Past month we travelled to London to learn about the investing behaviour of English Investors at the London Investor Show. On Friday 9th of November we travelled to Amsterdam to visit the Beleggersfair to learn about the investing behavior of Dutch investors. Two weeks ago it was time to learn about the investing behaviour of the Belgian investors.

Personally I spend one week at London Business school for an Executive Finance course. A very busy course schedule with a lot of required preparation for this course avoided me to write up the key learnings from my past visit.

Let’s reflect on what we learned during our visit to Finance Avenue. You can still find the programme at the following link.

The agenda will filled with Dutch and French speaking presentations, workshops and a real estate corner. We selected a few sessions to learn about the perspectives of the speakers. Please find summary write ups from the presentations we attended.

Key Learnings including Golden Tips 2019

Ten years after the crisis debate

We start the day with the debate of the economists William De Vijlder (Chief economist BNP Paribas), Jan Van Hove (Chief economist KBC) and Peter Vanden Houte (Chief economist ING). According to William there will still be growth next year. US is doing fine. If you look at the markets, markets are focused on growth dynamics. The growth is slowing down tough. Jan thinks that some emerging markets are getting in trouble. The growth story is more diverse. You need to look at specific countries.

Peter VDH believes that there has been a goldilocks period with low interest rates and stable growth. Now in the US salaries are increasing and interest rates are going up. This has an impact on other countries. Emerging countries are impacted by the US. You see the first fractures from the US growth. In Europe we will drop below 2%. If your growth is only 1,3%, not a lot can happen before you get in trouble. There is a greater possibility that we end in a bad scenario.

Question : There is a lot of debate about trade war between China and USA. What do you think?

Jan thinks that protectionism also existed before Trump’s time. But this protectionism will weigh on global markets as it impacts the investment climate, trust from investment companies and entrepreneurs. When people repeat and hear the same message over and over again, there is less appetite to invest. Peter sees the impact on the inflation in the USA. Higher import tariffs will impact on consumer pricing. Import tariff on 25% import on washer machines is an example. Now prices have increased with 15% this year where other years they dropped. We are lucky that the trade war has not escalated to other countries. Talks with Mexico and Canada have resulted in a new agreement. There could be a possible trade war in the car industry going forward. An escalation of the trade war can happen quickly between Europe and the USA. In third quarter, growth in Germany was negative -0,2% because of environment impact regulations. Export from Germany was growing tough. Trump doesn’t want a quick agreement. He just wants to be reelected. In Germany companies are more prudent as protectionism will impact Germany.

Question : Another risk is Italy ? Will this have a long term impact?

Peter thinks that Italy has a budget conflict with Europe. Italian government doesn’t want to follow European budget rules. The period of growth in Europe has not taken as an opportunity to strengthen the financial system and the Euro zone. The problem “Italy” will potentially weigh on the EURO zone for many years. Jan sees 0% growth in Italy. Italy needs growth. Large budget deficit and large pessimism amongst investors and companies. Italy is a rich country and the government tries to stimulate investment from retail investors. Europe has NO instruments to fix an Italian crisis and debt issue. The only one who can save Italy is the ECB. Wouter believes that the bad news is that this problem can only get bigger going forward. Growth forecasts are TOO optimistic. For the investor the key question is “When do we have a significant issue?” Slower growth and high interest rate has an impact on the banks. This causes bigger spread between Germany and Italy.

Question : Brexit Are you worried ?

Jan thinks that Brexit is a binair problem. No agreement, then there will be a shock effect on European countries. Belgium will be impacted with a 1% slower growth. That is big. We are still in soft BREXIT scenario. There is still a lot to debate. Hopefully we will land in a SOFT-ISH Brexit. Peter says ” Will it be a cliffhanger and will uncertainty prevail ?” The support is needed from the DUP Irish party and other members of the government are against the agreement. Until March we will suffer. William thinks that the date can also shift and that Europe will extend the deadline. 130.000 companies exporting to the US need to look at customs regulations and how to import their goods. This can shift the shock effect. Uncertainty is reflected in growth figures in the UK.

Question : European ECB interest rate policy. How will it evolve?

Peter thinks that short term interest rates will remain around 0%. William thinks that in 2020 there could be an interest rate growth. The FED will increase the interest rates going forward. At the end of 2019 we will look on the growth in 2020. If the US interest rate doesn’t grow, the European interest rate cannot grow. The difference between company bonds and government bonds will grow going forward.

