised about the price difference although it was the same food. Sometimes the bag was even bigger for a cheaper price…

You can see here the shopping cart of the kids. It was filled with meat, some vegetables, french fries, desserts such as ice cream and caramel pudding, sandwiches,…

At the end we asked the kids whether this was enough food and drinks for ONE week. They said YES so we went to the cashier to pay the bill. I explained to the guy who was scanning our goods that this was a financial exercise and lesson for the kids. He said he was 24 years old, working as a cashier and NEVER got a lesson like that in his life. He was STILL struggling how to manage his money, he said…

Wow…I told the kids what the cashier guy just told me. They looked at me with amazed eyes. Our total bill of our shopping cart was 91,40 EURO. Kids were amazed about this total expensive price realizing this was just food for ONE WEEK.

Task 5 : Make your financial summary

Back home…

I explained to the kids that we will now finish our financial game. First I asked them to pay me back 40% of their gross salary…they asked why? Well, this is the Belgian taxation on work. I explained them that Belgian taxes are very high. So kids calculated 40% of their salary and gave me back the money. Painful, I know…This is the NET Salary they will earn.

Then we multiplied our shopping bill with 3,5 to make it a monthly expense and filled in this amount in our monthly expenses sheet. Now it is time to make a calculation. I asked the kids to subtract all monthly expenses from their net salary and see if they had any money left. Where one kid ended up in debt, and another one had only 25 Euro left…

Now it was time to explain to the kids to review their expenses and see if they could reduce their expenditures… this led to interesting discussions and a lot of fun.

Task 6 : Goal 1 is your financial buffer

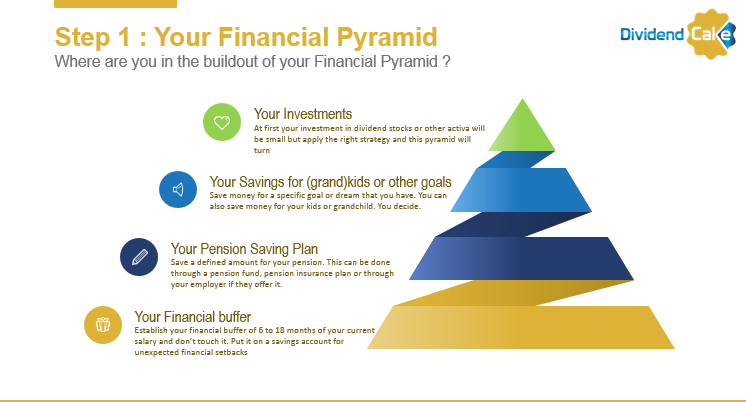

Slide 10. I explained to the kids that the first goal in life is to create a financial buffer. This is 6 months of salary to start with. This is the foundation of your financial pyramid.

This financial buffer is required for unexpected costs when you have troubles such as losing your job, car break down, and other financial problems. I asked kids to multiply their monthly net salary by 6 and then divide their monthly savings (money left at the end of the month). This results in the NUMBER of MONTHS required to save the FINANCIAL BUFFER.

The conclusion was that one kid needed 12 years, another one 20 years and another one 30 years to achieve a financial buffer. I asked them to review everything. I also explained them that 43% of their budget is spend on their rental property. This is TOO HIGH. They need to review each expenditure. Maybe they should spend only 25% on their rental property. Kids reviewed each expense and then concluded that they would be able to achieve saving this financial buffer within 2 to 5 years by making the necessary adjustments.

Final conclusion and key learnings of the day

To conclude the day, we asked the kids to list out their key learnings of this financial education. Here are the 3 key learnings of the kids they wrote down :

- We learned how to compare the prices of goods and services and rental properties. This impacts our monthly budget.

- We learned how to manage money and that it will be important to save money at the end of the month

- We learned that it is important to build first a financial buffer

We gave the kids a reward for their great enthusiasm and contribution. We were happy that they said it was fun. It was a challenge to get them engage d at first but once they started to see the value of the exercise they appreciated the aim of the educational game. We told them that many parents do not take the time or effort to give their children financial education. How will they ever manage money in the future?

d at first but once they started to see the value of the exercise they appreciated the aim of the educational game. We told them that many parents do not take the time or effort to give their children financial education. How will they ever manage money in the future?

One week later my son told me that he is now also managing his money in an online game Minetopia. See screenshot

He also bought his first book with his bank account card. Another milestone in his financial education.

Education is key to be successful in life and this also applies to financial education and knowledge. Did you know that 46% of teens do not know how to create a budget…did you educate your child some financial literacy? …leave your comments and feedback.

Download our materials below. Keep on following us on Twitter and Facebook where we share more blog posts and other articles. Share THIS blog post on your timeline in Facebook so you help make other parents aware of the need for financial education to their kids.

You can always translate this blog post in your OWN language by using the Google Translate selection at the top right of the page.

Subscribe to our newsletter so you don’t miss our next class materials. Thanks

Stay tuned for our next blog post !

Appendix

Below you can find the documents we used during our financial education.

English

DividendCake_Kids Financial education Class 1

Dutch

One Response Comment

Nice…. Looks like a great game to play. I plan this 5 years from now.