Recently I read the report ‘2016 Guide to retirement’ from the American bank JP Morgan Chase. I want to highlight one of the slides where the effect of the compound interest is clearly represented. I will explain in detail.

For the full report, download here

I highly recommend you read this whole document of JP Morgan.

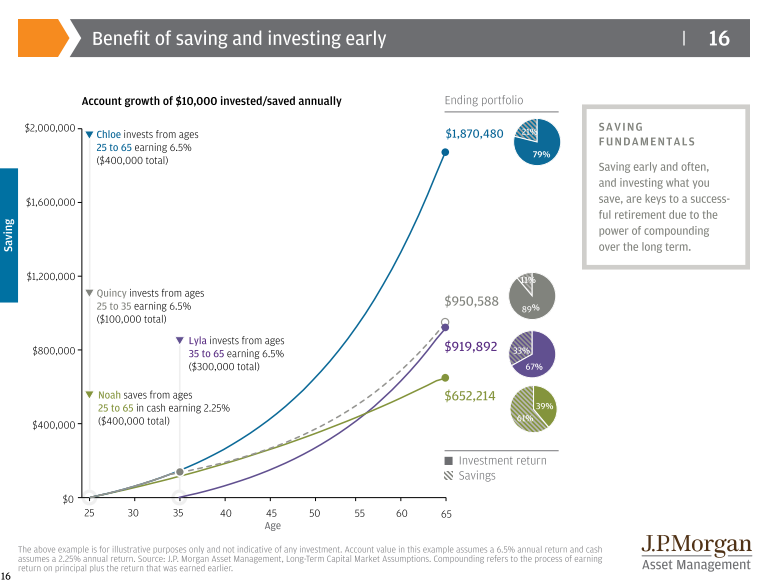

Chloe, Quincy, Lyla and Noah pension portfolio at the age of 65

The graph above shows the total ending portfolio of 4 different people Chloe, Quincy, Lyla and Noah that was built upon throughout the years. The assumption is that their investment on average gives a return of 6,5% per year and they save 2,25% per year from their salary.

Chloe saves every year 10.000 Dollar between her 25 and 65 years old. Quincy only saves the first 10 years after her 25 10.000 $ for her investment. Lyla starts at her 35 and saves until her 65 every year 10.000 $ and Noah puts every year 10.000 $ on a savings account of the bank.

The results

You will not be surprised that Chloe collected the most capital: almost $ 1,9 million. Interesting is the fact that only 21% (US $ 400.000) of this amount was saved by Chloe herself and the rest 79% was achieved from the average return and compounding. Quincy put only 10 years money aside and her portfolio grew to US $ 950.000. Of this amount $ 100.000 (11%) has been saved by Quincy herself and the rest 89% (!) comes from her compounding return. Lyla achieved little less with US $ 919,892 than Quincy while she invested 3 times more money. Here the split between savings (US $ 300.000) is one third while the other two third is coming from the return (67%).

Noah saves equal amount of money as Chloe ($ 400.000) but her final portfolio is the lowest from the 4. The reason is the low return that savings accounts give. From the savings, Noah saved 61% herself while the portfolio only provided 39% return.

Key Insights

What can we conclude from the above exercise? A higher return (or dividend yield) is important, even a few percentages can have a big impact over time. Chloe and Noah put equal amount of money aside but the portfolio of Chloe is so much higher, almost 3 times. If you would do this exercise with current savings rate (0,11%) in Belgium savings accounts, the difference would be phenomenal.

Time is another key factor. Lyla puts 3 times more money aside than Quincy but at the end Quincy achieved a higher portfolio because she benefit from the factor time.

Combine a nice dividend yield with a longtime horizon and the money will grow exponentially thanks to the compounded interest. This is an insight that young people should learn in order to give themselves financial independence as soon as possible…..If I had only know this when I was 20 years old….

My definition of being rich is different tough…but financial independence is the goal.

No Comment

You can post first response comment.