Question : What will be your investment strategy ?

Jan believes in TINA, there is no alternative. The current correction is an opportunity. Stocks ..but keep also a good cash position. Bonds are underweighted but remain important. Stock selection is more and more important. William says that KBC does look at growth perspectives and is overweight in stocks. Company bonds are still an opportunity. Look at EBITDA in US and Europe of companies to lower the risk. Peter from ING bank thinks that we are further in the cyclus. They are lowering the stocks positions. Dividend return is still above 3% which is important. Switch from cyclical to defensive sectors. The cash position is larger than normal.

Investing in Asian growth markets a theme or an opportunity ?

The next presentation was done by Michael Cornelis, Senior Portfolio Manager BNPP AM. He starts with two basic questions :

The next presentation was done by Michael Cornelis, Senior Portfolio Manager BNPP AM. He starts with two basic questions :

- Where is the growth in Asia ? is that an opportunity or risk?

- Is the growing economy sustainable ?

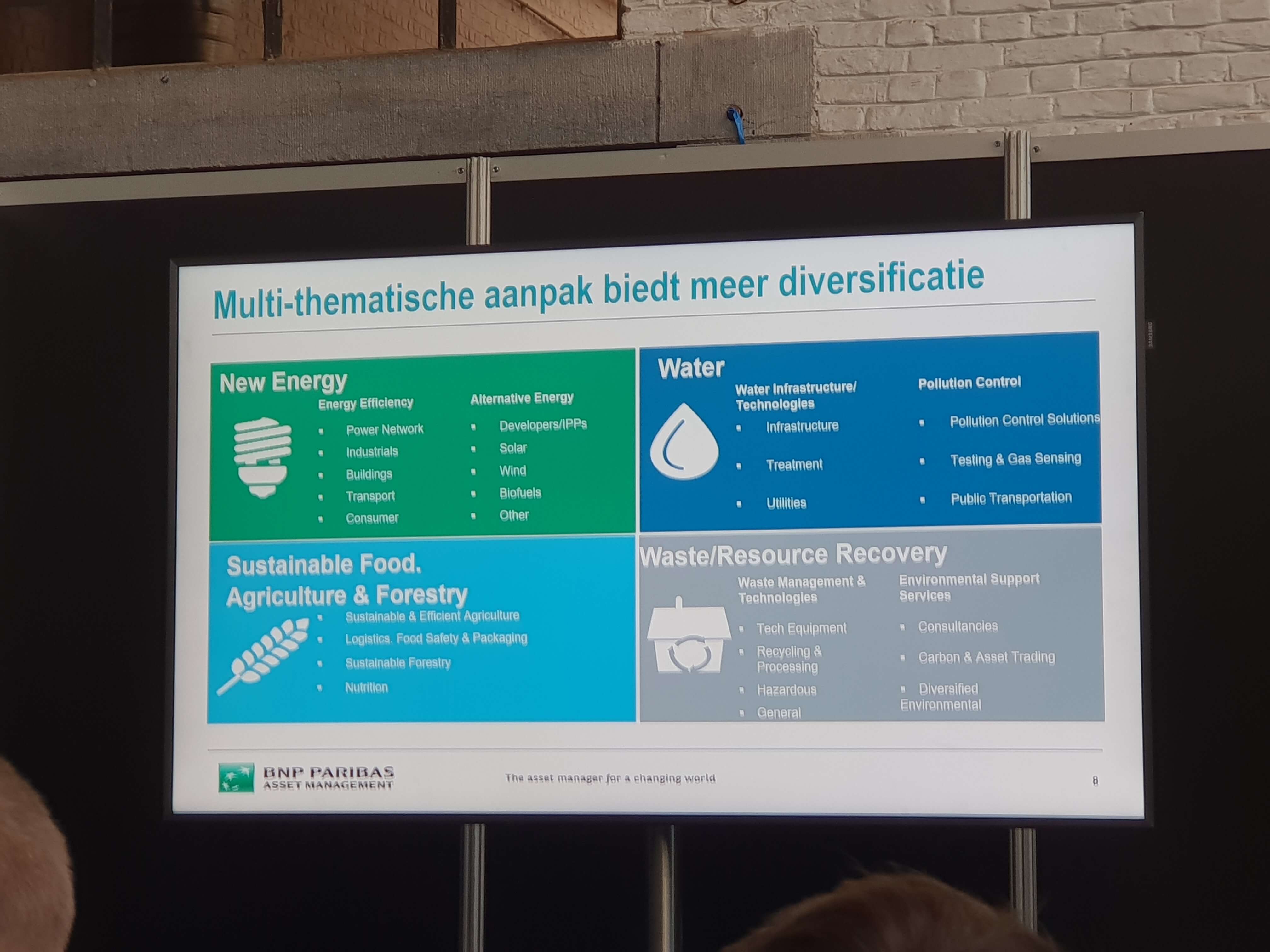

The UN has 17 sustainable development goals. Iceland has introduced a law for equal gender pay for companies. Emission impact is another example. Multiple themes approach leads to more diversification. We can invest in water, new energy (wind, solar),sustainable food & agriculture and waste/resources recovery.

Emerging markets offer high potential mid term. There is strong growing middle class and superior economic growth. In China there are a lot of investments in the army. The Chinese answer for growth is to invest in infrastructure. China invests massive in green environmental measures. Batteries are most important in the car industry. China will within 5 to 10 years be a global player in the batteries sector.

China has limited resources and food production becomes very important. Many regions have water scarcity. China is largest oil importer and this only grows. It has a large dependency on oil and that is why they invest in large wind and solar projects to lower the dependency.

What is the investment potential? Find the sustainable investment funds in combination with Asia.

100 Belgian companies in the Picture

The next session was the review of financial journalist Serge Mampaey. Construct your stocks portfolio like a house. He thinks the foundation of every portfolio is to focus on quality companies with low debt and good cash flows. Examples are holdings such as Ackermans & Vanhaeren, Bois Sauvage, Brederode,.. There are also REITs with a low share price value such as VGP, Real estates,..

