Investing money starts with informing yourself and learning how others do it. Two years ago I did meet a couple (Let’s call them Robert & Emma) at a bloggers meetup in Holland. This couple retired at the age of 30+ years old.

Now this couple organizes yearly an event with the name FIWE (Financially Independent Weekend) where bloggers and other people can meet to discuss FIRE (Financially Independent & Retired Early) and money topics. You have to apply in order to get in. For me, this was a perfect opportunity to learn from other people who retired early and discuss money topics.

One of the big issues in the Belgian society is that you can’t discuss any money topics. If you discuss how to grow money, you are immediately seen as a capitalist, a fishy financial advisor or a stock market gambler… do you recognize this ?

1. Our Key Learnings

On Thursday evening the event started with a speed dating night. Every 5-7 minutes we had another person in front of us and got acquainted with. Quickly I came to the conclusion that there were many participants working in the IT technology sector.

Friday morning the event started with the following public.

- 48 participants, with 5 kids in tow

- Exact 50/50 split between repeat and new participants

- 16 women, 32 men

- Countries of origin:

-

- Germany: 9

- Hungary: 7

- Romania: 3

- UK: 3

- 2 participants each from: Austria, Malta, Poland, Slovakia, Spain

- 1 participant each from: Belgium Bulgaria Canada Colombia Croatia Czechia Denmark Indonesia Ireland Italy Israel Mexico Serbia Sweden Ukraine USA

- Countries of residence:

- Germany: 13

- Hungary: 8

- Austria: 7

- Romania: 4

- UK: 3

- 2 participants each living in Croatia, Malta, Switzerland

- 1 participant each living in Belgium, France, Ireland, Israel, Serbia, Spain, Thailand

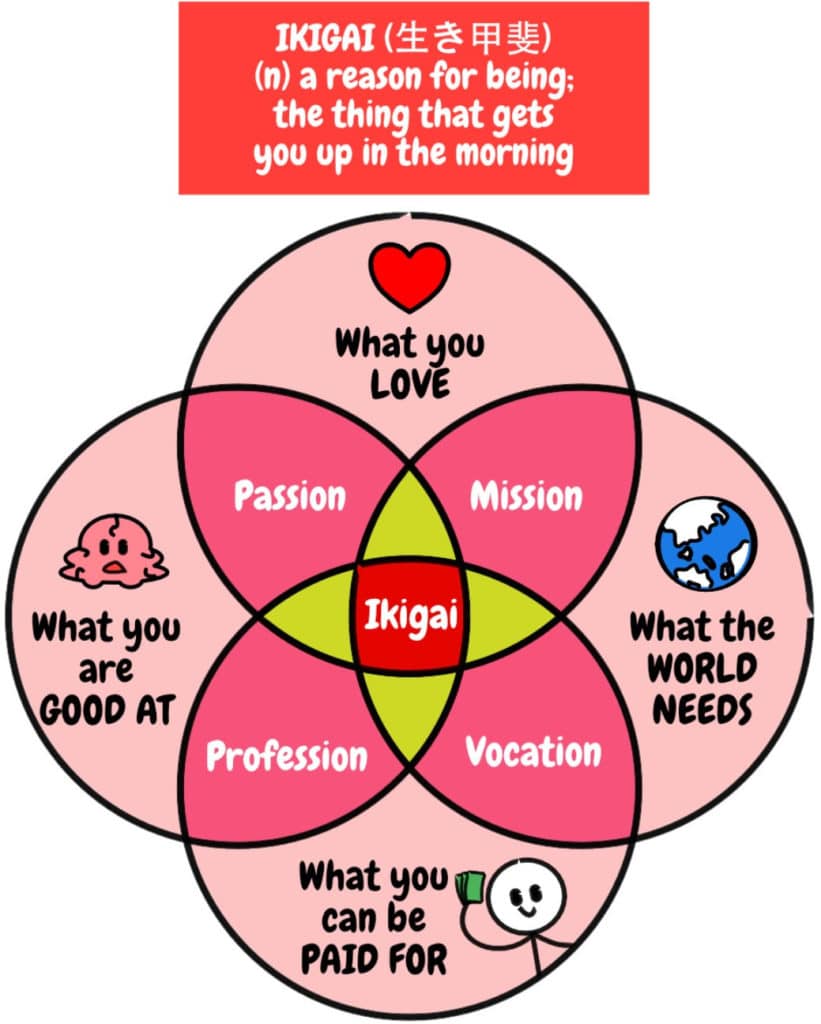

There is no direct English translation, ikigai is thought to combine the Japanese words ikiru, meaning “to live”, and kai, meaning “the realization of what one hopes for”. Together these definitions create the concept of a reason to live or the idea of having a purpose in life.