The next session was the review of financial journalist Serge Mampaey. Construct your stocks portfolio like a house. He thinks the foundation of every portfolio is to focus on quality companies with low debt and good cash flows. Examples are holdings such as Ackermans & Vanhaeren, Bois Sauvage, Brederode,.. There are also REITs with a low share price value such as VGP, Real estates,..

The next layer in your portfolio are growth companies. They function as the walls. Focus on specific themes. Middle class increase in emerging companies, older population : Jensen Goup, Aedificia, …

The roof of your portfolio house are cyclical companies with solid balance sheets. Examples are Aperam, Bekaert, Sioen,..

You can also do some decoration and garden furniture and spice your portfolio with spec plays. Galapagos, ArgenX, Econocom

Question : What are the cheapest companies and which ones pay good dividends ? Here you need to look at P/E ratios, Debt position,.. Nationale Bank van Belgie is the cheapest one but owned by government. Not interesting. Sioen, Bekaert and Aperam are potential candidates.

Question : How do you construct a stock portfolio for your kids?

Here holdings are important. Ackermans Vanhaeren share price did times x3, Berkeshire Hatheway (x7). Serge also has Sofina and added recently Floridienne. He has also a small position in Melexis.

Question : What are sustainable companies for an investment for the next 50 years ?

A company such as Solvay switching from old economy to the new economy. Ferrari uses materials of Solvay. Solvay earns a lot of cash with soda. You always need it to wash your cloths. GBL is another example that will survive the next 50 years. Dividends of the holding Sofina are paying the castles maintenance.

Investing in Volatile Markets – Gert Bakelants

Gert Bakelants starts with saying that long term interest rate in Germany is low. Below 0% in 2016. 2 years of horizontal movement. 10 years 0,36% gross. Will the interest rate increase ? Gert believes it can. Interest rates have been manipulated and this Quantitative Easing will stop in 2019. Short term interest rates cannot increase a lot. But this is not normal. It would be healthy that the long term interest rates go up.

Money is getting less each year thanks to inflation. Inflation such in Venezuela has a major impact. Inflation is the most universal tax of all – Thomas Sowell. Most people are NOT AWARE and do not care. Look at Eurostoxx 50 : 5 years – a large % of investors think the stock market will NOT increase. In Europe nothing has happened in the past 5 years but there has been volatility. Investing is ignoring emotions. Gert shows a video of Prudential where a person in an elevator follows the behavior of other people. It’s HUMAN nature to follow others!!