To find this reason or purpose, experts recommend starting with four questions:

- What do you love?

- What are you good at?

- What does the world need from you?

- What can you get paid for?

In a digital world and with information technology at its current stage of development, we spend most of our lives at work over our lifetime, and unfortunately many people spend doing something that doesn’t make us happy and fulfilled. FIRE people want to kill the question “What you can be paid for” and not be dependent on others for money.

A discussion amongst the participants lead to many project ideas and what the world really needs. Less food waste, financial education in schools, alternatives for plastic packaging, and many others topics became a FIRE Mastermind group topic for the future.

K. explained his way of FIRE by lifestyle deflation. Moving back in his parents house, eliminating any wishes, cutting expenses, giving up his job and being able to live from around 500 euro per month has put his mind and lifestyle in FIRE. As minimalist it is possible to live from 3-4 % of your savings or net worth. A. explained how (online) games teach you about life and finances.

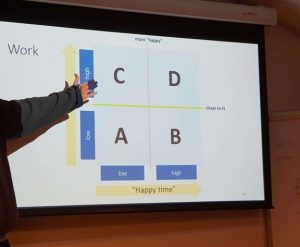

On saturday Z. explained his FI blueprint. The FIRE formula is to maximize the amount of TIME while living according to your individual choices. Therefor you need to know yourself and understand your maximizers and satisficers. In which quadrant are you at work ? Big life decisions can influence your FI journey. How many kids you (intend to) have? What is your type of relationship? Where do you live?

Also your financial choices decide upon your track towards financial independence and early retirement. The key is to maximize your time because we all have the same time available. The key is not spending time, but in investing it.

Also your financial choices decide upon your track towards financial independence and early retirement. The key is to maximize your time because we all have the same time available. The key is not spending time, but in investing it.

L. explained why being in early retirement might be the best or worst idea ever. In his case it does set you apart from the working society. It kills social relationships and connections with friends and family. Willyfog. and his wife, a Spanish couple living in Germany explained their view on ETF passive investing and how certain banks repackage other ETFs with an additional higher cost.

You can find their presentation at their blog Los Revisionistas

S. explained how he makes money online. By creating different websites solving a (business) problem, he became financially independent. One website found a buyer which did set him financially free. Although he doesn’t need to work for the money anymore, he continues his entrepreneurial journey with his friends/colleagues and continues to build websites. Maybe one day he can sell one of his projects again, who knows? Now it’s fun to build out new websites…

One interesting session was the panel discussion and Q&A. As five young entrepreneurs were financially independent, the public was very interested to hear from them how their life changed, how they see the future, what could impact their investments, …

The FIRE entrepreneurs do not use the 4% rule for living from their savings or investments. Mathematically they have a solid financial plan to sustain living from their businesses or investments. They do not worry about a financial stock market crash as they have diversified their investments. None would consider going back to a job. It would only be an emergency backup plan.

Being financially independent doesn’t necessarily make you happier. It sets you apart from the society and some people do lie about their lifestyle to strangers and/or friends. One person said he became grumpier and doesn’t like humans so much anymore. When you have more free time to observe other people, you realize about the rat race of other people in the society. I personally asked the question what their game plan was for their kids. The FIRE people don’t see the need for financial aid for their kids. They haven’t figured out yet the financial education plan either for their kids. They want to focus on the right mindset and relationship with their kids. It will be interesting to find out in the future how this evolves going forward. The key question is how they will sustain financial independence across generations. Some people are building the diversified portfolio to sustain wealth across generations.

2. Final Words

The key learning was that you need to become an entrepreneur to become financially independent at young age. Sometimes luck is needed, sometimes following your passion can set you mentally FI free. Personally I was the oldest person in the room and presented my own FIRE strategic plan to the public.

Are you learning about other investment strategies ? Don’t hesitate to leave your comments and feedback. Let us know what you think.

Good luck with your personal finance strategy! Thanks for following us on Twitter and Facebook and reading this blog post. As always we end with a quote.

Source : https://marionoioso.com

No Comment

You can post first response comment.