If you buy a company share price at 100 or at 20, that is a BIG difference for this asset, isn’t it? The media is the cause for making a lot of opinion noise, politicians are also responsible. Today there is a huge lack of financial literacy. “Investing is dangerous ! Do not do it !” is what we hear constantly.

There is fear for big volatility! Most people can not handle this. Real returns on equities is always better than real estate. Annualized return between 5 – 7%. Investing is the new saving. One time investment. 120.000 -> 128 months. Return of +40%.

And A crisis is always an opportunity. Pension savings – this can be fiscal deducted. Many people do not know they invest in stocks. This is without emotions. Start investing at young age! 8th world wonder. Compounding is key. The one who doesn’t – pays it!! You get poorer when you put it on a savings account.

Money is only what you can buy with it! Do your homework and diversify. Use your common sense. Do not speculate. A crisis will always exist in the future. This can be an opportunity.

Less growth and less uncertainty – Corne Van Zeijl (Actiam)

Corne starts with the economic surprise index. Eurozone is disappointing. Purchase Managers index PMI predicts economic growth. Recession would normally already have hit but with those monetary policies this is difficult.

Unemployment in the US is the lowest since 1969. So you need more people. But immigration gets more strict. With low unemployment salaries should increase but this is barely the case. This is due to digitalization and more robotic automation. Higher salaries are bad for companies. Populists are very popular…Poland, Hungary, Italy has such a government.

There are 4 risks : Monetary policy, the global debt position, trade war and Brexit. Corne say that you should not invest in BONDS. Corne prefers ETF index funds. An active mutual fund manager can almost never beat the markets.

Corne recommends to buy a gold ETF, a European Index ETF and be careful with US stocks.

Golden Tips 2019

The day ends with Golden tips from 4 stock analysts. The experts panel selected 12 stocks: AB InBev, Vranken-Pommery, Basic-Fit, Econocom, Danone, Euronav, Total, EVS, Veolia Environnement, Solvay, Recticel en Biocartis.

Visit to the booths

During the day I also visited the different booths. I can catalog the different booths in the following categories :

- Real Estate companies in the Real Estate corner

- Fund Managers such as Pictet and others

- Brokers such as Bolero and Keytrade bank

- Investors’ magazines such as De Belegger

- Investor organizations such as VFB and Capitant

- …

Compared to Investors events in the UK and Netherlands, real estate companies are much more present at Finance Avenue. It seems that Belgians like to invest in real estate projects. Whether this is a god choice, is a decision each investor needs to make himself.

Final Conclusion

Finance Avenue attracts more than 6000 people. It is larger in scope than the event in the Netherlands and the UK. After attending the three events, it is clear that Belgians are more “guided” to investing in funds. The presence of fund managers booths was impressive in Belgium. I didn’t see Pictet, Schroders or other fund managers at events abroad. Maybe they attend other events but funds and real estate seem to be the most popular investment vehicles for Belgians. Weird.

Finance Avenue attracts more than 6000 people. It is larger in scope than the event in the Netherlands and the UK. After attending the three events, it is clear that Belgians are more “guided” to investing in funds. The presence of fund managers booths was impressive in Belgium. I didn’t see Pictet, Schroders or other fund managers at events abroad. Maybe they attend other events but funds and real estate seem to be the most popular investment vehicles for Belgians. Weird.

The investment landscape in the Netherlands and the UK is much more diverse. During the event, I also got hold of the Bolero Magazine INDX. In this magazine there was an article about dividend kings and aristocrats. Finally some attention for dividend paying strategies. Although most people shy away from investing in dividend paying companies because the government doubled the taxes (30% – INSANE) on dividend payouts, at least there was some explanation how you can invest. The minister of Finance Van Overvelt did say it was impossible to lower the dividend tax. Of course…when you can NOT keep your budget and expenses in line, you never can lower taxes. As a retail investor, I get furious from such statements. When will they introduce performance and value based KPI metrics for governmental departments ? Corne van Zeijl said it…government debt increased with 84% worldwide.

If you want to review the presentations of Finance Avenue, find the LINK on the website of the Financial Newspaper De Tijd

Time to wrap up. It was an interesting Q3 so far with three interesting investor events. We have entered the last month of the year. 4 weeks and the year ends.

Good luck with your personal finance strategy! Thanks for following us on Twitter and Facebook and reading this blog post. As always we end with a quote.

No Comment

You can post first response comment.